Just this past Thursday I said GDX should go lower around 17.75, well, we sliced right through to 17.34. I still hold true that buy now, stop out 10% lower, now at $15.60, a low for 2008 is a relatively low risk play. 10% loss for possibly buy low deal.

Good luck!

Monday, December 15, 2014

Thursday, December 11, 2014

Last Entry point for GDX?

If you want to get back in, consider putting various buy points at 18 through 16.25, with a stop at 16.

This will provide a 5-10% risk entry depending on your cost averaging.

Miners hit 60 bucks only couple of years ago, as the saying buy low sell high, unless of course buying low turns out to not be low enough :)

Considering 2008 crash brought GDX down to 16, its pretty low now.

To the chart!

This will provide a 5-10% risk entry depending on your cost averaging.

Miners hit 60 bucks only couple of years ago, as the saying buy low sell high, unless of course buying low turns out to not be low enough :)

Considering 2008 crash brought GDX down to 16, its pretty low now.

To the chart!

Monday, December 8, 2014

Steve Basker, UK Parliament speech

A VERY good public speaking summary of the currency challenge the world is facing. And the impact of how the entire wealth system is being skewed by the current system benefiting money creators.

I am thinking Bitcoin was simply the first volley, the NEXT thing is likely to be the big thing.

But overall this is VERY healthy to see we are bringing to the public discussion items I pointed out in January 2011, 'Ideal form of money, empower the people'

Time will tell.

I am thinking Bitcoin was simply the first volley, the NEXT thing is likely to be the big thing.

But overall this is VERY healthy to see we are bringing to the public discussion items I pointed out in January 2011, 'Ideal form of money, empower the people'

Time will tell.

Thursday, December 4, 2014

Gold, USD, and 2015

If we ignore relaity, and look at the measuring sticks of USA proclivity, USD valuation, and thins such as inflation, I think 2015 looks insanely awesome!

This statement comes with caveat of those who are employable and those who are not.

As I explain in March of the Robots Deflation for Decades, we will experience in the west downward pressure on the masses for income.

But right now, the question focuses on three things. Interest rates (govern everything for future growth), USD valuation compared to world currency basket, and GDP to debt ratio.

The GDP to debt ratio is actually immaterial, for it rests on the stronger vs weaker to maintain sustainability. So it less about mechanics and more about people positioning.

So lets take a look at on Interest rates and USD valuation:

We are not even close to 2002 valuations, so USD as room to run upward.

If it does all commodities are downward, including gold.

The real story is borrowing on future income, interest rates.

Looking at USD 30 year bolds, the gold standard for long-term debt, we can analyze the 10 year return:

This DOES NOT mean gold = money. Gold is the WORST money ever. What this shows as an investment since 1970 god is about 3-4 times more valuable. Depending on stock market plays, this is either great or terrible.

The low-down is we continue to be in a middle ground, looking for direction.

when that happens I expect gold to rocket 15% higher in one day.

Good luck.

This statement comes with caveat of those who are employable and those who are not.

As I explain in March of the Robots Deflation for Decades, we will experience in the west downward pressure on the masses for income.

But right now, the question focuses on three things. Interest rates (govern everything for future growth), USD valuation compared to world currency basket, and GDP to debt ratio.

The GDP to debt ratio is actually immaterial, for it rests on the stronger vs weaker to maintain sustainability. So it less about mechanics and more about people positioning.

So lets take a look at on Interest rates and USD valuation:

We are not even close to 2002 valuations, so USD as room to run upward.

If it does all commodities are downward, including gold.

The real story is borrowing on future income, interest rates.

Looking at USD 30 year bolds, the gold standard for long-term debt, we can analyze the 10 year return:

then we come to gold, the outdated form of deflationary protection:

We have been on a tear since 1970, about when Nixon decoupled:

This DOES NOT mean gold = money. Gold is the WORST money ever. What this shows as an investment since 1970 god is about 3-4 times more valuable. Depending on stock market plays, this is either great or terrible.

The low-down is we continue to be in a middle ground, looking for direction.

when that happens I expect gold to rocket 15% higher in one day.

Good luck.

Monday, November 3, 2014

Election Week and Miners

Miners are near a multi year low, there is no question when looking at an historical chart.

The question is, do we go ANOTHER 40% lower first?

Whenever the bottom is hit, I expect a mega rally back.

I won't add a dime here, wait for miners to break above 24.

However from the low of 16.89 on Friday to 24 is a 42% gain, and GDX was at 24 just last month!

I think the bottom will depend on the elections and reaction, so I don't think we will know the result until next week.

Today GDX rebounded to 17.91 from 16.89, a 6% gain.

I recommend a read from ChartFreak by clicking here.

The question is, do we go ANOTHER 40% lower first?

Whenever the bottom is hit, I expect a mega rally back.

I won't add a dime here, wait for miners to break above 24.

However from the low of 16.89 on Friday to 24 is a 42% gain, and GDX was at 24 just last month!

I think the bottom will depend on the elections and reaction, so I don't think we will know the result until next week.

Today GDX rebounded to 17.91 from 16.89, a 6% gain.

I recommend a read from ChartFreak by clicking here.

Thursday, October 23, 2014

Market Zooming to the moon, comments on miners

Very nice snapback rally, and we very well could see a nice rally into the end of year with new highs.

I don't see anything really to kill this bull, unless buyers simply disappear.

But who could be buying? Big institutional money I have to suspect has replaced the common stock investor. I can't imagine tons o money from the 18 to 40 year olds pouring into the market.

As for Gold Miners, follow Chart freak through this, see what he says, now through the 30th may be interesting.

http://www.chartfreak.com/2014/10/23/look-dont-touch/

I don't see anything really to kill this bull, unless buyers simply disappear.

But who could be buying? Big institutional money I have to suspect has replaced the common stock investor. I can't imagine tons o money from the 18 to 40 year olds pouring into the market.

As for Gold Miners, follow Chart freak through this, see what he says, now through the 30th may be interesting.

http://www.chartfreak.com/2014/10/23/look-dont-touch/

Friday, October 17, 2014

Permabear says time to buy?

Its no secret, I tend to see reality wich is negative.

But that permabear slant ignores that rules and measurements change.

We have changed the measurements to make a better outcome. How unemployment was measured in 2007 is not the same criteria in 2015.

How we judge companies using accounting rules 1945 to 2008 is not the same since 2009.

So, is it time to buy? Without rules to judge something is wrong, really I can't wrap my head around how the market can make a move significantly lower. If you have faith in system to repair itself and move higher, YES!!!! BUY BUY BUY

Until we return to honest accounting, there is no neutral regulation its up to you the IGNORANT reader (due to lack of honest corporate reporting) to decide. Good luck

But that permabear slant ignores that rules and measurements change.

We have changed the measurements to make a better outcome. How unemployment was measured in 2007 is not the same criteria in 2015.

How we judge companies using accounting rules 1945 to 2008 is not the same since 2009.

So, is it time to buy? Without rules to judge something is wrong, really I can't wrap my head around how the market can make a move significantly lower. If you have faith in system to repair itself and move higher, YES!!!! BUY BUY BUY

Until we return to honest accounting, there is no neutral regulation its up to you the IGNORANT reader (due to lack of honest corporate reporting) to decide. Good luck

Monday, October 13, 2014

Market Returns vs Fixed Income

Today the S&P 500 took a 1.65% hit, which with current annual S&P 500 returns that is a major hit.

But lets take a look on how you fared if your money was in fixed 30 year US Treasury bonds vs the market, the ROI, assuming 3.25% fixed.

Over 5.5 years a return of 19.25 % vs 203% over the same period from S&P 500 low to high.

To put into perspective, lets look at the S&P 500 during that time period.

But lets take a look on how you fared if your money was in fixed 30 year US Treasury bonds vs the market, the ROI, assuming 3.25% fixed.

Over 5.5 years a return of 19.25 % vs 203% over the same period from S&P 500 low to high.

To put into perspective, lets look at the S&P 500 during that time period.

So almost any market correction will still put market investing ahead of fixed income investing over the same period. And that assumes all stocks owned give zero dividends. Therefore market correction of 4.8% over the last 3 days hardly puts this into a loss category.

GDX has been holding about flat over the same period, we will wait to see if it pans out to be a winner.

Please see post Possible Turning Point posted on October 8th before the 4.8% market correction began. If history holds true the market will rebound this week resuming the advance. Then again, market history is not a gaurantee rule of thumb. See post Market Dislocation if you place faith in history repeats itself in the markets. All I know is GDX has been beaten to a pulp, thinking it can't go much lower, and what won't go down will go up or sideways :) See Gold Miner Implosion, whats up with that?Wednesday, October 8, 2014

Possible turning point

Turning points are impossible to spot. Since 2008 my greatest fear is US over-reaction to financial crisis will spur an even bigger crisis. Since then some of my worst fears have come to pass including lack of law enforcement, fantasy accounting, and worst of all appeasement.

Some rule breaking in the depths of 2008-2009 was needed, best not to take all the medicine at once. But there has not yet been a time to knuckle down and return to normal law.

Today, the Federal Reserve bank released it's minutes and the International Monetary Fund warned the FED of possible trillion dollar losses.

Instantly, gold miners EXPLODED higher, as well as gold, and the overall market.

The 3x Junior miner ETF rose 43% in about 2 hours, quite insane.

Unfortunately, what this looks like combined with my other posts is a shift internationally.

First the FED basically announced more of the same, appeasement since 2008, easy money equals all is lookin great! I fear that once this buzz wears off we may see reality finally sink in that more of the same fixes nothing, combined with the world critiquing the Fed.

This fear may be unrealistic so we'll probably get our answer by February, if not earlier how this 'free money' announcement plays out.

Its hard to say if my post 'full route in gold before the going gets good' is now behind us. Every fiber of me says we saw the bottom and say its all good to buy GDX between 20 and 22 (probably will pull back from high today).

The post I did Sunday details how insanely low GDX is, how HEAVY buying was this past Friday, so buying at 'bottom 10% range' is all good.

Good luck out there, if what I think happens unfolds, gold and gold miners will have a VERY rough ride climbing the wall of worry from here to 5x higher. Once GDX hits 100 bucks a share we may start to see political bs appearing. This will not be easy money and will take until 2017 to reach a peak.

And of course, the USD has taken a hit.

Good luck out there, some charts!

USD

Some rule breaking in the depths of 2008-2009 was needed, best not to take all the medicine at once. But there has not yet been a time to knuckle down and return to normal law.

Today, the Federal Reserve bank released it's minutes and the International Monetary Fund warned the FED of possible trillion dollar losses.

Instantly, gold miners EXPLODED higher, as well as gold, and the overall market.

The 3x Junior miner ETF rose 43% in about 2 hours, quite insane.

Unfortunately, what this looks like combined with my other posts is a shift internationally.

First the FED basically announced more of the same, appeasement since 2008, easy money equals all is lookin great! I fear that once this buzz wears off we may see reality finally sink in that more of the same fixes nothing, combined with the world critiquing the Fed.

This fear may be unrealistic so we'll probably get our answer by February, if not earlier how this 'free money' announcement plays out.

Its hard to say if my post 'full route in gold before the going gets good' is now behind us. Every fiber of me says we saw the bottom and say its all good to buy GDX between 20 and 22 (probably will pull back from high today).

The post I did Sunday details how insanely low GDX is, how HEAVY buying was this past Friday, so buying at 'bottom 10% range' is all good.

Good luck out there, if what I think happens unfolds, gold and gold miners will have a VERY rough ride climbing the wall of worry from here to 5x higher. Once GDX hits 100 bucks a share we may start to see political bs appearing. This will not be easy money and will take until 2017 to reach a peak.

And of course, the USD has taken a hit.

Good luck out there, some charts!

USD

Sunday, October 5, 2014

Gold Miners IMPLOSION, whats up with that?

If you have anything in Gold Miners, it has really been destroyed last few months just as the market exploded higher.

The beating of gold miners is so severe, I feel like a truck ran over me.

The question is, what the heck is going on?

Gold miners profits are a combination of price of gold, production quantities, costs, perception, and politics.

I say politics because for better or worse Gold has an element of Politics in the mix.

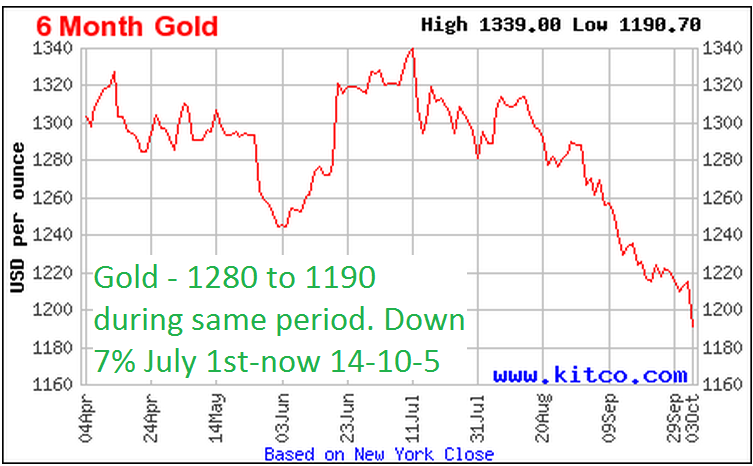

First lets take a look at the price of gold, in the last 3 months, it has dropped about 7%

During the same period USD has EXPLODED higher by over 8%

The beating of gold miners is so severe, I feel like a truck ran over me.

The question is, what the heck is going on?

Gold miners profits are a combination of price of gold, production quantities, costs, perception, and politics.

I say politics because for better or worse Gold has an element of Politics in the mix.

First lets take a look at the price of gold, in the last 3 months, it has dropped about 7%

During the same period USD has EXPLODED higher by over 8%

The correlation of price of gold to USD valuation seems correlated. Thats because Gold like all commodities are priced vs demand, but the 'localized' cost is a reflection of each countries currency valuation. If Gold demand collapsed, I would expected much more collapse in price. Basically gold price is trading in a tight range for the same period.

Now lets take a look at USD over the longer haul, is 86 really out of line?

Still within reason, but it is amazing the market is at near highs and USD is also on a rocket ride up. We are fast approaching the panic levels seen in 2009, and levels not seen regularly since pre 2005. So from a near historical perspective, it is appears out of character.

OK, lets see what happend to Gold Miners (Brace yourself).

Holly hell, that can only be called an all out destruction of Gold Miners during the same period.

It can be partially explained that the change of Gold price down to US valuation combined with overall market strength and overall perception of low near term demand due to market stability. Throw on there any political games and its a recipe for destruction.

The question is, are we near a bottom?

Lets take a look at GDX over the long Haul.

From a HISTORICAL perspective Gold miners is near its all time low from the 2008 collapse. That is outright amazing! the worst collapse in modern history and GDX hit 16 bucks a share, and now we are at 20.6, amazing! The panic selling began in earnest when the trend line broke down Friday. This could be beginning of a freefall of GDX down to 16, or a final panic sell for a reversal. There is NO NEED to jump infront of this train by adding more that what you may already have, wait and see.

NOTICE that the trend lines still show GDX is on a BULL trend up, not down, read and watch the video for the longer term trend indicator described on When to buy and get out of the stock market.

But I can say, from a historical perspective, Gold miners are DIRT cheap. Gold was at 700 oz at the depths of 2008 collapse and GDX at 16, while now Gold is at 1150 with GDX at 20.6.

PLACE all of this into context with my post Market Dislocation to help gain perspective. (click to read)

So in the end, whats the deal? Frankly I am shocked at the beatdown Gold Miners has taken. I knew this would be the hardest trade of my life, but still nothing prepared me to see GDX at these levels.

The facts remain, GDX is near all time lows, and it is possible it breaks those lows. But as a logical guy, playing the odds, the odds in history say GDX will go higher than it is today. I really doubt gold miners en-mass go bankrupt or the Asian demand for gold evaporates. China loves gold, the greatest threat to gold is if China adopts Crypto-Currencies and runs from gold, a distinct possibility. They could announce their own Bitcoin as the new standard for China.

If so the I would expect gold to go lower than 700 an ounce quite quickly. Outside of such an event, Gold Miners are experiencing a panic sell off. Once all those who will sell, sell, the bottom will be in, its anyone's guess when that will be.

At this point I am watching like a deer in headlights. Once Call Options for 2017 for GDX are publicly tradeable, I may buy some at these depressed lows for the long haul.

I'll post when I do, for now its a watch and see.

I would expect if USD doesn't continue on a vertical line straight up, Gold price will stabalize.

I recommend checking out this blog for more frequent commentaries, Alex talks of any trading opportunities:

Thursday, October 2, 2014

The next currency

USA is the world currency barometer that all other currencies are measured against. As such, no one country wants their currency to value or devalue against the USD.

If a currency becomes more valuable, their exports will become expensive. If their currency devalues then imports become expensive.

This is simply because the other participants in the system will try to keep their currencies to be stable against USD while outlier countries fluctuate.

This system is freaking pure genius, the US can do whatever it wants and the world will react to ensure that status quo remains. This includes if the US issues 1 million, 1 billion, 1 trillion, or 10 trillion new dollars in any given year. The excess currency will be 'soaked up' by other countries preventing those countries from spending on local economies, but instead to buy US bonds to prevent currency fluctuation.

Think about that, there is NOTHING too outrageous the US can do without the world attempting to maintain stability of their currency no matter HOW BAD the impact is immediately to the country funds. Simply because the currency change could cause severe and lasting effects from current local economies.

I am in awe of how the US was able to put this together under Nixon and cut from the gold standard to rely on this model for stability.

This system is pretty awesome really. Lets ASSUME the US never abuses it's position and always does the right thing for everyone. In that world, the status quo compels everyone to moderation for self preservation reasons. And since fiat currencies can be created as needed, with almost ZERO cost, it serves as a very efficient value creation and maintainer.

So, whats the issue? For each country the currency creation is NOT done by governments, but instead is done by banks by 'lending' money to governments to create money. This in effect puts a tax on every single dollar every created with an annual tax paid to the banks. Don't get me wrong, I am not against banking, simply against an infinite fee for creating a dollar in 1945 STILL being paid to the banks through bonds.

Further the entire system is done behind closed doors. Banks today declare their asset values simply by fiat, before 2009 it was by market valuations. That's like someone in Detroit who's home is worth $1K declaring it is still worth 100K from 1980 prices. You can't get away with such a declaration, and neither should anyone. Currency and accounting must be equal from the lowest person to the richest person. The richest should have every single advantage money can buy, without special 'systematic currency' privileges.

Bitcoin's secret sauce is the block chain. Every single bitcoin is tracked and recorded publicly with millions of computers around the world. NO ONE PERSON owns the general ledger of who owns what. No one person can TAKE a single cent without the right key to prove ownership to transfer.

I have HUGE problems with bitcoin, but zero with the framework that Bitcoin brought to the world.

So when I see the graph below, I hope that when the USD finally loses it's status as the measurement of the rest, I hope a bitcoin-like public record replaces it. I suspect the Chinese Yuan or worse yet, gold, replaces USD before we can 'discover' the genius of an open corrupt-free general ledger system.

I know with every fiber of my being that a system controlled by people who 'declare' new rules, special privileges, insider knowledge, opacity for protection of questions, or any paradigm that relies on individuals to simply do the right thing daily for 100 years is subject to atrophy, corruption, and failure.

A system such as block chain that DOES evolve, with clear transparency to every single human on the planet, and does so with intense visibility and critique will be much more trustworthy and long lasting.

Further innovation is to take the smallest bitcoin unit and use it to track a myriad of other items, such as contracts using the blockchain.

Good luck!

If a currency becomes more valuable, their exports will become expensive. If their currency devalues then imports become expensive.

This is simply because the other participants in the system will try to keep their currencies to be stable against USD while outlier countries fluctuate.

This system is freaking pure genius, the US can do whatever it wants and the world will react to ensure that status quo remains. This includes if the US issues 1 million, 1 billion, 1 trillion, or 10 trillion new dollars in any given year. The excess currency will be 'soaked up' by other countries preventing those countries from spending on local economies, but instead to buy US bonds to prevent currency fluctuation.

Think about that, there is NOTHING too outrageous the US can do without the world attempting to maintain stability of their currency no matter HOW BAD the impact is immediately to the country funds. Simply because the currency change could cause severe and lasting effects from current local economies.

I am in awe of how the US was able to put this together under Nixon and cut from the gold standard to rely on this model for stability.

This system is pretty awesome really. Lets ASSUME the US never abuses it's position and always does the right thing for everyone. In that world, the status quo compels everyone to moderation for self preservation reasons. And since fiat currencies can be created as needed, with almost ZERO cost, it serves as a very efficient value creation and maintainer.

So, whats the issue? For each country the currency creation is NOT done by governments, but instead is done by banks by 'lending' money to governments to create money. This in effect puts a tax on every single dollar every created with an annual tax paid to the banks. Don't get me wrong, I am not against banking, simply against an infinite fee for creating a dollar in 1945 STILL being paid to the banks through bonds.

Further the entire system is done behind closed doors. Banks today declare their asset values simply by fiat, before 2009 it was by market valuations. That's like someone in Detroit who's home is worth $1K declaring it is still worth 100K from 1980 prices. You can't get away with such a declaration, and neither should anyone. Currency and accounting must be equal from the lowest person to the richest person. The richest should have every single advantage money can buy, without special 'systematic currency' privileges.

Bitcoin's secret sauce is the block chain. Every single bitcoin is tracked and recorded publicly with millions of computers around the world. NO ONE PERSON owns the general ledger of who owns what. No one person can TAKE a single cent without the right key to prove ownership to transfer.

I have HUGE problems with bitcoin, but zero with the framework that Bitcoin brought to the world.

So when I see the graph below, I hope that when the USD finally loses it's status as the measurement of the rest, I hope a bitcoin-like public record replaces it. I suspect the Chinese Yuan or worse yet, gold, replaces USD before we can 'discover' the genius of an open corrupt-free general ledger system.

I know with every fiber of my being that a system controlled by people who 'declare' new rules, special privileges, insider knowledge, opacity for protection of questions, or any paradigm that relies on individuals to simply do the right thing daily for 100 years is subject to atrophy, corruption, and failure.

A system such as block chain that DOES evolve, with clear transparency to every single human on the planet, and does so with intense visibility and critique will be much more trustworthy and long lasting.

Further innovation is to take the smallest bitcoin unit and use it to track a myriad of other items, such as contracts using the blockchain.

Good luck!

Market Dislocation?

For the last 2 major bull runs, the market ran about 5.5 years before a severe correction.

We are about 5.5 years in this bull run, the question is, what next?

I have been playing chess recently, and as such, I come to realize in chess, as in work, often it is all about positioning. The global economic control, power struggle, and what is next is about what next moves benefit the USA in what seems like the right path. More on this later.

Please look at picture below. Using history as a guide, we are in dangerous territory.

I honestly think we could have a 1-4 year parabolic run that explodes to the market of 2-5x current valuations. The byproduct would be a full on collapse of USD in the world, relegating USA to second tier status. The casualties of this would be severe in the world.

I am NOT saying likely, just that it is possible. The driver of course would be full crystalization of lack of law and currency injection. I give this a low percentage of possibility.

The 'Blame' of such an event would result in USA loss of global leader, hence, low probability, but possible.

What is more likely is for a correction to begin, we need to blame something. Right now we are full of excuses for the picking. We have Ebola in USA, ISIS, China, Russia, and a host of other challenges. One thing is certain, if we have a market meltdown the result cannot be its because of the current structure, blame must be assigned elsewhere.

Ignoring paranoia talk about USD collapse or a tense market waiting to be pricked by an excuse, one thing to ask yourself. Assuming USD and politics away, are stocks undervalued, equal value, or over valued. To me, they are NOT undervalued. At BEST equal value, but quite likely over valued.

Keep in mind that standard accounting in place since the great depression is STILL suspended, making valuations of financial companies truely a fantasy guess. Without mark-to-market accounting, its pretty much 'take our word for it'. With such loose standards, and a nice run up, I can't make a case for undervalued.

If there is a prick in the market, bonds should yet one final bull run, collapsing interest rates. Afterwards bonds would be the last place to be, as I expect we enter the final phase of this game.

For now, cold cash, debt payoff, and investing in yourself are best. Gold and Gold miners are pre-beaten up, but if a market correction happens tends to take all down with it.

In 2008, gold miners collapsed hard. But when the market hit low in March 2009, they where up quite nicely. Since miners are PRE-deflated, this time it may be a safe play. China is a backer of gold and as I posted in previous post, aligning direct currency trading to avoid USD. If they make a push with a crisis, I have to think gold atleast holds its own.

A mix of cash, stocks, and resources hopefully to weather what maybe a nasty turn.

Good luck!

We are about 5.5 years in this bull run, the question is, what next?

I have been playing chess recently, and as such, I come to realize in chess, as in work, often it is all about positioning. The global economic control, power struggle, and what is next is about what next moves benefit the USA in what seems like the right path. More on this later.

Please look at picture below. Using history as a guide, we are in dangerous territory.

I honestly think we could have a 1-4 year parabolic run that explodes to the market of 2-5x current valuations. The byproduct would be a full on collapse of USD in the world, relegating USA to second tier status. The casualties of this would be severe in the world.

I am NOT saying likely, just that it is possible. The driver of course would be full crystalization of lack of law and currency injection. I give this a low percentage of possibility.

The 'Blame' of such an event would result in USA loss of global leader, hence, low probability, but possible.

What is more likely is for a correction to begin, we need to blame something. Right now we are full of excuses for the picking. We have Ebola in USA, ISIS, China, Russia, and a host of other challenges. One thing is certain, if we have a market meltdown the result cannot be its because of the current structure, blame must be assigned elsewhere.

Ignoring paranoia talk about USD collapse or a tense market waiting to be pricked by an excuse, one thing to ask yourself. Assuming USD and politics away, are stocks undervalued, equal value, or over valued. To me, they are NOT undervalued. At BEST equal value, but quite likely over valued.

Keep in mind that standard accounting in place since the great depression is STILL suspended, making valuations of financial companies truely a fantasy guess. Without mark-to-market accounting, its pretty much 'take our word for it'. With such loose standards, and a nice run up, I can't make a case for undervalued.

If there is a prick in the market, bonds should yet one final bull run, collapsing interest rates. Afterwards bonds would be the last place to be, as I expect we enter the final phase of this game.

For now, cold cash, debt payoff, and investing in yourself are best. Gold and Gold miners are pre-beaten up, but if a market correction happens tends to take all down with it.

In 2008, gold miners collapsed hard. But when the market hit low in March 2009, they where up quite nicely. Since miners are PRE-deflated, this time it may be a safe play. China is a backer of gold and as I posted in previous post, aligning direct currency trading to avoid USD. If they make a push with a crisis, I have to think gold atleast holds its own.

A mix of cash, stocks, and resources hopefully to weather what maybe a nasty turn.

Good luck!

Sunday, September 28, 2014

Full route in gold before it gets good

Who knows, maybe the bottom is in. But I fear a full routing of gold and we won't see a bottom until December-January 2015 finally.

Hopefully we get a nice bounce for a couple of weeks before the routing resumes. For a really good objective look at gold and miner charting see chartfreak post here.

Gold is being politicized, and with politics comes games. China is trying to get into the gold game in a big way, and I believe its part of their mult-fork strategy to take away USA as the global currency, signing deals with UK, French and German Corps, Russia, Brazil, Australia, Canada, Argintena, South Korea, Singapore-Malasia , UAE-Saudi Arabia (limited trade), and of all things Bitcoin!

With such high stakes I can't imagine that we have a smooth ride ahead in any market.

In the next 3 months, I really have no clue about gold, I could easily believe it hits 990 an ounce before the bottom is in, and GDX hit 16 bucks. Or its quite possible we are near the low and its a great time to buy.

With politics comes games, and with games you can't trust anything. The US dollar has been the world currency for quite a while, and as the graph below shows, it isn't that crazy that the world will seek a change.

I am for Crypto-Currency to be the next world currency, meaning no country has it. But I suspect we'll have to go through the pain of China attempting to take the world currency first, then later after that fails go to Crypto. that could take a decade or so!

Eh, if only the worl operated effeciantly and just jumped to the end game :)

So your on your own through December, I really can't imagine 'knowing' the bottom is in until then.

Sunday, September 21, 2014

Gold Blood

There is no denying it, gold in on an epic crash right now.

Frankly, I have no idea where this goes, and its likely to get worse.

The hope, thought is, when this is done, there are no more sellers, and the bottom will be in.

Is that 10% or 30% lower to find that bottom, who knows.

I wouldn't be surprised if gold hits 990 an ounce, enough to get full capitulation.

Starting Sept 26th-ish, China will open it's gold exchange in an attempt to take leadership in gold pricing.

Perhaps thats when the bottom hits, or not.....

I took an edge off Friday, I may dump more monday, each buck is a bigger % loss now, I simply can't take it.

good luck.

Frankly, I have no idea where this goes, and its likely to get worse.

The hope, thought is, when this is done, there are no more sellers, and the bottom will be in.

Is that 10% or 30% lower to find that bottom, who knows.

I wouldn't be surprised if gold hits 990 an ounce, enough to get full capitulation.

Starting Sept 26th-ish, China will open it's gold exchange in an attempt to take leadership in gold pricing.

Perhaps thats when the bottom hits, or not.....

I took an edge off Friday, I may dump more monday, each buck is a bigger % loss now, I simply can't take it.

good luck.

Wednesday, August 20, 2014

Robotic army advancing, deflationary forces accelerate

The sheer reason why the dollar and fiat currencies will not implode is that we will continue to have people increase in unemployment, lower wages, and generally people getting poorer.

As the money printing increases, there is NO WAY to force the money to the people, outside of government handouts in benefits. The extra money of course, will continue to flow in those who own the technological infrastructure that is killing off jobs. For those calling foul of politics why top 1% is accelerating in wealth, one has to only look at who will own the future robot army to see how wealth continues to concentrate.

I present to you different developments, click on each to watch the video or go to the article.

Keep in mind, technology gets 100% faster every 18 months for a lower price.

Robots are in use in Germany airport today to park your car.

Driverless taxi's are being deployed in the UK in 2015. Robots already drive mining trucks. In a decade I am sure 75% of transportation driving jobs will be lost.

Robots taking over restaurant jobs in China. Apparently Chinese wait staff make too much money.

As wages rise for low cost workers, this will force acceleration of robot workers replacing fast food workers.

Not just low cost workers are being hit, Anesthesiologists making upwards of 300,000 a year are being replaced.

Associated Press will employ Robotic writers to create 1,00's of business articles each year.

Sports writers are already being replaced by robots, will readers notice?

I personally ate at a bar/restaurant in LaGuardia airport with no waiters, using tablets to handle ordering and paying for food. A food runner dropped off the food to your table.

Amazon is leading the way of using robots to run their warehouses.

Robots are being used to do artistic work, such as writing music, and create paintings.

As I posted previously, robots are building houses at a fraction of the cost, 10 simple houses in 1 day in china. Want a traditional house? Employ a robot bricklayer.

Bartending, Soldiers, Farming, Housekeeping, are also seeing robot army approaching.

I predict 10,000's of well paying jobs in corporate data centers will be downsized as operations move to centralized cloud hosting.

And of course, my favorite robot, Baxter. A general purpose robot equivilant of the PC of the 80's, easy to program simply by showing it what to do.

This video highlights the massive deflationary forces the world faces.

As the money printing increases, there is NO WAY to force the money to the people, outside of government handouts in benefits. The extra money of course, will continue to flow in those who own the technological infrastructure that is killing off jobs. For those calling foul of politics why top 1% is accelerating in wealth, one has to only look at who will own the future robot army to see how wealth continues to concentrate.

I present to you different developments, click on each to watch the video or go to the article.

Keep in mind, technology gets 100% faster every 18 months for a lower price.

Robots are in use in Germany airport today to park your car.

Driverless taxi's are being deployed in the UK in 2015. Robots already drive mining trucks. In a decade I am sure 75% of transportation driving jobs will be lost.

Robots taking over restaurant jobs in China. Apparently Chinese wait staff make too much money.

As wages rise for low cost workers, this will force acceleration of robot workers replacing fast food workers.

Not just low cost workers are being hit, Anesthesiologists making upwards of 300,000 a year are being replaced.

Associated Press will employ Robotic writers to create 1,00's of business articles each year.

Sports writers are already being replaced by robots, will readers notice?

I personally ate at a bar/restaurant in LaGuardia airport with no waiters, using tablets to handle ordering and paying for food. A food runner dropped off the food to your table.

Amazon is leading the way of using robots to run their warehouses.

Robots are being used to do artistic work, such as writing music, and create paintings.

As I posted previously, robots are building houses at a fraction of the cost, 10 simple houses in 1 day in china. Want a traditional house? Employ a robot bricklayer.

Bartending, Soldiers, Farming, Housekeeping, are also seeing robot army approaching.

I predict 10,000's of well paying jobs in corporate data centers will be downsized as operations move to centralized cloud hosting.

And of course, my favorite robot, Baxter. A general purpose robot equivilant of the PC of the 80's, easy to program simply by showing it what to do.

This video highlights the massive deflationary forces the world faces.

Friday, August 15, 2014

Friday, August 1, 2014

Deflationary Forces

Market tanked yesterday taking everythign down, including gold and gold miners.

As of Friday AM, the market appears to be opening lower, but only marginally.

Setpping aside and waiting to see gold go ABOVE 1326 before buying in is prudent.

I'll be lightening positions today and sitting on sidelines somewhat.

As of Friday AM, the market appears to be opening lower, but only marginally.

Setpping aside and waiting to see gold go ABOVE 1326 before buying in is prudent.

I'll be lightening positions today and sitting on sidelines somewhat.

Sunday, July 27, 2014

Market Musings

This week has the potential to be very important for Gold Miners.

First, there is the recent whip-saw for gold, I expect some follow through one way or the other this week.

Gold Miner stocks report earnings this week, so the news should affect ETF's GDX & GDXJ in some manner.

Then there is the matter of the overall market. Is this time truely different? Market about ready for a rapid rise? Don't dismiss it! If gobal currencies start to fail we could see an epic market tear.

However if this time is not different, reversion to the mean is long overdue.

I think this time its different is possible, but not plausible if you use history as a guide. But then again, we are in a time unlike any in history.

I happened to have sold 1/2 of what Gary told me in Quest and got full in near the GDX bottom last week with cheap options, so this week I am very interested to see what happens, as I am out there, on my own.

Good Luck!

First, there is the recent whip-saw for gold, I expect some follow through one way or the other this week.

Gold Miner stocks report earnings this week, so the news should affect ETF's GDX & GDXJ in some manner.

Then there is the matter of the overall market. Is this time truely different? Market about ready for a rapid rise? Don't dismiss it! If gobal currencies start to fail we could see an epic market tear.

However if this time is not different, reversion to the mean is long overdue.

I think this time its different is possible, but not plausible if you use history as a guide. But then again, we are in a time unlike any in history.

I happened to have sold 1/2 of what Gary told me in Quest and got full in near the GDX bottom last week with cheap options, so this week I am very interested to see what happens, as I am out there, on my own.

Good Luck!

Tuesday, July 15, 2014

Blockchain will bring on most sweeping changes yet

Bitcoin has been given wide press, but the secret sauce is the blockchain.

The blockchain is what allows distributed ownership, enabling a reliable system that does not require centralized authority.

This key building block for bitcoin can be leveraged for a wide variety of things, including voting.

Ran across this article titled The coming digital anarchy, read if you want to take the red pill.

The blockchain is what allows distributed ownership, enabling a reliable system that does not require centralized authority.

This key building block for bitcoin can be leveraged for a wide variety of things, including voting.

Ran across this article titled The coming digital anarchy, read if you want to take the red pill.

Sunday, July 13, 2014

Market goes up, up, up

Every time I talk to a hands off investor who has good savings, I hear commentary that the market will continue higher.

Until my post in 2010, I believed that laws and the 'system' would revert to the mean. That somehow fundamentals would curb asset inflation eventually.

Since my post in 2010 titled View Change, I am open to the idea that this here, right now, is a market bottom never to be seen again, S&P 500 will hit 4000, then 20,000, on the way to a million.

All that has to happen is stop enforcing financial laws, give away money no strings attached, and influence the market through manipulation. As I said in 2010, if the S&P 500 hits 2000, USA citizens will hit a new low for USA living standards. With 41% of working age Americans not working, 15% of Americans living in poverty, inflation for 2014 target double the central bank target, forecast at 4.1%, As a comparison how US citizens are faring, in 12 months 22 billion dollars in homes bought by Chinese citizens in CASH in just California!

We have seen this to varying degrees since 2008, starting off with suspending honest accounting in place since the great depression back in 2009. Without honest accounting, I am still unsure how any company under fictitious accounting can ever be severely punished by the market.

Please keep in mind, if the market doubles from here in the next year or two, all is not well.

We will see an acceleration of side effects, consequences, there will be ripples into bond markets, commodities, currency destabilization with smaller countries, and worst of all big money starting to lose fear.

Losing fear of consequences of actions, companies no longer required to work as hard to get that carrot. Recklessness, corruption, and acceleration of lawlessness. Money is a powerful motivator for change, to drive people to be productive, but it can drive down real work if too easy as it would become if the market drives higher and faster.

I honestly have no clue what is next market wise, today maybe the best time ever to buy into the market, I really mean that. Or we are about to get a long over-due correction back to reality. When the orange line crosses below the blue line, you must listen and get out of the market, for we could have one hell of a correction.

For now, party on dude, S&P 500 to 4,000 and beyond!

Until my post in 2010, I believed that laws and the 'system' would revert to the mean. That somehow fundamentals would curb asset inflation eventually.

Since my post in 2010 titled View Change, I am open to the idea that this here, right now, is a market bottom never to be seen again, S&P 500 will hit 4000, then 20,000, on the way to a million.

All that has to happen is stop enforcing financial laws, give away money no strings attached, and influence the market through manipulation. As I said in 2010, if the S&P 500 hits 2000, USA citizens will hit a new low for USA living standards. With 41% of working age Americans not working, 15% of Americans living in poverty, inflation for 2014 target double the central bank target, forecast at 4.1%, As a comparison how US citizens are faring, in 12 months 22 billion dollars in homes bought by Chinese citizens in CASH in just California!

We have seen this to varying degrees since 2008, starting off with suspending honest accounting in place since the great depression back in 2009. Without honest accounting, I am still unsure how any company under fictitious accounting can ever be severely punished by the market.

Please keep in mind, if the market doubles from here in the next year or two, all is not well.

We will see an acceleration of side effects, consequences, there will be ripples into bond markets, commodities, currency destabilization with smaller countries, and worst of all big money starting to lose fear.

Losing fear of consequences of actions, companies no longer required to work as hard to get that carrot. Recklessness, corruption, and acceleration of lawlessness. Money is a powerful motivator for change, to drive people to be productive, but it can drive down real work if too easy as it would become if the market drives higher and faster.

I honestly have no clue what is next market wise, today maybe the best time ever to buy into the market, I really mean that. Or we are about to get a long over-due correction back to reality. When the orange line crosses below the blue line, you must listen and get out of the market, for we could have one hell of a correction.

For now, party on dude, S&P 500 to 4,000 and beyond!

Tuesday, July 8, 2014

The dislocation ahead

Its no secret that I believe that society is at risk of a dislocation. An economic global shock could change the world forever, nothing like 2008.

I ran across a video yet again from Mish's wine country fund raiser.

This is a good casual talk between Chris and Mish, and I agree longer term the world ends up in a good place. Between where we stand now and the passage through crisis is really the risk we will all face.

I ran across a video yet again from Mish's wine country fund raiser.

This is a good casual talk between Chris and Mish, and I agree longer term the world ends up in a good place. Between where we stand now and the passage through crisis is really the risk we will all face.

Monday, July 7, 2014

Money 4.0

Money 1.0 was simply barter, I give you eggs, you give me some hay.

Money 2.0 was I give you a precious metal like gold coins for hay. This is really 1.0, however unlike eggs, gold coins are easily stored over time, can be sized easily to different sizes, and can have a similar value across cultures. Gold coins to me is same as barter, but its a widely acceptable physical value to barter with.

Money 3.0 - Fiat currencies by central authority created out of thin air has value.

Money 4.0 - Fiat currencies by shared authority created out of thin air has value. To me what we need is in my post, Ideal Form of Money, Empower the People

I ran across this video, similar sentiment but a different angle. His accent is heavy but does a good job to explain why the current system is unsustainable.

Money 2.0 was I give you a precious metal like gold coins for hay. This is really 1.0, however unlike eggs, gold coins are easily stored over time, can be sized easily to different sizes, and can have a similar value across cultures. Gold coins to me is same as barter, but its a widely acceptable physical value to barter with.

Money 3.0 - Fiat currencies by central authority created out of thin air has value.

Money 4.0 - Fiat currencies by shared authority created out of thin air has value. To me what we need is in my post, Ideal Form of Money, Empower the People

I ran across this video, similar sentiment but a different angle. His accent is heavy but does a good job to explain why the current system is unsustainable.

Sunday, July 6, 2014

Quest

I just joined Gary Savage's Quest challenge, to turn 1K into 100K in the next year or so.

I'll be happy to land with simply my money back :) But hey, some people buy lottery tickets, I'd rather try Quest.

For more info, pay for Gary Savage's https://smartmoneytrackerpremium.com/ for his daily blog commentary, and Quest. Pretty sure quest will close forever in next day or so.

I'll be happy to land with simply my money back :) But hey, some people buy lottery tickets, I'd rather try Quest.

For more info, pay for Gary Savage's https://smartmoneytrackerpremium.com/ for his daily blog commentary, and Quest. Pretty sure quest will close forever in next day or so.

Saturday, July 5, 2014

I have been posting much less in the past year. My work takes up significantly more time, as well as ever increasing family time.

I recently started using app called feedly. It will allow me to tweet articles I find interesting easily from my RSS feeds.

I will start tweeting any article that interests me, not just macro economics.

So in lieu of this blog, if you want to follow the items I find of interest, I highly recommend subscribing to my twitter.

There are three ways to subscribe to my posts, first you need a twitter account.

Follow directions by clicking here.

Once you have a twitter account, subscribe one of three ways.

WARNING: I will likely do a bunch of posts in a row with long lulls, you may find this annoying if updated by SMS.

Twitter Application or Twitter Web page

1) Login to twitter (follow signup directions if new user)

I recently started using app called feedly. It will allow me to tweet articles I find interesting easily from my RSS feeds.

I will start tweeting any article that interests me, not just macro economics.

So in lieu of this blog, if you want to follow the items I find of interest, I highly recommend subscribing to my twitter.

There are three ways to subscribe to my posts, first you need a twitter account.

Follow directions by clicking here.

Once you have a twitter account, subscribe one of three ways.

WARNING: I will likely do a bunch of posts in a row with long lulls, you may find this annoying if updated by SMS.

Twitter Application or Twitter Web page

1) Login to twitter (follow signup directions if new user)

2) Go to http://Twitter.com/WebSurfinMurf

3) Find the follow button on right side and click to follow.

Updates to your cell phone, follow these steps.

1) Send a text message "START" to 40404. (USA)

2) Twitter will text back, send text of your full name.

3) Twitter will text back your twitter username

4) Send text "Follow WebSurfinMurf" to 40404. (USA)

Update from email, follow these steps.

1) Login to twitter (follow signup directions if new user)

2) Go to http://Twitter.com/WebSurfinMurf

3) Find the follow button on right side and click to follow.

4) Click on the gear icon in upper right hand corner

5) Select settings from drop down menu

6) Click on Email Notifications on left hand side.

7) Check notification boxes to reflect your email preferences.

8) Click Save changes.

Friday, July 4, 2014

Politics and Economics

Politics ENABLES good economic growth.

Economic construct growth is harnessing the people to be productive, that productivity is reflected in economic constructs such as stocks, interest rates, and other forms.

Today on Audible, you can buy for 6 bucks an audible book to learn about the start of this Great Nation. I haven't listened to this book, but the basics of this nation are the greatest foundation of government in human history in my opinion. Where we are today is struggling to find this nations path moving forward.

I am a believer of understand the basics is a must to construct a better framework. Understanding why this nation was constructed the way it was needs to understand two things.

First, the politics of people of all economic classes, belief systems, and personality types. These often clash violently, and the system needs a way to allow all conflicts to be resolved in a manner that does not result in violent turmoil. I believe the founding fathers did an outstanding job, one we have drifted from as the rule of law is not respected. If we don't follow the law, the construct no longer functions.

Second is the tools available to the people at the time. When solving a problem, people solve with what is possible at that time period. The best solution in 1000 BC vs 1000 AD, vs 1776 and 2014 are not the same. I do believe that 1776 the solution was the best possible outcome, but in 2014 the new technologies, global society, and many other factors are putting strain on a system designed in 1776.

So when reading / listening to this book understand the first and think of how today the second could enable a better framework.

If you do not belong to Audible, see this post on how to get two free books, and buy this book on sale for 6 bucks.

http://www.audible.com/pd/History/Empire-of-Liberty-Audiobook/B003155WUO

NOTE: I added to previous post a must read book:

Outliers: The Story of Success

http://www.audible.com/pd/Nonfiction/Outliers-Audiobook/B002UZDRK8/ref=a_search_c4_1_1_srTtl?qid=1404474932&sr=1-1

Economic construct growth is harnessing the people to be productive, that productivity is reflected in economic constructs such as stocks, interest rates, and other forms.

Today on Audible, you can buy for 6 bucks an audible book to learn about the start of this Great Nation. I haven't listened to this book, but the basics of this nation are the greatest foundation of government in human history in my opinion. Where we are today is struggling to find this nations path moving forward.

I am a believer of understand the basics is a must to construct a better framework. Understanding why this nation was constructed the way it was needs to understand two things.

First, the politics of people of all economic classes, belief systems, and personality types. These often clash violently, and the system needs a way to allow all conflicts to be resolved in a manner that does not result in violent turmoil. I believe the founding fathers did an outstanding job, one we have drifted from as the rule of law is not respected. If we don't follow the law, the construct no longer functions.

Second is the tools available to the people at the time. When solving a problem, people solve with what is possible at that time period. The best solution in 1000 BC vs 1000 AD, vs 1776 and 2014 are not the same. I do believe that 1776 the solution was the best possible outcome, but in 2014 the new technologies, global society, and many other factors are putting strain on a system designed in 1776.

So when reading / listening to this book understand the first and think of how today the second could enable a better framework.

If you do not belong to Audible, see this post on how to get two free books, and buy this book on sale for 6 bucks.

http://www.audible.com/pd/History/Empire-of-Liberty-Audiobook/B003155WUO

NOTE: I added to previous post a must read book:

Outliers: The Story of Success

http://www.audible.com/pd/Nonfiction/Outliers-Audiobook/B002UZDRK8/ref=a_search_c4_1_1_srTtl?qid=1404474932&sr=1-1

Wednesday, June 25, 2014

Large Macro Issues

Chris Martenson created a video series I posted back in March 2011 in post Chris Martenson.

Recently I posted his recent 38 minute talk at Mish's fund raiser in my latest New Reader Post.

Mr. Martenson just released a 58 minute video quick crash course compared to the 2011 series.

I urge everyone to watch.

Recently I posted his recent 38 minute talk at Mish's fund raiser in my latest New Reader Post.

Mr. Martenson just released a 58 minute video quick crash course compared to the 2011 series.

I urge everyone to watch.

Sunday, June 22, 2014

Technology

I look at my life, one thing that has had the greatest impact has been technology.

That is of course, excluding my wife and son :) They dwarf everything, but that is a different level of impact.

My parents, family, friends, and the masses give depth, breadth, perspective, and giving content to life.

But for the mind, for my interest, to learn, grow, observe, connect, earn a living, entertainment, technology crushes everything.

I have witnessed at age of 8, the first personal PC, the Apple 1 released in 1976.

I still remember my father showing me article BEFORE 76 about these hobbyists making home PC's then when Apple 1 came out about them.

Fast forward to today, my cell phone contains much more power than computers that drove spaceship Apollo to the moon. At any whim, I can watch just about any video ever made online. I can listen to any music, audio book, read any book, look at any picture, learn any topic, basically do anything that is not a human connection but of the mind.

Sure there is social media, a farce of a personal connection. I was lucky enough to live before the internet to see the difference of knowing people vs 'connecting' with them.

I now see a future that includes local creation of any physical object below computer chips from every home as 3d printing technology advances. Local sourcing of energy with a combination of sun, wind, water and thermal. Automation to wipe out any job that does not require a doctorate in a generation. Decentralization removing the few commanding the many on many fronts, culminating with decentralized currency and government.

It is truly an amazing time to live, to see this unreal transition in the core of humanity.

It is actually possible for this post to be discovered 1,000 years from now, heck a million years from now and become a topic of some sort of viral boom.

And all it took was for me to sign up using any PC, tablet, and phone to Google and spend a few minutes to create this post. Seconds after I hit save a person anywhere in the world could read this.

As much as I am awe of technology, the ability to level the playing field from the mega rich to the poorest of the poor, I can't help but worry about the other side of the sword.

All technology has two edges, a side for good and evil, makes it even more human to see how we use the tools available. I no longer watch TV or read fiction. The mystery of past, present, and future on a personal, professional, and humanist level is so engaging, why bother?

Sure, I have a a few personal indulgent vices like occasional video game, I'll chalk that up to human self indulgence.

But what keeps me going at this age is my immediate family, sheer curiosity of how all this chaos turns out, teaching the next generation of brilliant minds I encounter, and my awe of scientific method driving humanity from humans 4,000 years ago.

There will come a time where the advancement in computing processing power will advance in 1 day what it took from 1971 to 2001. This is Moore's law in effect to this day, and if it maintains what it has done since 1971, it will happen.

Can you conceive of computing power advancing in 1 day equal to 30 years global human of effort to advance computing technology? It will come to pass and the NEXT day will be that plus extra.

Lets hope through this advancement we keep perspective on human life, relationships, and enjoyment of the gift of life.

That is of course, excluding my wife and son :) They dwarf everything, but that is a different level of impact.

My parents, family, friends, and the masses give depth, breadth, perspective, and giving content to life.

But for the mind, for my interest, to learn, grow, observe, connect, earn a living, entertainment, technology crushes everything.

I have witnessed at age of 8, the first personal PC, the Apple 1 released in 1976.

I still remember my father showing me article BEFORE 76 about these hobbyists making home PC's then when Apple 1 came out about them.

Fast forward to today, my cell phone contains much more power than computers that drove spaceship Apollo to the moon. At any whim, I can watch just about any video ever made online. I can listen to any music, audio book, read any book, look at any picture, learn any topic, basically do anything that is not a human connection but of the mind.

Sure there is social media, a farce of a personal connection. I was lucky enough to live before the internet to see the difference of knowing people vs 'connecting' with them.

I now see a future that includes local creation of any physical object below computer chips from every home as 3d printing technology advances. Local sourcing of energy with a combination of sun, wind, water and thermal. Automation to wipe out any job that does not require a doctorate in a generation. Decentralization removing the few commanding the many on many fronts, culminating with decentralized currency and government.

It is truly an amazing time to live, to see this unreal transition in the core of humanity.

It is actually possible for this post to be discovered 1,000 years from now, heck a million years from now and become a topic of some sort of viral boom.

And all it took was for me to sign up using any PC, tablet, and phone to Google and spend a few minutes to create this post. Seconds after I hit save a person anywhere in the world could read this.

As much as I am awe of technology, the ability to level the playing field from the mega rich to the poorest of the poor, I can't help but worry about the other side of the sword.

All technology has two edges, a side for good and evil, makes it even more human to see how we use the tools available. I no longer watch TV or read fiction. The mystery of past, present, and future on a personal, professional, and humanist level is so engaging, why bother?

Sure, I have a a few personal indulgent vices like occasional video game, I'll chalk that up to human self indulgence.

But what keeps me going at this age is my immediate family, sheer curiosity of how all this chaos turns out, teaching the next generation of brilliant minds I encounter, and my awe of scientific method driving humanity from humans 4,000 years ago.

There will come a time where the advancement in computing processing power will advance in 1 day what it took from 1971 to 2001. This is Moore's law in effect to this day, and if it maintains what it has done since 1971, it will happen.

Can you conceive of computing power advancing in 1 day equal to 30 years global human of effort to advance computing technology? It will come to pass and the NEXT day will be that plus extra.

Lets hope through this advancement we keep perspective on human life, relationships, and enjoyment of the gift of life.

Thursday, June 19, 2014

The Golden Bull

On Sunday night I revised my New Reader entry to highlight my concerns and positioning on gold.

Wednesday of last week my post Gold miners, Stock Market what next? all of the stocks below where even lower than Tuesday AM, so gains are even greater in 7 days.

Assuming GDX breaks above 27, the long term stock indicator will indicate a probable multi-month rally. since gold has been very suppressed for so long, I suspect the pent up demand and heavy short covering will make this scream higher.

Tuesday AM EOD Thursday Percent gain

GLD 122 127 4.1%

GDX 23.75 26 9.5%

GDXJ 38 43.07 13.3%

GLDX 14.25 15.90 11.5%

Gold, 10 year view

Wednesday, June 18, 2014

Gold miners indicating multi-month rally

The etf GDX, gold miners, has crossed on 20-50 weekly SMA, indicating a potential multi-month trend change. GDXJ, junior gold miner ETF may have better return on investment, as well as the etf GLDX, gold miner explorers.

Since the 20-50 weekly SMA just crossed today, it is not yet a convincing indicator. GDX hitting above 27 I believe will be a clear indicator of trend change. However, the miners have been depressed for so long, there is a good chance this is the beginning of the final, multi year rally I have been waiting for since April 2011, in post Precious Metals into 2015-2017.

In that post, I violated my own advice with this statement:

I am sitting more on the sidelines as per his paid service recommendations. I am keeping core positions, as I will until this run ends, sometime after 2013.

I grew impatient and started re-entering gold miners earlier, to my detriment. It is 2014, and I think the down trend may have finally run its course.

Throw into the mix of Iraq falling apart, Russia acting very aggressive, and China always looking for ways to advance itself as the next world super power, any instability should send gold shooting insanely higher.

My original thesis for liking gold is still in tact, that India and China as they grow richer will buy more gold as part of their culture. See blog post why I like natural resources better than bonds.

Below is GDX 20-50 weekly SMA long term investing indicator, as explained in post when to buy stocks or get out of the stock market.

Since the 20-50 weekly SMA just crossed today, it is not yet a convincing indicator. GDX hitting above 27 I believe will be a clear indicator of trend change. However, the miners have been depressed for so long, there is a good chance this is the beginning of the final, multi year rally I have been waiting for since April 2011, in post Precious Metals into 2015-2017.

In that post, I violated my own advice with this statement:

I am sitting more on the sidelines as per his paid service recommendations. I am keeping core positions, as I will until this run ends, sometime after 2013.

I grew impatient and started re-entering gold miners earlier, to my detriment. It is 2014, and I think the down trend may have finally run its course.

Throw into the mix of Iraq falling apart, Russia acting very aggressive, and China always looking for ways to advance itself as the next world super power, any instability should send gold shooting insanely higher.

My original thesis for liking gold is still in tact, that India and China as they grow richer will buy more gold as part of their culture. See blog post why I like natural resources better than bonds.

Below is GDX 20-50 weekly SMA long term investing indicator, as explained in post when to buy stocks or get out of the stock market.

Saturday, June 14, 2014

Welcome New Reader

You will see text hyperlinks throughout posts, please link through for more information.

Back in August 2006, while talking to my friend John Chinnock, came to realize that the entire financial markets where based on a ponzi-scheme of subprime mortgages and off-balance sheet derivatives. Since then I was obsessed with reading ever aspect of the global economic forces at work, up until about 2013, as you can see by looking at my posting activity.

One of the reasons I have posted less is in my minds eye, I grasp enough to personally satisfy my own curiosity of the pressures on the global economic system. I hope to someday boil down all the information into a concise summary. For now, here is my short-sweet version.

**UPDATE** Skip all the summary below and read future of employment Post (click). While below are all important and factors, the reality that affects you most is your ability to be employed.

**UPDATE** Skip all the summary below and read future of employment Post (click). While below are all important and factors, the reality that affects you most is your ability to be employed.

The world faces unprecedented challenges today, the most critical being peak oil. Fossil fuels are the reason why we have the lifestyle we have today in the west. Fossil fuels took about 400 million years of sunshine on plant life to create, and mankind will take about 200 years to burn. That release of stored energy has created the incredible world we live in today. Peak Oil basically means that the era of cheap fuel is over. I urge you to watch the 58 minute video below to indoctrinate you on the many resource challenges we face today.

The world is facing epic deflationary forces driven by technology, except monetary policy which is helping hide the financial strain. As of this writing I believe stock market valuations are precarious at best, partially inflated due to monetary policy. However, after living through the last few years I have come to realize that investing depends on laws, or lack of laws to determine valuations. Given reasonable expectations of maintaining sane law enforcement in the USA, a reversion to the mean is historically likely. For an ample discussion on this, please see the third video below, starting at 50 minutes in. An independent indicator for longer term investing that you can read more about here, I do apply this to other stocks and ETF's as an indicator. The jump the shark moment will be if US Treasuries break the downtrend of last 40 years.

If you think China is somehow going to pull the global economy, I for one don't believe it. I have posted much about the China ponzi scheme, and with Jim Chanos providing an excellent job in his 2013 synopsis below on China's troubles. Even if somehow China is wildly successful it would result is substantial cuts to western lifestyles due to resource redistribution.

I do believe in crypto-currencies, a great place to start is my series on money, and what I wrote back in 2011 the ideal form of money. I think crytpo-currencies are a manifest-ion of what I described back in 2011, and I am lightly following bitcoin and 100 other crypto currencies as they develop. And I have great hope for the new economy that is brewing with latest manufacturing revolution. But for the old generation I see deflation for decades as robotics and technology sheds millions of more jobs. Its a generational shift, bad for the older employees, good for latest smart students out of college.

As of June 2014 I do think Gold Miners are a good buy, however due to all the issues above I am nervous about them as a longer term play. ( GDX at 24 dollars)

For more information, if you care to research, my old new reader post is here. If you browse my old posts keep this in mind, the world is changing as I am, which affects viewpoints over time. Posts in 2008 are likely to be significantly different than my current view.

I highly recommend the first two videos as a must watch.

Headwinds ahead

China is NOT the answer

Market Investing June 2014

Wednesday, June 11, 2014

Gold Miners, Stock Market what next?

Gary of the Smart Money tracker is getting bullish on Gold Miners. I myself added to my options a few weeks ago.

There is a neutral indicator that I have used and at times dis-reguarded to my own detriment of a stock direction.

Please refer to post When to buy and get out of the stock market, a guide for long term investing.

Using this same indicator, I applied it to GDX, and it is not yet clear that GDX is on the rise using this indicator, but the stock may push the indicator over the edge in the days ahead.

Below is a graph of GDX, calling out when the 20-50 weekly SMA crosses, potentially indicating a stock trend change.

As you can see it is reasonably accurate as an independent indicator over long periods of time.

Using this same indicator, I applied it to GDX, and it is not yet clear that GDX is on the rise using this indicator, but the stock may push the indicator over the edge in the days ahead.

Below is a graph of GDX, calling out when the 20-50 weekly SMA crosses, potentially indicating a stock trend change.

As you can see it is reasonably accurate as an independent indicator over long periods of time.

Using this indicator, there is ZERO indication of a market trend change, so for now the sky is the limit.

Tuesday, June 10, 2014

Audio Books

Very good sale today 6-10-2014 for 4 bucks on Audible for Niall Ferguson's book

The Ascent of Money: A financial History of the World.

http://www.audible.com/pd/

If you don't belong to Audible, can get two books free to join

Books that I either recommend

Outliers: The Story of Success

My most recommended book, a must read for anyone under age 30, or with kids.

http://www.audible.com/pd/Nonfiction/Outliers-Audiobook/B002UZDRK8/ref=a_search_c4_1_1_srTtl?qid=1404474932&sr=1-1

No Excuses, Existentialism and the Meaning of Life

http://www.audible.com/pd/Nonfiction/No-Excuses-Existentialism-and-the-Meaning-of-Life-Audiobook/B00DDY7SWS

The World is Flat

http://www.audible.com/pd/History/The-World-Is-Flat-Audiobook/B002VA8GTO/ref=a_search_c4_1_3_srTtl?qid=1402408697&sr=1-3

On Intelligence

http://www.audible.com/pd/Science-Technology/On-Intelligence-Audiobook/B002V8LKTE

Getting things Done

http://www.audible.com/pd/Business/Getting-Things-Done-Audiobook/B002V0PPRU/ref=a_search_c4_1_1_srTtl?qid=1402409266&sr=1-1

I have on my queue to listen to:

The Fourth Revolution: The Global Race to Reinvent the State

http://www.audible.com/pd/History/The-Fourth-Revolution-Audiobook/B00KCSJ8NU

The Ascent of Money: A financial History of the World.

http://www.audible.com/pd/

If you don't belong to Audible, can get two books free to join

Outliers: The Story of Success

My most recommended book, a must read for anyone under age 30, or with kids.

http://www.audible.com/pd/Nonfiction/Outliers-Audiobook/B002UZDRK8/ref=a_search_c4_1_1_srTtl?qid=1404474932&sr=1-1

No Excuses, Existentialism and the Meaning of Life

http://www.audible.com/pd/Nonfiction/No-Excuses-Existentialism-and-the-Meaning-of-Life-Audiobook/B00DDY7SWS

The World is Flat

http://www.audible.com/pd/History/The-World-Is-Flat-Audiobook/B002VA8GTO/ref=a_search_c4_1_3_srTtl?qid=1402408697&sr=1-3

http://www.audible.com/pd/Science-Technology/On-Intelligence-Audiobook/B002V8LKTE

Getting things Done

http://www.audible.com/pd/Business/Getting-Things-Done-Audiobook/B002V0PPRU/ref=a_search_c4_1_1_srTtl?qid=1402409266&sr=1-1

I have on my queue to listen to:

The Fourth Revolution: The Global Race to Reinvent the State

http://www.audible.com/pd/History/The-Fourth-Revolution-Audiobook/B00KCSJ8NU

Sunday, June 8, 2014

Corruption, Gold, Bitcoin, and Beyond

I ran across a summary of recent massive corruption in the US financial system of preferred treatment.

I actually have Zero against the rich or influential, I have a problem with the law not being applied evenly.

Not because its immoral, but because a system without law, is a system that is bound to fail, as history has shown many times over.

As I write this, gold MAY have bottomed last week, and Gary of Smart Money Tracker is thinking it has. I did buy some options last week for a GDX bounce, but time will tell. If gold rises, miners should follow. Bitcoin has exploded from about $50 a coin when I bought in a couple of weeks ago to 650 a coin. I should have put ever nickel into bit coin, but its hard to pull that trigger.