The Shorter Take

The markets in 2019 did very well, up about 35%! BUT if you look at August 2018 until today, its up about 12%. Remember, back in 2018 the market took a hard turn for the last half of that year.

Looking ahead we have two paths ahead, a banner year of gains, perhaps +50% or more, or a market correction. I am truly torn which one we will see. The president of the US will press against any fiscal responsibility to keep the market roaring, as he has shown by pressuring the private group, the Federal Reserve Bank. President Trump stated publicly that we should join in on the reducing of interest rates to negative, to be competitive to the world. Austria has issued 100 year bonds with NEGATIVE interest rates. Germany currently pays a negative rate for 1 to 15 year bonds! Compare that to the USA paying 2.4% for a 30 year bond.

If the USA tries to join in on unconstrained 'free debt', and the world can sustain it, I really do think the market up 50% in 2020 is possible. S&P 500 from 3250 to 4,875!

Before I go into greater detail about the economic health, I do what to call out one thing for you to seriously consider. If you are over the age of 55, and therefore may not have 10-15 years for your savings to return with a market correction-recovery, what is your strategy in investing? The market has recovered about 480% since 2008, that is very good growth! That took 10 years to do, but if you where in the market in 2007, you took ~6 years just to stay even assuming you never sold.

PLEASE take serious consideration of your strategy to withstand a market correction that takes typically 10 years to recover. RISK only what you can afford to wait even longer to grow your savings. I drew S&P 500 from 1991 to today to illustrate how amazing the market has been, and yes, can be in 2020. My opinion is 50% into cash/conservative investments in 2020 is wise after 480% gains if you are 55 or older. See your professional adviser for whats right for you.

One cautionary factor is to the USA has advanced its debt spending substantially since 2016 with tax cuts. Our deficit is now at over 1 trillion a year at the HEIGHT of the US economy. To put that into perspective, if you where paid at 2.7 million an hour 24x7 since the birth of Jesus (year 0) you still wouldn't have enough money to pay 1 year of USA's debt spending!

If we assume the USA and the world will not enter into the one way abyss of racing to the bottom of free debt, lets look at other economic factors that may affect the market.

The question is , if we needed massive tax cuts, QE easing by the banks to get here, what is the government willing to do to keep this party ontrack for the year ahead?

The question is , if we needed massive tax cuts, QE easing by the banks to get here, what is the government willing to do to keep this party ontrack for the year ahead?

NOTE: I am long the market in the under-valued precious metal sector and Marijuana stocks.

ETF's are GDX, GDXJ, and MJ.

The details

I advise you stop reading here unless you want to understand where I get my view from.

I have gathered items I have found interesting across a variety of sources. My own thoughts of peak valuation was done in August 2019 post Decade old topping pattern completing. Although the graphs have advanced, my opinion is the same.

Below is a quote from Hussman Funds, you can read their full post The Meaning of Valuation .

Yes, interest rates are low, but with them, so are the discount rates and long-term returns that are embedded into current prices. Indeed, the most reliable valuation measures suggest that stock prices are presently about three times the level that would imply future long-term returns close to the historical norm. That may sound like a preposterous assertion, but we’ve seen such extremes before, and they’ve ended quite badly.

Worse, there is a great deal of evidence to support the assertion that interest rates are low because structural economic growth rates are also low. In that kind of environment, a proper discounted cash flow analysis would show that no valuation premium is “justified” by the low interest rates at all. Hiking valuation multiples in response to this situation only adds insult to injury.

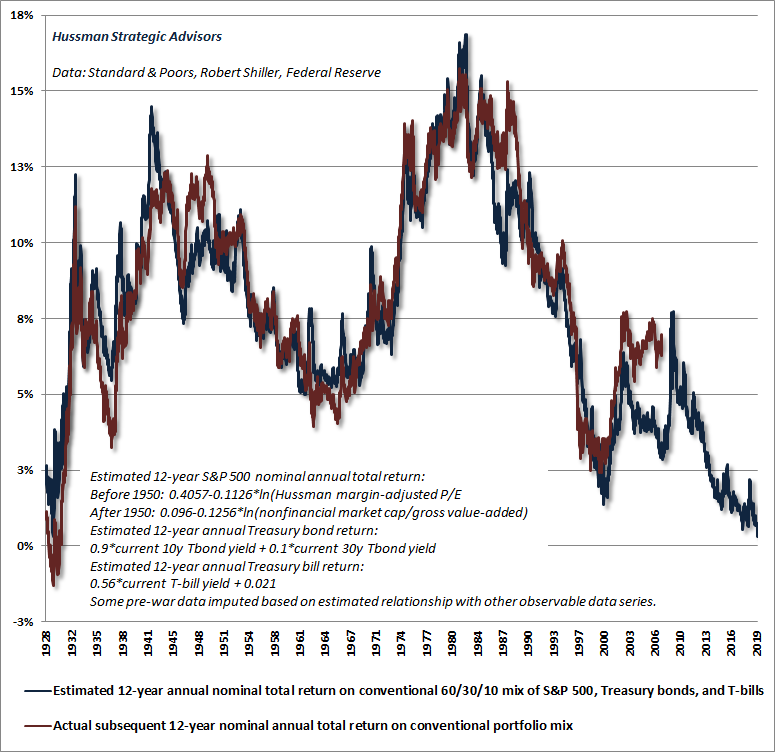

Last week, our estimate of prospective 12-year nominal annual total returns on a conventional portfolio mix (invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills) fell to the lowest level in U.S. history, plunging below the level previously set at the peak of the 1929 market bubble. The chart below shows these estimates (blue), along with the actual subsequent 12-year total returns that have followed (red).

Another Hussman post, you can read full here: One Tier and Rubble Down Below

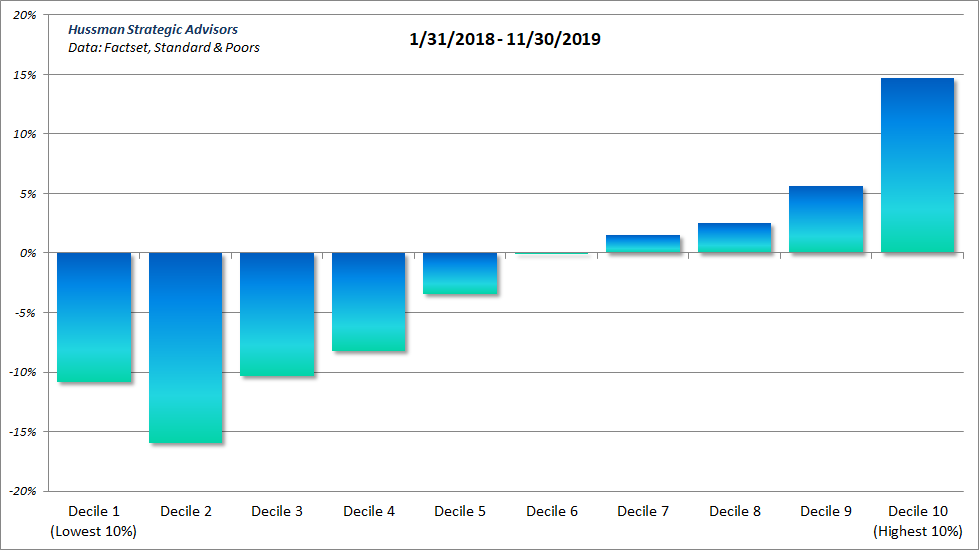

The next chart shows the percentage change in median price/revenue ratios since January 2018. Notice the striking loss of uniformity here. What we see here is essentially a “Nifty Fifty” type of environment, where the most richly valued deciles have accounted for a disproportionate share of the gains while more value-oriented sectors have stagnated or even lost value. This is the hallmark of a market that is losing its engines, yet at the same time maintaining the face of speculation.

We’ve observed precisely the same pattern in the late stages of previous bubbles. Indeed, during much of the tech bubble and the mortgage bubble, value-oriented stocks outperformed other deciles through the bulk of the advance. However, that pattern shifted profoundly as the market approached its peak, with investors increasingly chasing high-valuation “glamour” stocks while the broader market gradually lost its sponsorship.

MISH post: Jim Bianco says this is QE, Like Y2K

We are in QE, free money for the financial system! this goes back to my point, if we continue to support the system with free money, S&P 500 up 50% in 2020 is possible!

Smaller articles, the titles sum up the gist, click through to learn more.

Consumer confidence down 4th time out of 5 months.

Nine States Projected to Contract in 2020: More on the Way

Cass Year-Over-Year Freight Index Sinks to a 12-Year Low

Manufacturing Has Peaked This Economic Cycle

No improvement in corporate profits since 2012

China Posts Slowest Growth in 29 Years But Still Overstated

Ticking Time bomb of record high corporate debt

Cass Year-Over-Year Freight Index Sinks to a 12-Year Low

Manufacturing Has Peaked This Economic Cycle

No improvement in corporate profits since 2012

China Posts Slowest Growth in 29 Years But Still Overstated

Ticking Time bomb of record high corporate debt

Bills due on vacant chines properties - ( China is significantly financially worse than USA )

Capital flight: Money leaving China at record rate - (If China has its crisis, the world will go with it )

No comments:

Post a Comment