The beating of gold miners is so severe, I feel like a truck ran over me.

The question is, what the heck is going on?

Gold miners profits are a combination of price of gold, production quantities, costs, perception, and politics.

I say politics because for better or worse Gold has an element of Politics in the mix.

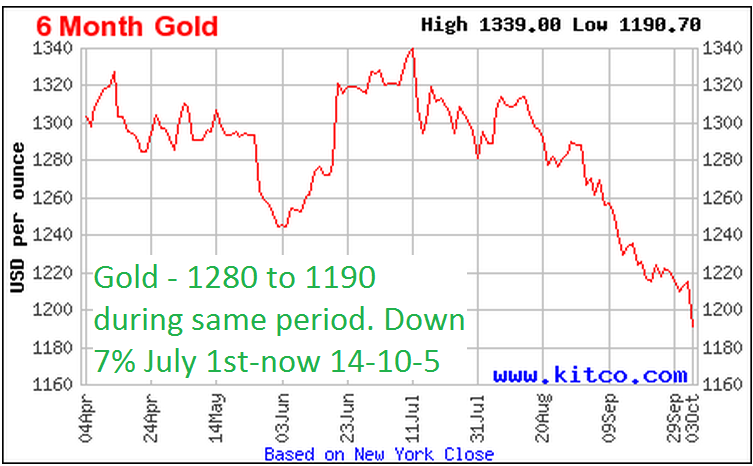

First lets take a look at the price of gold, in the last 3 months, it has dropped about 7%

During the same period USD has EXPLODED higher by over 8%

The correlation of price of gold to USD valuation seems correlated. Thats because Gold like all commodities are priced vs demand, but the 'localized' cost is a reflection of each countries currency valuation. If Gold demand collapsed, I would expected much more collapse in price. Basically gold price is trading in a tight range for the same period.

Now lets take a look at USD over the longer haul, is 86 really out of line?

Still within reason, but it is amazing the market is at near highs and USD is also on a rocket ride up. We are fast approaching the panic levels seen in 2009, and levels not seen regularly since pre 2005. So from a near historical perspective, it is appears out of character.

OK, lets see what happend to Gold Miners (Brace yourself).

Holly hell, that can only be called an all out destruction of Gold Miners during the same period.

It can be partially explained that the change of Gold price down to US valuation combined with overall market strength and overall perception of low near term demand due to market stability. Throw on there any political games and its a recipe for destruction.

The question is, are we near a bottom?

Lets take a look at GDX over the long Haul.

From a HISTORICAL perspective Gold miners is near its all time low from the 2008 collapse. That is outright amazing! the worst collapse in modern history and GDX hit 16 bucks a share, and now we are at 20.6, amazing! The panic selling began in earnest when the trend line broke down Friday. This could be beginning of a freefall of GDX down to 16, or a final panic sell for a reversal. There is NO NEED to jump infront of this train by adding more that what you may already have, wait and see.

NOTICE that the trend lines still show GDX is on a BULL trend up, not down, read and watch the video for the longer term trend indicator described on When to buy and get out of the stock market.

But I can say, from a historical perspective, Gold miners are DIRT cheap. Gold was at 700 oz at the depths of 2008 collapse and GDX at 16, while now Gold is at 1150 with GDX at 20.6.

PLACE all of this into context with my post Market Dislocation to help gain perspective. (click to read)

So in the end, whats the deal? Frankly I am shocked at the beatdown Gold Miners has taken. I knew this would be the hardest trade of my life, but still nothing prepared me to see GDX at these levels.

The facts remain, GDX is near all time lows, and it is possible it breaks those lows. But as a logical guy, playing the odds, the odds in history say GDX will go higher than it is today. I really doubt gold miners en-mass go bankrupt or the Asian demand for gold evaporates. China loves gold, the greatest threat to gold is if China adopts Crypto-Currencies and runs from gold, a distinct possibility. They could announce their own Bitcoin as the new standard for China.

If so the I would expect gold to go lower than 700 an ounce quite quickly. Outside of such an event, Gold Miners are experiencing a panic sell off. Once all those who will sell, sell, the bottom will be in, its anyone's guess when that will be.

At this point I am watching like a deer in headlights. Once Call Options for 2017 for GDX are publicly tradeable, I may buy some at these depressed lows for the long haul.

I'll post when I do, for now its a watch and see.

I would expect if USD doesn't continue on a vertical line straight up, Gold price will stabalize.

I recommend checking out this blog for more frequent commentaries, Alex talks of any trading opportunities:

No comments:

Post a Comment