It is no coincidence that Fed Chairman Ben Bernanke spoke on Friday to support market over-valuation. The market chartists where watching for high volatility as we broke down through a up trend line. Due to Friday's bounce, the trend line held. Click here for analysis of various charts that held at critical levels Friday.

However, quite a few bloggers wrote about Mr. Bernanke's comments, and basically they think the Federal Reserve is out of arrows. While I agree with these articles, I think that this Federal Reserve could be even more creative on ways to create money without work value. Time will tell if Mr. Bernanke is bluffing, will do same old tricks, or get even more creative.

Since only 7 of the federal reserve board members now thing more Quantitative Easing (basically raw printing of money) is bad, I don't think Ben is out of rope. Quite the contrary, bond rates are at a new recent low, this gives him MORE room to seal the fate of destroying the US financial system.

I am starting to think this huge ponzi scheme has 5 years before blowing up. Not because of John Chinnock's comments, but because of the bond rates. HUGE amounts of debt is being placed in 5, 10, and 30 year bonds. The government has taking vast sums of private debt, made it public debt, and put it in basically the worlds largest ticking time bomb.

For now, I'll continue to play with gold, silver, gold/silver miners, and a tiny amount of shorts.

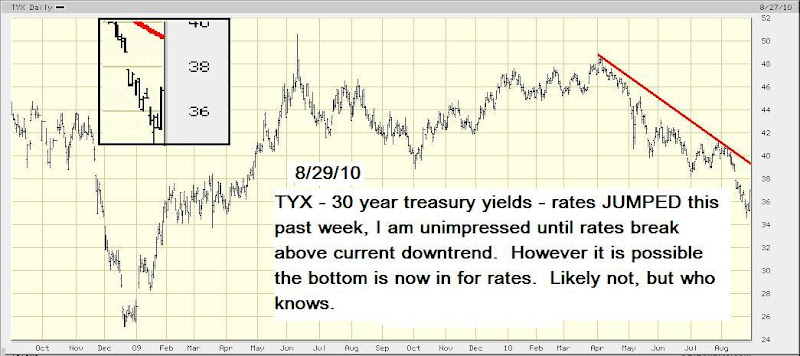

Now to the charts, notice the SPX bounced up off of the trend line, rates jumped, gold is holding in strong.

No comments:

Post a Comment