The puzzle pieces I bring you today is an economic one.

I'll give you the pieces, and you can choose the puzzle solution.

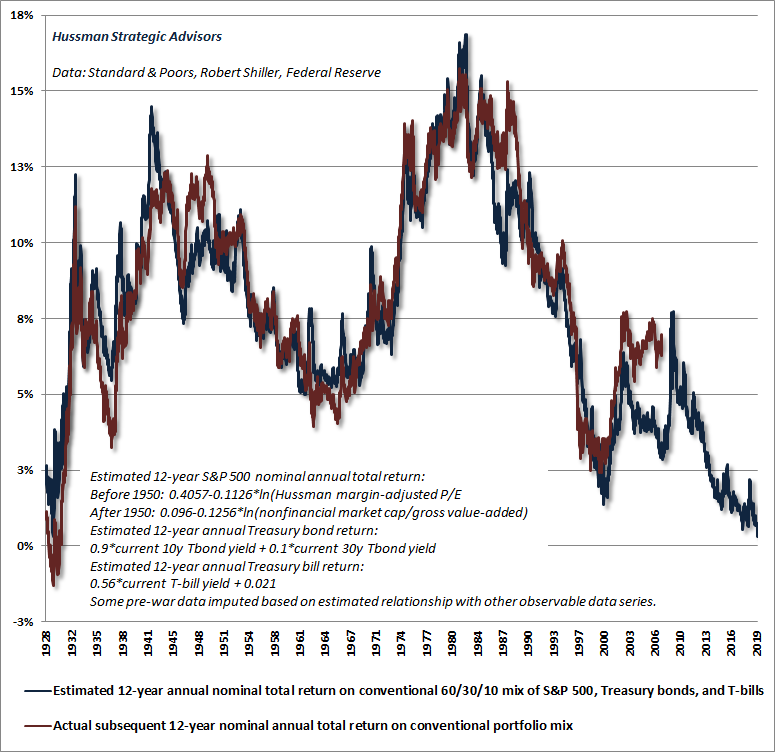

Expected market returns BEFORE COVID-19

I posted The Shorter Take to illustrate expected market returns looking forward, and it was horrible. The market fundamentals of the last 11 years didn't make America strong, it was weakened.

Then Covid-19 happened, so the bubble got popped. It may have just slowly leaked but instead we got a big bang. To read on my market view before Covid-19 click here.

US Unemployment

The weekly claims looks like this:

As per last post, there are 13.5 million on disability benefits, for a total of 171 million potential workers, for total of 40 million unemployed, 23.4%. (see alternate for 23%) The Great depression 3 years in achieved 23%. We are now at the level of unemployment not seen since 1932.

Home Sales

US home-sales have taken a nose dive, now about what it was a year ago. this isn't that bad, but it is a pretty steep drop for a month. But one month isn't a trend change. You decide what the next 6 months will yield, given the unemployment above. Will more homes foreclose? Will purchases accelerate? Keep in mind 30 year interest rate is already at 3.5%, would 2.5% spark an explosion in home buying or refinancing?

Mortgage Payments

Most people's biggest bill is home mortgage. We have seen the largest jump in mortgage delinquencies jump 3.3% in March since 2000. What will April, May, and June bring?

Car Sales

Before Covid-19, I presented the case the economy was slowing after a 11 year bull run. (click). Below you can clearly see car sales was slowing for a quite a while, but notice a new low being achieved in March. What will the months ahead bring?

Retail sales

Retail sales fell off a cliff. Will retail sales recover to January 2020 levels in 2 months? 6 months? A year? If retail doesn't recover in 3 months will the market of those stocks rise to January 2020 in advance of seeing materially improving sales? Will these retailers reopen and rehire at pre-Covid levels? Will shoppers have extra spending cash to go out and buy buy buy?

Bank Health

Notice the huge hump in bad debts US banks are reporting for March. What do you think April, May, and June will bring? Do you think one stick and back to January levels or potentially mirror something like 2008?

Federal Debt

The expectation is the USA will spend its way out of this, after all in January it was announced the US economic is spectacular, the best in history! But take a look at the Federal debt to GDP ratio, notice unlike past economic highs our debt increased, not decreased. Now we'll have to see Federal debt accelerate with GDP plummeting. When the Federal Debt to GDP ratio rockets higher this year, will this have any effect on USA bond rates? Will in the year ahead the Federal government be free to spend and spend to put the economy back on track?

Non-Financial company corporate debt

Before Covid-19, the USA corporate debt hit levels beyond the worst in 2008 crisis.

Now that companies will be strained, what will the levels rise to?

And who will finance it?

Federal Reserve bank Asset Purchases

The Federal Reserve bank is NOT a government entity, and not truly private one either. It is the bridge between the private banking world and the Federal government. It acts as a keeper of good fiscal policy. In 2008, it broke from tradition and purchased assets from private debt holders. Basically it created 4.5 trillion dollars by changing a database entry and used it to buy bad debt. it circumvented the basis for Federal and private money norms. This term is called monetization. And it is doing it again. This seems real bad, but in principle I have no issue with creating money with no debt. What I do have a problem with is how it is used. Its enabling the companies that took highest risks, or perhaps bent the law or fiscal duties beyond what is considered moral, and wiping the mistakes away. What kind of behavior would companies who profited learn? I'd say do it more!

So unlike gold bugs, I have no issue with this money for nothing approach, I do have a problem with everyone else needs bonds or interest for debt payback, unless you are REALLY bad, then you don't have to worry.

Do you have any concerns with keep on taking this action at 10 trillion? 20 trillion, 100 trillion?

Remember if you earned 2.5 million per hour since the time of Jesus birth, you wouldn't have 1 trillion dollars yet. Its pretty hard to comprehend the impact of this magnitude of 'process exception'.

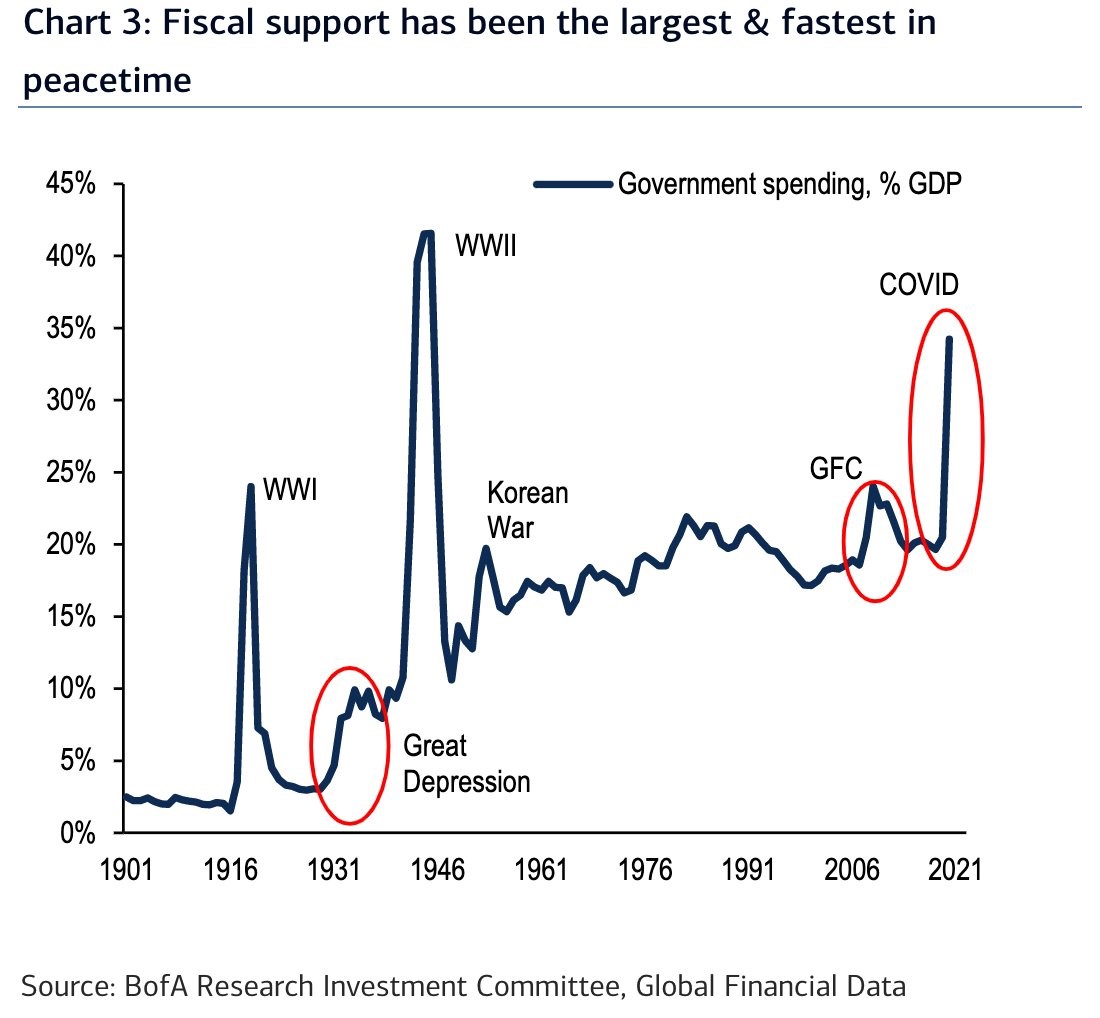

Fiscal Stimulus action.

The action of the Federal Reserve and the US Government has been beyond a doubt, the fastest and largest in human history. Spending more as percent of GDP than anytime in US history outside of WW1 and WW2. But is the money being directed in ways to ensure a quick recovery? Or will it function helping companies highly leveraged in debt without savings? What if it isn't enough, what next?

Pieces of the puzzle, what does it tell you?

Thats many puzzle pieces! Fundamentally I have no issue with this dip being sharp and a quick rebound, quicker than anyone has seen in human history. The problem I have is, agreeing with the actions of the Federal government and Federal reserve addresses the heart of financial challenges, or are we simply trying to kick a can down the road.

Then again, I had this problem in 2008-2009, and the can kicking worked quite well!

So lets hope for debt levels past100% for people and companies won't be an issue, and the Federal Reserve Bank just buying every asset in sight with free money will all lead to another 10 year run.

Whats does these puzzle pieces tell you?

My thoughts are basically in these two posts, Great Depression chart and Market - Whats next.

No comments:

Post a Comment