I stand by my view we are reaching a top with a significant move to the downside. I expect potentially 10% more move up before we trend down. This will enable taking money away from those betting to the downside, shorts, and forcing them to buy shares to cover their positions. In effect, the people who rode this market for what will be a 80% retrace to unload their long positions into the capitulating short sellers.

Since neither I or anyone can tell you the exact top, it's impossible to play the long side safely. But it's important to set thresholds to know when I am wrong. For me, this one isn't going to be market valuation, but time. If Trump is elected president in November, and the market hasn't turned down, it is possible that stock values have decoupled from corporate earnings. This means stocks are pure speculation. In effect we will have destroyed the basics of capitalism, and our market will be more like China.

We will have decimated 95% of the shortsellers, in effect not having anyone to 'buy with greed' when the market falls. We will only have 'sell with fear' .

The Fed will have helped achieved what China or Russia couldn't do, decouple the US economic engine.

Welcome new reader!

Financial news I consider important, with my opinion, which is worth as much as you paid for it.

Wednesday, April 29, 2020

Thursday, April 23, 2020

Pieces of a puzzle

The puzzle pieces I bring you today is an economic one.

I'll give you the pieces, and you can choose the puzzle solution.

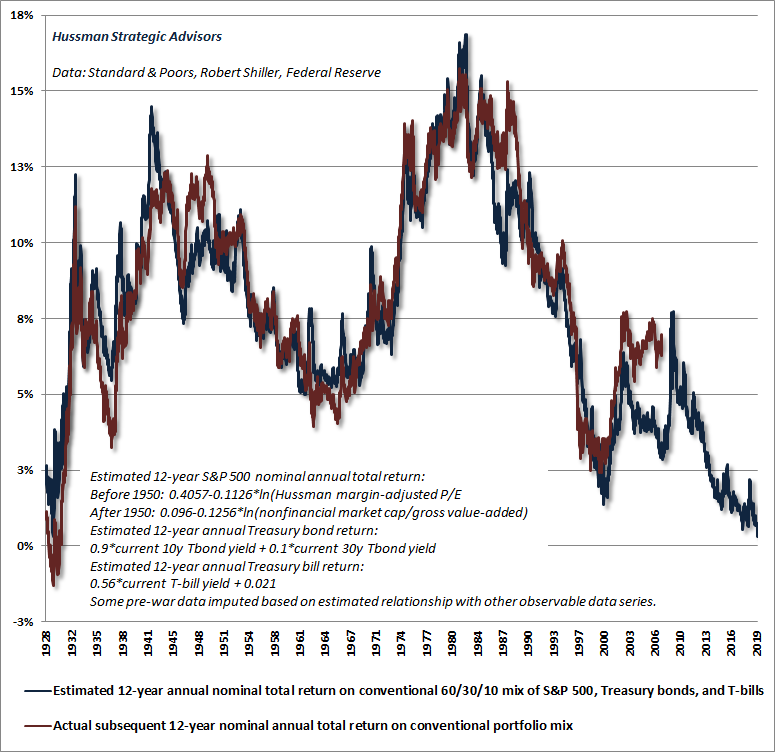

Expected market returns BEFORE COVID-19

I posted The Shorter Take to illustrate expected market returns looking forward, and it was horrible. The market fundamentals of the last 11 years didn't make America strong, it was weakened.

Then Covid-19 happened, so the bubble got popped. It may have just slowly leaked but instead we got a big bang. To read on my market view before Covid-19 click here.

US Unemployment

The weekly claims looks like this:

As per last post, there are 13.5 million on disability benefits, for a total of 171 million potential workers, for total of 40 million unemployed, 23.4%. (see alternate for 23%) The Great depression 3 years in achieved 23%. We are now at the level of unemployment not seen since 1932.

Home Sales

US home-sales have taken a nose dive, now about what it was a year ago. this isn't that bad, but it is a pretty steep drop for a month. But one month isn't a trend change. You decide what the next 6 months will yield, given the unemployment above. Will more homes foreclose? Will purchases accelerate? Keep in mind 30 year interest rate is already at 3.5%, would 2.5% spark an explosion in home buying or refinancing?

Mortgage Payments

Most people's biggest bill is home mortgage. We have seen the largest jump in mortgage delinquencies jump 3.3% in March since 2000. What will April, May, and June bring?

Car Sales

Before Covid-19, I presented the case the economy was slowing after a 11 year bull run. (click). Below you can clearly see car sales was slowing for a quite a while, but notice a new low being achieved in March. What will the months ahead bring?

Retail sales

Retail sales fell off a cliff. Will retail sales recover to January 2020 levels in 2 months? 6 months? A year? If retail doesn't recover in 3 months will the market of those stocks rise to January 2020 in advance of seeing materially improving sales? Will these retailers reopen and rehire at pre-Covid levels? Will shoppers have extra spending cash to go out and buy buy buy?

Bank Health

Notice the huge hump in bad debts US banks are reporting for March. What do you think April, May, and June will bring? Do you think one stick and back to January levels or potentially mirror something like 2008?

Federal Debt

The expectation is the USA will spend its way out of this, after all in January it was announced the US economic is spectacular, the best in history! But take a look at the Federal debt to GDP ratio, notice unlike past economic highs our debt increased, not decreased. Now we'll have to see Federal debt accelerate with GDP plummeting. When the Federal Debt to GDP ratio rockets higher this year, will this have any effect on USA bond rates? Will in the year ahead the Federal government be free to spend and spend to put the economy back on track?

Non-Financial company corporate debt

Before Covid-19, the USA corporate debt hit levels beyond the worst in 2008 crisis.

Now that companies will be strained, what will the levels rise to?

And who will finance it?

Federal Reserve bank Asset Purchases

The Federal Reserve bank is NOT a government entity, and not truly private one either. It is the bridge between the private banking world and the Federal government. It acts as a keeper of good fiscal policy. In 2008, it broke from tradition and purchased assets from private debt holders. Basically it created 4.5 trillion dollars by changing a database entry and used it to buy bad debt. it circumvented the basis for Federal and private money norms. This term is called monetization. And it is doing it again. This seems real bad, but in principle I have no issue with creating money with no debt. What I do have a problem with is how it is used. Its enabling the companies that took highest risks, or perhaps bent the law or fiscal duties beyond what is considered moral, and wiping the mistakes away. What kind of behavior would companies who profited learn? I'd say do it more!

So unlike gold bugs, I have no issue with this money for nothing approach, I do have a problem with everyone else needs bonds or interest for debt payback, unless you are REALLY bad, then you don't have to worry.

Do you have any concerns with keep on taking this action at 10 trillion? 20 trillion, 100 trillion?

Remember if you earned 2.5 million per hour since the time of Jesus birth, you wouldn't have 1 trillion dollars yet. Its pretty hard to comprehend the impact of this magnitude of 'process exception'.

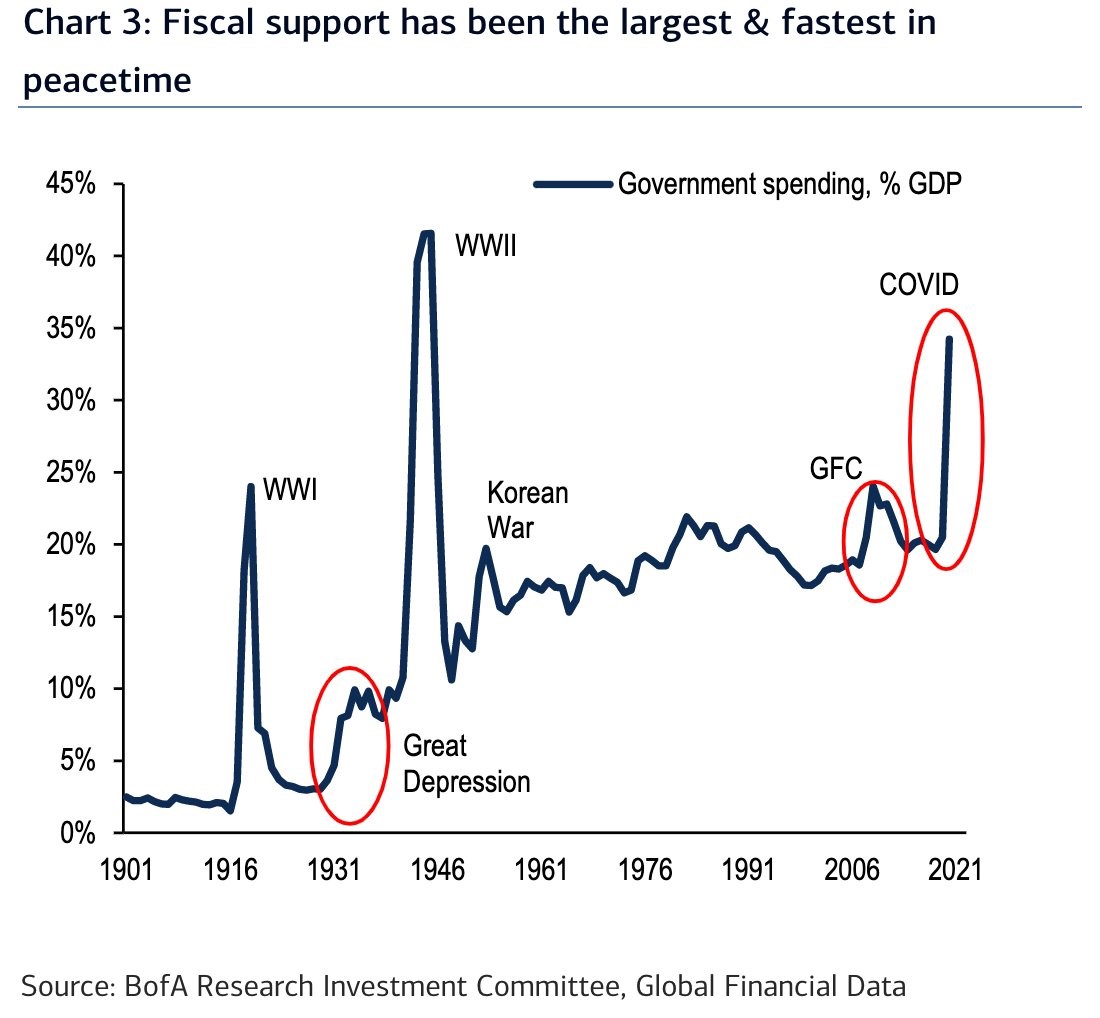

Fiscal Stimulus action.

The action of the Federal Reserve and the US Government has been beyond a doubt, the fastest and largest in human history. Spending more as percent of GDP than anytime in US history outside of WW1 and WW2. But is the money being directed in ways to ensure a quick recovery? Or will it function helping companies highly leveraged in debt without savings? What if it isn't enough, what next?

Pieces of the puzzle, what does it tell you?

Thats many puzzle pieces! Fundamentally I have no issue with this dip being sharp and a quick rebound, quicker than anyone has seen in human history. The problem I have is, agreeing with the actions of the Federal government and Federal reserve addresses the heart of financial challenges, or are we simply trying to kick a can down the road.

Then again, I had this problem in 2008-2009, and the can kicking worked quite well!

So lets hope for debt levels past100% for people and companies won't be an issue, and the Federal Reserve Bank just buying every asset in sight with free money will all lead to another 10 year run.

Whats does these puzzle pieces tell you?

My thoughts are basically in these two posts, Great Depression chart and Market - Whats next.

Wednesday, April 22, 2020

A history lesson, Great Depression then and now

UPDATE 4/23/20: I added economic data to tie in with post below, click here to read Pieces of a puzzle.

In 1929 the Great Depression started, the market highs did not return until 26 years later. Back then, the currency was tied to gold. Banks and governments couldn't just 'inject' money into the system. So crawling back to new highs took 26 years. This time around I am thinking maybe 3 to 10 years to get back to the old highs. But for now, lets look at the stock market chart of 1929, notice the nice steep drop from ~375 to 200, a drop of 46%, then a counter rally to about 290, which is a little over 50% of the drop being covered. Next up, lets look at today

In 1929 the Great Depression started, the market highs did not return until 26 years later. Back then, the currency was tied to gold. Banks and governments couldn't just 'inject' money into the system. So crawling back to new highs took 26 years. This time around I am thinking maybe 3 to 10 years to get back to the old highs. But for now, lets look at the stock market chart of 1929, notice the nice steep drop from ~375 to 200, a drop of 46%, then a counter rally to about 290, which is a little over 50% of the drop being covered. Next up, lets look at today

Notice that the SPX market dropped from about 3400 down to 2190, a 36% drop, with a retrace from 2190 to 2880, a counter rally of about 57%.

Both drops are 36-46% range, the drop took 35 days and now it took 16 days, both counter rallies are 50-57% range. History doesn't repeat but it often rhymes. This past Friday and today are excellent times to lighten your long positions, I did.

But this isn't a Great depression right? Well in 1929 the total USA unemployed went from 1.5 million in 1929 to 12 million in 1932, a 700% increase to 23% of the workforce over 3 years. In 2020 unemployment went from 5.7 million to about 22 million in about four weeks, a 285% rise to about 14% of the workforce. The total workforce in 2020 is about 158 million people that could work, but then tack on 13.5 million in disability program that didn't exist in 1929, making it a 171 million potential workers. A total of 35 million out of work is about 20% of the 171 million potential workers circa 1929 measurements. Again, things aren't exactly the same, but there are parallels.

Do I think the market will take 26 years to new highs? Not a chance, it will be much shorter. Do I think next year will be making new market highs through end of 2022 (adjusted for currency valuation)? Not a chance.

The economy has been hit with a big blow. We are injecting money into the system that could NOT have been done in 1929, this alone will change how this plays out. But pushing money from the top won't work quickly. If we start giving out direct payments to displaced workers completely different story, the rebound will be very quick. But pushing money through banks and financial companies doesn't automatically put money into people's pockets. They have to be employed and get a wage equal or better than before the bust to return to same valuation. To boot, we have no idea how to return to normal business and sustain it over the next year!

If we take the hard nose American route of don't dole out money to people, but give money to companies, I expect this to last much longer as we need to regain spending and employment back to January before the market can sustain new highs and keep them.

Winston Churchill said “You can always count on the Americans to do the right thing after they have tried everything else.”

And that will determine how long the downswing lasts. Not wishful thinking, praying, not democrat vs republican, not Trump vs Biden, just actual action to help restore the economy through the consumers.

Like we did in the Great Depression with the then new social safety net, it needs to go to the next level. I am investing relying on Churchill's wisdom, and will go all into the market when we do the right thing.

Saturday, April 18, 2020

Concerned over Municipal Bond Market

I wrote back in October of 2008 a warning about Municipal bonds, and here it is 12 years later repeating the message. The key difference between the federal government and states is the feds can print money at will. Critically, municipal governments cannot.

The feds promise social security, medical, and all sorts of benefits to those not working, and can pay it simply by issuing currency. Before 2020 the bonds must be purchased by the open market, but now the Federal Reserve is buying bonds, in effect monetizing the debt. This has effect of keeping rates low, as the fed will buy at any rate.

Municipalities have made many promises, of working for decades with great retirement payments for more time than you worked! The issue is the cash comes from someplace, and politicians have allowed kicking the can fund the pensions. I live in NJ, and we had a well funded pension system until Christine Whitman, a republican, decided to stop funding pensions properly. Then every governor since then republican or democrat kept the tradition alive. So far, I haven't read doom is around the corner for NJ.

I can't say the same for Illinois. For over promising and under-funding pensions Illinois is the best at the nation! So the next action is going to be one of the following.

1) Tell retirees payments will end or cut dramatically. (75%+?)

2) Raise taxes in the state that already has highest taxes in the nation.

And keep business and rich mobile people in the state.

3) Go bankrupt

4) Trump looks at Illinois and decides to bail them out, with Republican support, for Police, Fire, Teacher, and municipal pensions.

Any one or combination or all are in play. Since I expect the market to get cut 40% from current levels of valuation, I think the can is nearing the end of kicking. Illinois has 8 years of funding right now. If they see assets cut 50%, I doubt they can make 3 years (since there isn't time for ROI). Municipalities could see bond interest spike much sooner, as people understand the magnitude of whats is ahead. If I am right, people already invested in Municipal bonds will get their values cut. Option 4 above will be a HUGE can kick that makes my fears go away for a few years.

To get an idea of how bad Illinois is, they have 10 pensions (made up of police, fire, ERS, Forest, Teachers, University, State, General Assembly) all funded with LESS than 14% of funds needed.

Great picture below and link to article here:

Message: Stay out of municipal bonds.

The feds promise social security, medical, and all sorts of benefits to those not working, and can pay it simply by issuing currency. Before 2020 the bonds must be purchased by the open market, but now the Federal Reserve is buying bonds, in effect monetizing the debt. This has effect of keeping rates low, as the fed will buy at any rate.

Municipalities have made many promises, of working for decades with great retirement payments for more time than you worked! The issue is the cash comes from someplace, and politicians have allowed kicking the can fund the pensions. I live in NJ, and we had a well funded pension system until Christine Whitman, a republican, decided to stop funding pensions properly. Then every governor since then republican or democrat kept the tradition alive. So far, I haven't read doom is around the corner for NJ.

I can't say the same for Illinois. For over promising and under-funding pensions Illinois is the best at the nation! So the next action is going to be one of the following.

1) Tell retirees payments will end or cut dramatically. (75%+?)

2) Raise taxes in the state that already has highest taxes in the nation.

And keep business and rich mobile people in the state.

3) Go bankrupt

4) Trump looks at Illinois and decides to bail them out, with Republican support, for Police, Fire, Teacher, and municipal pensions.

Any one or combination or all are in play. Since I expect the market to get cut 40% from current levels of valuation, I think the can is nearing the end of kicking. Illinois has 8 years of funding right now. If they see assets cut 50%, I doubt they can make 3 years (since there isn't time for ROI). Municipalities could see bond interest spike much sooner, as people understand the magnitude of whats is ahead. If I am right, people already invested in Municipal bonds will get their values cut. Option 4 above will be a HUGE can kick that makes my fears go away for a few years.

To get an idea of how bad Illinois is, they have 10 pensions (made up of police, fire, ERS, Forest, Teachers, University, State, General Assembly) all funded with LESS than 14% of funds needed.

Great picture below and link to article here:

Message: Stay out of municipal bonds.

Thursday, April 16, 2020

When is good time to start moving into miners?

I am looking for GDX as a gauge for overall miner health. GDX breaking below 28.50 is a fantastic place to buy.

GDX breaking below 26 then I am concerned this has been read entirely wrong, and I need to lighten.

Buying now, or on a dip is immaterial, GDX is headed for much higher.

Because of this, GDX may not break below 29 this year. So its tough to say wait or not, with 1-2 buck 'savings', not sure if worth it. I may reload starting today and try to not look back until GDX 40.

GDX breaking below 26 then I am concerned this has been read entirely wrong, and I need to lighten.

Buying now, or on a dip is immaterial, GDX is headed for much higher.

Because of this, GDX may not break below 29 this year. So its tough to say wait or not, with 1-2 buck 'savings', not sure if worth it. I may reload starting today and try to not look back until GDX 40.

Tuesday, April 14, 2020

Target Stocks to consider

UPDATE 4/15 morning: I am making purchases SLOWLY watching for market to hit a new low, or we break higher than yesterday's high. With a falling market, all things get pulled down, please see my concern: Unbelievable market gains, 50% recovery in two weeks! If you are looking for buy and hold for long term, wait for market to get cut by 40% from here, start looking at S&P 500 at 1600-1800 range (currently 2846).

----

Yesterday I posted a first pass at analyzing stocks.

Today I added additional stock and did additional analysis.

I bring you the top stocks I consider currently a good purchase.

These stocks have been identified using a few criteria.

1) The stock has shown strength / change of direction.

2) The PE ratio isn't high.

3) Stop-loss is favorable considering the reward.

I really like companies GOLD, KGC, SVM, and FSM.

I'll be reworking my investments to be in line with this analysis.

I will be sure to put stop-losses in. If the stock breaks below targets, clearly I am wrong and I want to cut losses.

One of the reasons I am fixed on this sector is gold is breaking out to new highs, oil is at historic lows, and the world banks are infusing trillions of dollars into the system. Many are nervous, and I expect precious metals to continue to rise.

Please see a financial adviser for risk, I have no formal training and this, and take ZERO responsibility for sharing what I am doing.

----

Yesterday I posted a first pass at analyzing stocks.

Today I added additional stock and did additional analysis.

I bring you the top stocks I consider currently a good purchase.

These stocks have been identified using a few criteria.

1) The stock has shown strength / change of direction.

2) The PE ratio isn't high.

3) Stop-loss is favorable considering the reward.

I really like companies GOLD, KGC, SVM, and FSM.

I'll be reworking my investments to be in line with this analysis.

I will be sure to put stop-losses in. If the stock breaks below targets, clearly I am wrong and I want to cut losses.

One of the reasons I am fixed on this sector is gold is breaking out to new highs, oil is at historic lows, and the world banks are infusing trillions of dollars into the system. Many are nervous, and I expect precious metals to continue to rise.

Please see a financial adviser for risk, I have no formal training and this, and take ZERO responsibility for sharing what I am doing.

Many stocks to buy

UPDATE 4/14, see new POST by clicking HERE:

So when I panicked out of some positions Thursday, I noticed gold has exploded higher.

As I said in Sunday's post, i was going to buy back in to gold miners.

I decided to create a grid I can use to gauge best place to put money with highest potential.

The stock GOLD I mentioned EXPLODED today higher!

The next ones to pop is AG and CDE. I may jump in to catch the wave.

I may add to whatever looks good for risk to profit.

UPDATE: 4/14 - looking at taking a position in USLV, silver, been lagging to gold move.

For your viewing pleasure, the analysis. I plan to add much more over time. Enjoy

Click here to see full View of Stocks.

So when I panicked out of some positions Thursday, I noticed gold has exploded higher.

As I said in Sunday's post, i was going to buy back in to gold miners.

I decided to create a grid I can use to gauge best place to put money with highest potential.

The stock GOLD I mentioned EXPLODED today higher!

The next ones to pop is AG and CDE. I may jump in to catch the wave.

I may add to whatever looks good for risk to profit.

UPDATE: 4/14 - looking at taking a position in USLV, silver, been lagging to gold move.

For your viewing pleasure, the analysis. I plan to add much more over time. Enjoy

Click here to see full View of Stocks.

Sunday, April 12, 2020

Buying Gold and Gold miner Dips...maybe Bitcoin

The market rose so fast, that Thursday I dumped many longs and call options.

I went a little over the top and sold SOME of the long term plays in Gold, Gold miners, and Bitcoin stocks. As I look forward and read various pontificators, I am thinking I may add back to Gold and Gold miners Monday morning, but leave quite a bit of extra cash to be wrong.

GOLD - Gold miner

GDX / GDXJ - Gold miner stocks

CDE - gold miner that hasn't rocketed up yet.

GLD - gold ETN

SLV - Silver ETN

UGLD - short term play ETN, can't hold for long term.

USLV - short term play ETN, can't hold for long term.

HMY - another miner

Bitcoin

RIOT - already up 50% from buy...holding.

SNSR - ETF 'internet of things' has some exposure to bit miners.

There is speculation bitcoin may hit $5K again. Monday I'll setup to be ready to buy more.

Right now its $6.7K

I am going to start poking around other cryptos and look to diversifying out for the years ahead.

I went a little over the top and sold SOME of the long term plays in Gold, Gold miners, and Bitcoin stocks. As I look forward and read various pontificators, I am thinking I may add back to Gold and Gold miners Monday morning, but leave quite a bit of extra cash to be wrong.

GOLD - Gold miner

GDX / GDXJ - Gold miner stocks

CDE - gold miner that hasn't rocketed up yet.

GLD - gold ETN

SLV - Silver ETN

UGLD - short term play ETN, can't hold for long term.

USLV - short term play ETN, can't hold for long term.

HMY - another miner

Bitcoin

RIOT - already up 50% from buy...holding.

SNSR - ETF 'internet of things' has some exposure to bit miners.

There is speculation bitcoin may hit $5K again. Monday I'll setup to be ready to buy more.

Right now its $6.7K

I am going to start poking around other cryptos and look to diversifying out for the years ahead.

Thursday, April 9, 2020

Unbelievable market gains, 50% recovery in two weeks!

The market is likely to hit a 50% retrace of losses Thursday April 9th. Friday the markets are closed.

The market I still think will hit S&P 500 value of 3,000 before going much lower, my target is S&P 500 30-40% lower from here. (As originally stated Jan 30th, ACT NOW Sell the market!, up to 50% from high, down to SPX 1700) In the short term, we maybe getting close to a high for a few months. I suspect we will enter into a period moving between 2850 and 2450 for a bit as good vs bad news comes out.

Getting a market return of 50% in about two weeks is INSANELY GOOD! You can't look at the high in February as a gauge, you can look at market return from recent lows to current value to judge the market return. For the day-traders and big money this is their returns, many fold over, by using options. The 'easy money' is to drive the market down a gain to S&P 500 2450-ish, then back up to 3,000 to get returns up and down using options.

If you want to risk the recent gains for 'getting all your losses back', I highly doubt this in the year ahead, if not much longer. I suggest you think back to March 23rd and what you would have been thankful for. What we just got back in value was your 'wish' , don't changed your wish! Consider lowering your risk, and gamble with a little less.

If/when S&P 500 crack 3,000, please consider taking more off the table. I'll be going heavily out if we hit that. As it is, I'll take a little more off today and start to unwind my long disposition started on March 22nd.

UPDATE: 1pm Eastern: I dumped many long positions, I am not short either.

Monday, April 6, 2020

COVID-19 Update

Last post "Covid-19 updated Statistics" was on March 19th, today I bring mixed news.

World is slightly under projected death count. But America is WAY higher in deaths than last projected, about 500% worse. Yikes! I suspect this is because of lack of testing, we had many more cases than reported in the works.

I am hopeful that we hit the target green area and cap under 100K dead in USA at the top.

I'll try to update again April 30th or May 6th.

If we don't continue being vigilant, we could hit a million dead in USA. So keep up the social distancing!

I was wrong about Gold Miner Concerns

Gold is looking very good as we hit new highs. I was wrong to be Concerned about Gold Miners.

Going back to being positioned for the year ahead, and that includes Gold miners, Bitcoin, and Bitcoin miners as a counter play to what is in the next 1-2 years ahead.

Please consider Mish's post Gold's New Breakout is Very Bullish

Below is a chart of GDX.

Going back to being positioned for the year ahead, and that includes Gold miners, Bitcoin, and Bitcoin miners as a counter play to what is in the next 1-2 years ahead.

Please consider Mish's post Gold's New Breakout is Very Bullish

Below is a chart of GDX.

Thursday, April 2, 2020

Short Bull run?

My hope is the market recovers into early next week. If it does, I'll likely unload more long positions. I think the counter-rally will be much shorter than I hoped for. I was (and still) am hoping for a rally into August with the next major downturn in September as the effects of 'free money' wears off.

In either case, if we get to SPX 3100 (S&P 500) its a perfect time to unwind long positions. I have a very hard time believing we can get to new highs.

The target is SPX 1600. Lower than 1600 will start raising my concern, until then its all expected to me.

Currently, I have no good insights, except nothing goes in a straight line. The few weeks of straight down was a delayed reaction to what I posted on January 30th ACT Now, Sell the Market! The delayed reaction gave big money time to sell into a buying public.

We did bounce at the 2200 line I called out as a short term target in March 12th post 'Short Term Market Bottom'.

In either case, if we get to SPX 3100 (S&P 500) its a perfect time to unwind long positions. I have a very hard time believing we can get to new highs.

The target is SPX 1600. Lower than 1600 will start raising my concern, until then its all expected to me.

Currently, I have no good insights, except nothing goes in a straight line. The few weeks of straight down was a delayed reaction to what I posted on January 30th ACT Now, Sell the Market! The delayed reaction gave big money time to sell into a buying public.

We did bounce at the 2200 line I called out as a short term target in March 12th post 'Short Term Market Bottom'.

Subscribe to:

Posts (Atom)