Recap

On March 30th I posted Net Long. Unfortunately I didn't play big Zoom and sold early, but I did catch most of the upside in other stocks, including GDX/GDXJ.

GDX went from 16 to 45 in August.

Then I switched to Crypto in the post in July, What Next Gold, Crypto or Both?.

Crypto near term gains.

HVBTF was .60 , recently hit 2.40, (I sold most of my position in this. )

RIOT was 2.19, today its trading at 12.06

HUMTF was 0.80, today its trading at 2.96

GBTC was at 10.39 and today its at 31.61 (largest current position)

Bitcoin was at below 11k, trading today above 23k.

Obviously, all good trades, congrats if you participated.

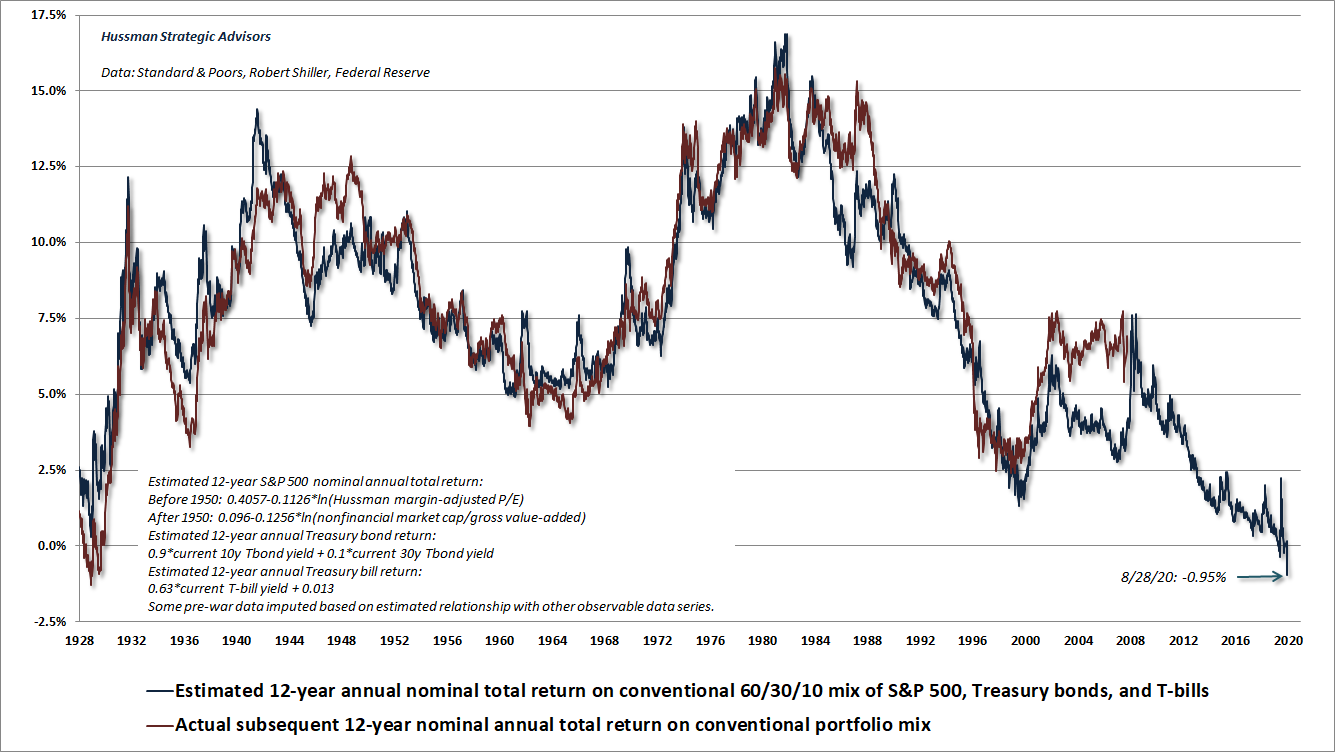

However, I am concerned about a market correction as market valuations are at levels YEARS out. This is attributed that if a stock may get 2% ROI over the next 10 years, its better than a 10 year treasury note. The issue is, at some point, all of this excess will be priced into the market. All that is required is the 'wrong' piece of news to spook the market and putting capital hoping for 2% ROI over 10 years in a stock seems like high risk vs 1% in a 10 year bond. To read more of my concerns read 'Resuming the march decline ahead'.

Cash maybe the right play in the next 6 months. But 'irrational exuberance' can sustain much longer than anyone thought. It's impossible to know when the top is, to sell and avoid the downside risk. So I do think its a good time to be in very conservative plays. But I caution do NOT invest in old companies like EXXON or IBM, Casinos, but into the future. Stay away from hype stocks like TESLA. This is a list of stocks I am looking at:

Crypto direct investing

Bitcoin direct, with smaller positions in Ethereum, Lite Coin, Bitcoin Cash, and Compound.

if you consider buying some bitcoin, I recommend coin base, use this link to sign up.

https://www.coinbase.com/join/murphy_b9f

Bitcoin I think is being positioned as the new gold alternative. It is starting to take hold into mainstream investing, and Bitcoin I think is a 'no brainer' to hit 100K, cases can be made it will go to 400K, and I do think briefly it could hit 1 million a coin. To be clear, Bitcoin is like gold, its value is as a buy and hold 'ponzi' like scheme. The biggest downside to Bitcoin is the same as Gold, its a collectible, like a baseball card or rare whisky. It has no intrinsic value or money creation like a business such as Amazon or Apple. So it is a terrible 10-30 year investment, but I do think the transition of moving into public ownership is a good investment bet. I strongly recommend having a target to actually sell at.

Crypto Stocks

Grayscale is a company that is PRIVATELY owned, I would really like to be able to invest in the company. They take only large scale investors like Guggenheim or Mass Mutual to the tune of up to 500Million for a buy in.

There are several ETF's Grayscale offers.

GBTC - its an ETF proxy to buy actual Bitcoin - Word of caution - it will trade HIGHER than the underlying intrinsic value, to see the chart click here.

GDLC - It is an ETF proxy to a variety of crypto currencies including bitcoin, rebalanced every quarter. Again, it can trade ahead of its intrinsic value. (click)

Grayscale offers ETF's for specific cryptos , click here to see current list. Some notables is ETHE or LTCN .

Crypto Miners

All of these miners are very high risk, none make any material profits. They are all only short-term plays and should be sold after a good rally.

HUTMF - Reported gross Revenue of 63M in 2019, posted a profit of 28M. Doing best in this sector.

HVBTC - They report annual gross revenue of 30M into March 2020, they posted a 7m profit. Compared to most other miners they are doing well.

RIOT - On the plus side, most self directed 401k's let you purchase, on the downside, its turns a razor thin profit. Total Revenue in 2019 was under 7M

Crytpo ETF's and other stocks

SI - Silvergate - Provides banking services that include Crypto. Earned 25M on 81M gross in 2019.

BLOK - invests in blockchain companies

MARA - Mara Patent Group - 1 Million in revenue, 1 million in losses.

BRPHF - Galaxy Digital Holdings - An asset management firm, operates in the digital assets and blockchain technology industry. No reported financials. Earnings.

Gold Miners

GDX - Gold Miner ETF - Wide array of gold miners, decent play to protect purchasing power of your USD assets relative to the world.

GDXJ - Smaller Gold Miners with some silver ETF - Wide array of smaller gold miners, decent play to protect purchasing power of your USD assets relative to the world.

GOLD - Barrack Gold based in USA - A well run Gold mining company, even Warren Buffet has invested in it.

Betting on the future - BIOTECH - 10 year horizon

If I had to pick one non-crazy investment (crypto/gold, etc) its Biotech. Big Data & AI mixed with evolving technologies supporting medical advancements (DNA, etc) is a recipe for huge win in solving many medical challenges. Its not if, but when. So for a 10 year hold, no brainer, this is a winning sector. Click here for list of ETFs.

Stay away from 3x ETFs like LABU, unless the market has corrected and you are buying near a bottom.

IBB - iShares Nasdaq Biotech, today at 157 (10 billion invested)

GNOM - Global investing ETF in Biotech , Today its at 25.

XBI - SPDR Nasdaq Biotech , today at 150 (8 billion invested)

Insane high risk - Shorting

Just a note, as of today I am short TESLA, NIO, WYNN, DVA, have puts against the DJIA, and I am buying SPXS as a counter play to my longs. These positions are small compared to my other plays.