Welcome new reader!

Tuesday, September 22, 2020

The Top and the Bottom

If we can't get a double punch of great market news of that magnitude, the top is in, so what is the bottom?

I think we will have a volitile but wiggle market with an overall trend down, straight through to 2028. The bottom I think is in 2028-2029. This is for OVERALL market. The top 30 tech companies should continue do to well and become bigger buying companies along the way. I have a hard time seeing these companies retreating over the next 8 years. (Amazon primarily in mind).

I use the S and P 500 and not DOW 30 as to me it is a better representation of the US economy. The recent high of 3,508 I think could retreat to 1000. The charts indicate as low as 500. I have a real hard time believing we can hit 1,000 or pass it materially.

The global banking system will simply print endlessly and would rather see a hamburger at mcdonalds cost 20 bucks than a market that retreats below 1,000. So in real purchasing power, I do think hitting 500 is in the cards.

But this isn't about real purchasing power, its about a better place for money to ensure relative wealth in the market vs individual companies vs bonds vs gold vs cryptos.

Over the next 8 years, staying in CASH IS TRASH, this includes bonds. Investing will be about every 6 months assessing which asset has greater chance of doing better. Cash has retreated by 10% in purchasing power since March. Now its the markets turn to take a hit. At some point it will be cash's turn again, and repeat. The overall wealth of the nation will need to be re-aligned to the world wealth.

Good luck!

Sunday, September 20, 2020

COVID-19 confusion

I decided to go back, and look at the posts I did about COVID-19, and analyze what I projected vs what occurred, and then using that data update a view of what may happen and what could happen.

Fun stuff? Lets go!

On January 26th, 2020 I posted "Potential Pandemic Precautions" and I asserted 2.7 Million American may die. At that time I did not share the math I used to come up with that number. That was in error, as it wasn't believable. So I started to post the math, which I wonder if anyone who questioned my 26th post even read my math! :)

On March 5th 2020, I posted "Humans don't know exponentials COVID-19" I posted the math. The key is using the math at the time, I extrapolated the infection count and death counts based on what we knew then. Key items are 3.44% mortality rate, and USA death count projected by 3/19 to hit 44, and 11.K dead by 5/4, with 180K dead by 5/28.

On March 19th 2020 I posted "COVID-19 Updated statistics", the death count hit 218, causing me to revise the 11K death to cross before 4/24 and mortality rate to be 1.5%. I suspect the mortality rate was artificially low due to infected rose rapidly and death follows later. The deaths are FAST than 3/5 projections. I also stated clearly:

I also think the infection rate will slow down dramatically in three weeks, when USA 'stay at home' efforts help and large scale testing identifies the sick.

This comes into play after my next update.

On April 6th was my last update in "COVID-19 Update'. This post is a little under my 3 week projection to dramatically slow down infections and death. Lets see what we find:

I projected by April 6th about 1,750 dead in the USA and this update shows dead to be at 10,876!

The US infection was to be at 114,392, and instead we came in at 367,85. The mortality rate is at 2.961% .

I attribute this distortion to several things including accurate reporting and inadequate testing.

The projections showed dead at 195K by about 5/2/20, but we stand today at 195K, so what changed?

Well perhaps that actually taking precautions dramatically slowed down the death as forecasted on 3/19. Some may say that immunity kicked in. Lets take a look at the infection and death rate to spot check this.

USA has increased testing, and supposedly that is 'driving up numbers' unfairly. Meaning, we didnt test as much and now we are showing people having COVID we didnt before.

If this is true, then what I would expect is that the number of people reported infected would be high, and relative to that number a much lower mortality rate. (the dead is not rising as quickly as testing.)

Today we have 6,548,503 infected. using the mortality rate of 2.961%

Wednesday, September 9, 2020

COVID-19, Mortality rate April, now and the future

I welcome to learn how my logic is flawed.

Posts referenced in video are linked below:

Nothing goes in a straight line

I expect a short term bounce here, maybe a week?

I am buying GOLD (Barrick gold) since it held up so well, and Warren Buffet is a buyer.

Also TGB, it rose during this downturn, so I am a buyer

Also buying back into crypto miners (a little) of GBTC, HTBX, HUTMF.

Adding to TSLA short if it hits 390, and WYNN if it hits 92.

Good luck!

Thursday, September 3, 2020

True Diversification

Over the last 50 years, diversification of investments has been defined as a mix of bonds, stocks, cash, and sometimes natural resources.

A USD diversified portfolio will lose value as USD depreciates, taking away wealth from stocks, bonds, and cash.

The alternatives for true diversification is natural resources, international investing, or alternative currencies.

Natural resources will likely go down in demand if there is a deflationary economy. Gold may do better , but unless there is a financial system crisis it won't explode in value. However, I do expect it to do well as it is an alternative to USD. (stocks GDX, GDXJ, GOLD, RGLD, and SLV)

Other currencies may do well, but I would expect turmoil if USD is devaluing. Some countries, like Norway, currency did very well in 2008, and you could buy stocks in that country as a hedge of both currency and income. Most investors are not sophisticated enough to purchase foreign companies, but some are available on US stock market. It is a viable option for true diversification.

The problem is very complicated, as I shared in post "The world needs to move past a 'reserve currency'.

What we need is a new solution that currencies around the world can remain stable and 'fair'. The closest thing to a new innovation in currencies is Crypto currencies.

Therefore a truly diversified portfolio would be stocks, bonds, natural resources, foreign companies, crypto currencies, and cash.

I am a big believer in Crypto's for the next stage of the unfolding economic crisis, however I am hoping gold is a big winner first.

Consider opening an account to purchase Crypto's now and get setup, buy $100 bucks of cryptos and start to learn. Crypto's right now are not a perfect storage of value, but it does have advantages over gold. First and foremost, it is the likely future of the world's currency challenges. By setting it up now, you have a new lever for moving wealth.

Use the link below, and I'll get $10 bucks for opening an account.

https://www.coinbase.com/join/murphy_b9f

Consider trying out Bitcoin (as its the 'gold' standard). Although a coin is worth about $11K, you can buy $100 worth (a fraction of a coin).

Consider Bitcoin Cash and Lite coin Trust as they will be listed as a trade-able stock ticker (BCHG & LTCN. I expect easy access to drive prices up. (click to read)

If you want to move money to any currency, any country, and buy any stock in local currency, I highly recommend https://www1.interactivebrokers.com/ , however it takes quite a bit of work to understand AND avoid pitfalls that will cost you dearly.

As always, consult a professional financial advisor!

Good luck!

Additional thoughts

Historically when stocks go up, bond rates go down, and when stocks plummet interest rates (cost to borrow) goes up. This diversification worked well through 2008. Since then the Federal Reserve bank has been actively suppressing interest rates both at federal and now commercial level. The result is rates that are at historic lows with the Federal Reserve promising to force rates lower.

That has forced money to seek returns, which is heavier into stocks. But what if stocks start a new down trend, where to put money? The answer 100 years ago was flight to safety, gold. Back then gold was tied to money so the 'value' of each dollar was preserved as there is a shortage of dollars in a deflationary period.

There is still some truth to this, but not as reliable.

Many will chose to remain in bonds even with near zero interest rates as not losing value is better than gambling on stocks or resources. But even this is a choice, what if USD devalues?

Since March of 2020, the USD has depreciated by 10% compared to other currencies. USD denominated debt, including 'derivatives' is about 500 trillion. The US stock market is total valued of US stock market is about 35 trillion. I am sharing these numbers to illustrate the impact of USD valuation has on the world economy, and why the USD has been so strong for so long.

Wednesday, September 2, 2020

A Must read article

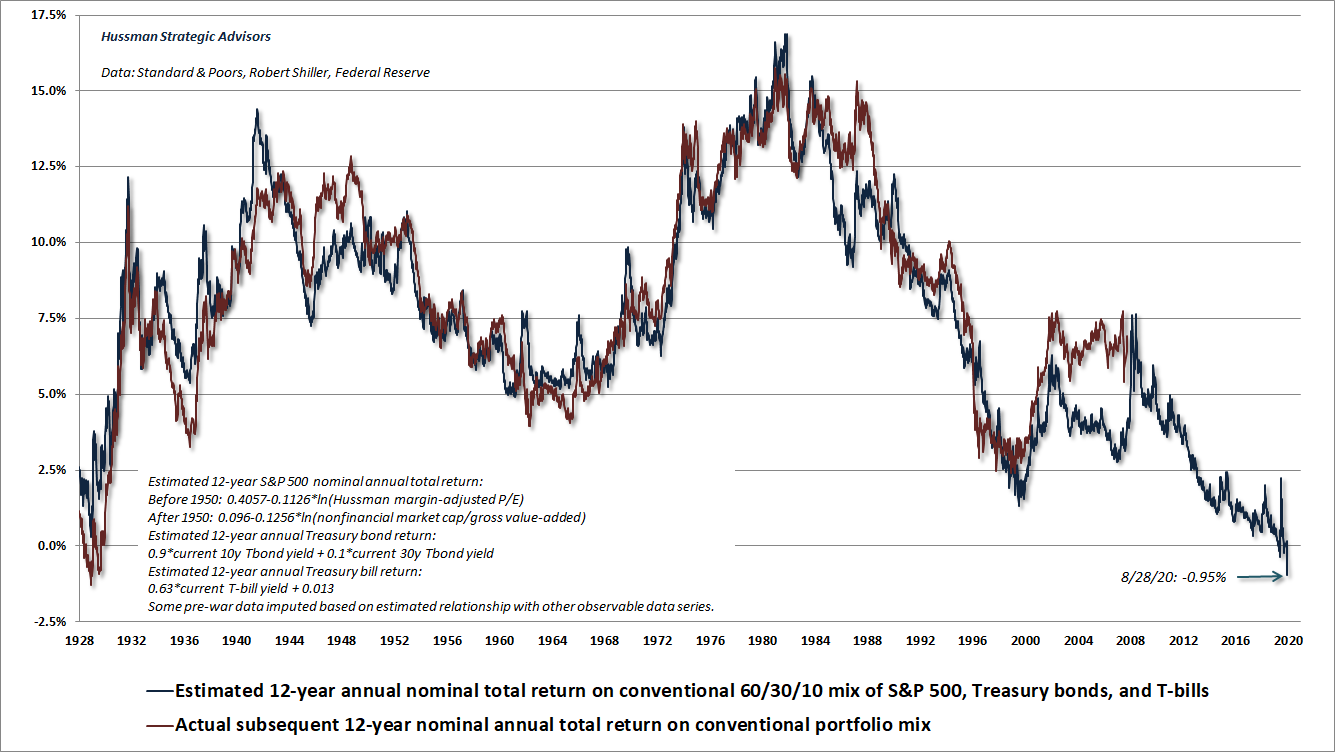

An EXCELLENT summary of US current extremes compared through history back to 1929.

I highly recommend everyone read. We are all Bull market participants right now.

https://www.hussmanfunds.com/comment/mc200901/