Have you ever believed you knew something so true, that you want to share with others to understand?

Some its God, others its their living values, others is activities benefits like exercise, and still some others is facts that seem to not be recognized by others.

Today is some FACTS I want you to really absorb.

- The stock market is a value based on emotion. If it was based on pure fact, company values could be computed by accounting and price fixed. Stocks enable speculation to be captured into a dollar value. Speculation is emotion.

- There is a pandemic of lifetime proportions building. Even if as humans we curb the pending disaster, between now and then there will be emotional negative views thrown into the world.

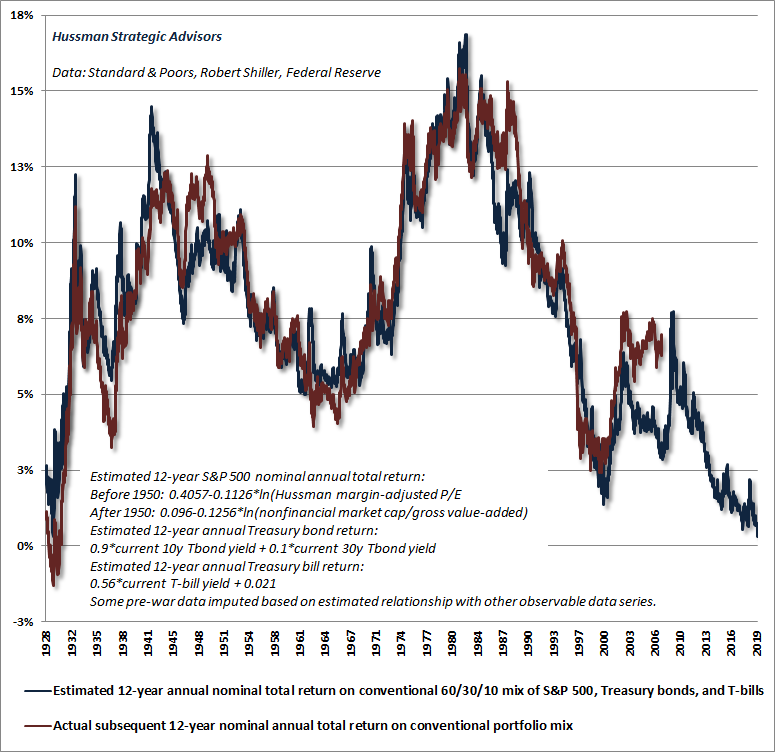

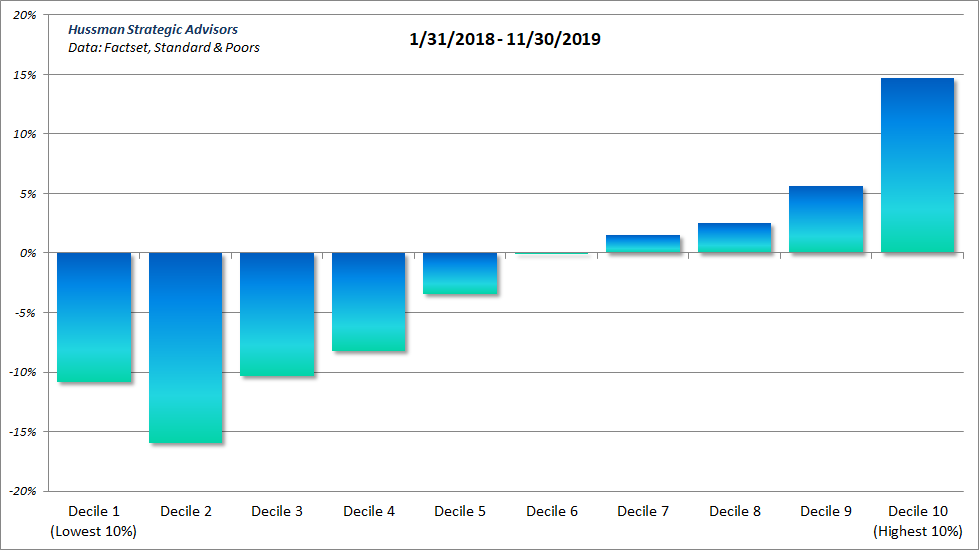

- The general view of the market has been herd mentality positive since 2010, and since 2008 from low to high the market has risen every year on average almost 13%, the average the market has risen since 2001 is 6%.

- Reversion to the mean is due, to help reduce the 13% annual average since 2008, a year after a 29% gain increases likelihood of a reversion to the mean.

- There is a discipline called "Chart analysis" which looks at market charts to identify patterns and use them to help predict next events. Monday we had a market gap down, Tuesday into Wednesday we had a gap fill. Wednesday was FOMC meeting and the market melted into close. This reads bad after a series of other events in charts to the downside.

- If the market moves down, your emotions will trap you making personal bets with yourself "I'll sell at new market highs". Think back to the tipping point in 2008 that you refused to sell, sell near the decade high while its easy decision. How do I know that what happened to you? We are all trapped by emotions to make decisions.

- UPDATE 2/18/2020 - Or with new highs dismiss fears as nothing can stop the market, once again trapping you into buy and hold after 400%+ run up in the market.

- Read my posts for more Year of an explosive market and Choose your expected returns

The potential downside is substantial. The market reversion WILL be 10% to 50%. My suggestion is if you are over age of 50, I am not a market professional, make your own decisions. Sell today, re-evaluate March 1st. If selling after 400%+ move up since 2008, after 29% gain in 2019, and 3% up in January (which is 50% of typical annual move up) during a pandemic which WILL trigger emotional negative views.

I believe this so firmly I am placing very high risk trades on the market in anticipation of a market decline. Last time I did this was in August 2008. So I am acting on this view, not just spewing it. And if I am wrong, I will lose much more than if I played it safe in fixed funds for February.

Chances are if you are reading this, my will is to clear MY conscience that I did my best as a friend to try to help you. Good luck!

UPDATE: 2/2/2020

from Hussman Funds, worth a read:

https://www.hussmanfunds.com/comment/mc200130/

Update 2/8/20

State street asserts 70% chance of recession in next 6 months

China is starting to impact world trade, iPhone delays is one example

Update: 2/18/2020

Dow Futures Slide as Morgan Stanley Warns ‘Downturn’ Has Begun

Apple warns it will miss quarterly revenue target due to effects of coronavirus

Largest Shipping Decline Since 2009 and That's Before Coronavirus

HSBC To Cut 35,000 Jobs, Shed $100 Billion In Assets As Profits Plunge

Dramatic Coronavirus Timelapse Reveals an Economical Wrecking Ball in China

China Shutdown To Crush India’s Already-Crumbling Economy