The weekend is upon us, and the market is jittery.

Companies continue to issue bad forecasts, layoffs, and other news.

Personal Income +0.2%, spending -0.3% (month over month)

American Express to cut 10% of the workforce, about 7,000 jobs

Moody's downgrades GMAC Australia

Japan announces 260 Billion dollar stimulus package

GMAC may become a bank (as every business should) to help overhaul debt

US Treasury debt issuing will top 1 trillion for 08, a record

The Hartford Insurance company stock is cut by 50%, on 2.6 Billion loss news

Questions arise on AIG, how the Insurance company needed Federal loans of 123 Billion dollars in a month

Motorola cuts jobs by 3,000, announces loss

Stock Mutual Funds Saw $9.23B Outflow Thu-Wed

And GDP contracts to 0.3 (from expected 0.5), (many bloggers question this number, due to highly irregular accounting, many suggest in negative territory)

NOTE: We still may be in a short term bull market (1-3 months), the jitters is the bi-polar of reality with market rallying.

Friday, October 31, 2008

Thursday, October 30, 2008

WackyWednesday

The Fed announced a 50 basis point (0.5%) rate cut for institution lending. This doesn't directly affect mortgages, that is typically tied to the LIBOR.

The Fed announced a 50 basis point (0.5%) rate cut for institution lending. This doesn't directly affect mortgages, that is typically tied to the LIBOR.The market soared to a high of 9.347 but took a nose dive in last hour down 370 points or so to close at 8,976. In any event, the DJIA is starting to form a range, and I would like to see the DJIA break upwards 9,400 to confirm we are in rally mode for a while. See chart on the left.

As I go to bed, the DJIA futures are pointing to a higher open Thursday am.

The GDX (Gold Miner index) went from low on Friday of 15.80 to a high today of 21.31. Not too shabby, between 25 and 29% return depending where GDX was purchased Friday/Monday. Wouldn't surprised to see a pullback, unless GDX breaks down below 17, I am not concerned.

As for the US Dollar, it stumbled slightly today as it hit the bottom of a previous support level. It will be interesting to see if the dollar reverses or makes in into the trading range. (See chart on right).

As for the US Dollar, it stumbled slightly today as it hit the bottom of a previous support level. It will be interesting to see if the dollar reverses or makes in into the trading range. (See chart on right).if the Dollar/Euro breaks above 0.85, I'll be baffled on how the dollar became this strong.

The dollar will eventually get weaker by the reckless actions by the US Fed.

NEWS:

Fed to guarantee 3 million mortgages

Fed to open swap lines with emerging markets

Treasury gives Wells Fargo 25 billion in exchange for stock

Chrysler Financial Ford, GM have access to Fed TARP

Calls for regulation on Credit Default Swaps, as 3 Trillion dollar government expense on banking crisis is reached worldwide.

Wednesday, October 29, 2008

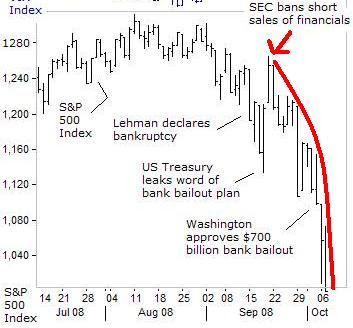

Government Backed Market Manipulation hurts the little guy

This hilarious video expresses my frustration in the last year as the government constantly changed the rules mid-game. At one point I lost my annual salary in under 4 hours when shorting was banned. (I got it back thankfully).

On the right I added "Shadow Market Stats", A web site that attempts to give the true view of economic statistics, instead of the manipulated indicators the government generates.

On the right I added "Shadow Market Stats", A web site that attempts to give the true view of economic statistics, instead of the manipulated indicators the government generates.

Tuesday, October 28, 2008

Fantastic Tuesday!

Today we saw what I believe was a market turning point, DOW up 889 points! (10.88% in one day!)

Today we saw what I believe was a market turning point, DOW up 889 points! (10.88% in one day!)Bad news, bah! We are off to the races once again.

The market is probably back into bull mode, probably for weeks, into Thanksgiving weekend.

Thanksgiving weekend may bring some very bad news as stores report bad sales, and bring the bear back, time will tell.

In any event, I am 90% long the market. I have NEVER been this deep long. From 2006 to 2 weeks ago I was 99% short. Currently majority stake is in GDX, Gold Minders, DIG, VMWARE, EMC, and couple other positions. (see past blog entry here)

I still recommend GDX, the low was this past Friday at 15.80. Today it closed at 18.69.

I still recommend GDX, the low was this past Friday at 15.80. Today it closed at 18.69.Assuming GDX rallies between now and Dec 2009 back to it's high of 56.87, you could stand to make 40 bucks per share by purchasing NOW.

If wrong, GDX may go down to 10 bucks, but it's hard to believe it will, after all, GDX in an index of companies that mine Gold. And at SOME point in the next year it will almost guarantee rally to 20 bucks (1.40 away) so risk to reward is golden.

I added a link to the right to follow GDX at-a-glance.

BTW, many many thanks to "Happy John" [formerly known as "The Punisher" :) ] who brought this play to my attention.

UPDATE: 11:22PM

UPDATE: 11:22PMAnother reason why I like gold is by looking at the US GOVERNMENTS financial data.

Take a look at the fed report shown to the left. Using the St. Louis Fed’s Adjusted Monetary Base (effectively total reserves plus M1 cash in circulation), the year-to-year growth in the latest period was an unprecedented 38.0%. In the period since 1919, the previous high growth rate was 28% in September 1939, and that was driven by WWII preparations. Loose fiscal policy WILL yield adverse effects on the US Dollar. See Preserving Wealth post.

High Expectations Tuesday

The stock market is about the same level as the end level for October 10th. This level has been a resistance level for 5 days in the last two weeks. Tuesday the FOMC begins with rate announcement Wednesday. At this point rate cuts have become, expected and the last couple had minimal impact. Expected rate cut is about 0.5, but I wouldn't be surprised if it was significantly more, bringing interest rate to near zero.

The stock market is about the same level as the end level for October 10th. This level has been a resistance level for 5 days in the last two weeks. Tuesday the FOMC begins with rate announcement Wednesday. At this point rate cuts have become, expected and the last couple had minimal impact. Expected rate cut is about 0.5, but I wouldn't be surprised if it was significantly more, bringing interest rate to near zero.Unfortunately, if the FOMC brings the interest rate to near zero, this will have exhausted this mechanism, leaving one less action that the government can do to attempt to stimulate lending.

The issue is, between now and Wednesday the world will hold its breath, to see if any surprise announcement comes from the government in Tuesday or Wednesday, along with the rate cut.

Monday, October 27, 2008

Depressing News

Yes it's once again time to bring out the depressing news. If the mainstream media won't focus on it, someone has to! :)

Federal "bailout money" may be used by banks as leverage to buy out other banks. My Spin The government spin is if a "healthy" bank (if its healthy, why does it need federal funds?) buys a troubled bank, it helps the consumer. To me it make zero sense that companies than need bailout money are expanding their influence/business? But what do I know?

Federal "bailout money" may be used by banks as leverage to buy out other banks. My Spin The government spin is if a "healthy" bank (if its healthy, why does it need federal funds?) buys a troubled bank, it helps the consumer. To me it make zero sense that companies than need bailout money are expanding their influence/business? But what do I know?

Insurers and banks face billions in loses in Credit Default swaps My Spin: A 62 trillion dollar unregulated credit derivatives market is bound to bring losses that stagger the imagination. It doesn't take a huge leap to be concerned that this will adversely affect the market.

Korean Bank to use USA Federal money for assistance. My Spin: Ben Bernanke is trying hard to stop something he can't. Mr. Bush needs to step up to the plate, lead for 2 minutes and reign in the lending machine. Also, I need to lose 100 lbs. Both have same probability of occurring.

Moody's downgrades GM to deep junk bond status, and the Treasury to expand helping (bailout?) from Investment banks, Banks, Insurance companies (AIG), bond insurers (ABK), and now car manufacturers GM & Chrysler. My Spin: I blogged on this in the past, with all the cash being focused on financial industry I question if the government will have enough resources to help the industry that actually produces products. GM will eventually be a government business or foreign owned. I still contend Bennigans should apply for a Fed "loan" to re-open its business.

Bernanke announces any company in the world with a stock value above 1 dollar is insured from failure using USA Taxpayer money. OK, you got me, I made this one up, just checking to see if you where paying attention.

Nasdaq suspends exchange delisting rules. Why is this needed? When staple companies like AIG see their stock go below a buck a share, it would add fuel to the fire to have it delisted. My Spin: This fixes nothing, except less scary headlines.

Thailand to buy oil with rice. My Spin: Breaking down trading to a barter system is not good sign. Maybe the USA can export SUV's, and McMansions for oil.....

Britain may need ZERO percent interest rate to spurn growth. My Spin: Like an older brother (like Fredo) Britain is probably doing what it's told to give Bernanke room to not seem crazy when he does it first. FREE money does not SOLVE ANYTHING. It will hurt! Hence my Gold miner play. Money will have a COST, either by interest rates or devaluation!

Goldman Sachs sought Citibank to take GS over, but was rebuked. My Spin: This stock is screaming short me. Why else would GS want to be taken over?

AIG has about eight weeks of cash left. My Spin: AIG goes down, we will see new DOW lows immediately.

Japan's stock market hits 26 YEAR low! My Spin: For all readers who believe "buy and hold" is the way to a secure retirement, Japan is an example of being prepared to hold for 40 years to eek out some sort of profit, and 26 years to break even (discounting inflation)

NYTimes has an interesting article on how the government plans to encourage banks to use Government money to finance mergers. My Spin: I thought one of the problems was institutions where "too big to fail". Isn't this going to fuel this problem? And I thought Republicans where against Corporate Welfare and Government meddling in business. This administration is taking this to a level that was un-imaginable 2 months ago.

My Closing Spin: We either have seen a near term bottom or we are going to crash from here. But then again, I keep thinking that for the last week. Eventually I'll be right one way or the other. :)

(image source)

Federal "bailout money" may be used by banks as leverage to buy out other banks. My Spin The government spin is if a "healthy" bank (if its healthy, why does it need federal funds?) buys a troubled bank, it helps the consumer. To me it make zero sense that companies than need bailout money are expanding their influence/business? But what do I know?

Federal "bailout money" may be used by banks as leverage to buy out other banks. My Spin The government spin is if a "healthy" bank (if its healthy, why does it need federal funds?) buys a troubled bank, it helps the consumer. To me it make zero sense that companies than need bailout money are expanding their influence/business? But what do I know?Insurers and banks face billions in loses in Credit Default swaps My Spin: A 62 trillion dollar unregulated credit derivatives market is bound to bring losses that stagger the imagination. It doesn't take a huge leap to be concerned that this will adversely affect the market.

Korean Bank to use USA Federal money for assistance. My Spin: Ben Bernanke is trying hard to stop something he can't. Mr. Bush needs to step up to the plate, lead for 2 minutes and reign in the lending machine. Also, I need to lose 100 lbs. Both have same probability of occurring.

Moody's downgrades GM to deep junk bond status, and the Treasury to expand helping (bailout?) from Investment banks, Banks, Insurance companies (AIG), bond insurers (ABK), and now car manufacturers GM & Chrysler. My Spin: I blogged on this in the past, with all the cash being focused on financial industry I question if the government will have enough resources to help the industry that actually produces products. GM will eventually be a government business or foreign owned. I still contend Bennigans should apply for a Fed "loan" to re-open its business.

Bernanke announces any company in the world with a stock value above 1 dollar is insured from failure using USA Taxpayer money. OK, you got me, I made this one up, just checking to see if you where paying attention.

Nasdaq suspends exchange delisting rules. Why is this needed? When staple companies like AIG see their stock go below a buck a share, it would add fuel to the fire to have it delisted. My Spin: This fixes nothing, except less scary headlines.

Thailand to buy oil with rice. My Spin: Breaking down trading to a barter system is not good sign. Maybe the USA can export SUV's, and McMansions for oil.....

Britain may need ZERO percent interest rate to spurn growth. My Spin: Like an older brother (like Fredo) Britain is probably doing what it's told to give Bernanke room to not seem crazy when he does it first. FREE money does not SOLVE ANYTHING. It will hurt! Hence my Gold miner play. Money will have a COST, either by interest rates or devaluation!

Goldman Sachs sought Citibank to take GS over, but was rebuked. My Spin: This stock is screaming short me. Why else would GS want to be taken over?

AIG has about eight weeks of cash left. My Spin: AIG goes down, we will see new DOW lows immediately.

Japan's stock market hits 26 YEAR low! My Spin: For all readers who believe "buy and hold" is the way to a secure retirement, Japan is an example of being prepared to hold for 40 years to eek out some sort of profit, and 26 years to break even (discounting inflation)

NYTimes has an interesting article on how the government plans to encourage banks to use Government money to finance mergers. My Spin: I thought one of the problems was institutions where "too big to fail". Isn't this going to fuel this problem? And I thought Republicans where against Corporate Welfare and Government meddling in business. This administration is taking this to a level that was un-imaginable 2 months ago.

My Closing Spin: We either have seen a near term bottom or we are going to crash from here. But then again, I keep thinking that for the last week. Eventually I'll be right one way or the other. :)

(image source)

Sunday, October 26, 2008

Preserving Wealth

The name of the game has shifted from profiting from change (Bull or Bear market) to preserving wealth. With the chaos the world is seeing in the financial markets, its hard, if not impossible to know what is the safest thing to preserve wealth.

Buy gold? Well, gold in itself is a play, as gold bugs have found out as gold plummeted from 1,000 an once down to 690 an once this past week. And it could go down to 400 an ounce, but I think this is unlikely, but possible.

Buy US bonds? I have emailed, blogged, and discussed US Treasuries are safest parking spot for wealth. The interest rate doesn't mater, the name of the game is to NOT lose money. However at some point, next week, next month, 2 years from now, Interest rates will rise, and I believe rather sharply. If your in a 1 year bond at 1% return, if interest rates skyrocket you will be losing wealth by not keeping up with inflation and interest rates. Worse yet, if the US Dollar collapses, your wealth relative to the world will be greatly diminished.

US Bonds at interest rates of 1% are an excellent "parking spot" for wealth, but not for preservation.

Buy Stock? As I have blogged, I don't believe the US is out of this downturn, not by a long shot. Housing has not yet stabilized, every business sector, not just financial are looking for hand outs from the government. Car Manufacturers, Insurance Companies, Banks, general companies like GE, and a long line of additional companies are going bankrupt, cutting forecasts, cutting dividends, etc. The market will go up, the market will go down, but the TREND is what you want to be on the side of, and trend is still DOWN. See entry on when to buy US stocks.

Buy commodities? Oil, Steel, corn, etc where stellar plays in the summer as everything shot to the moon. All have since collapsed. Commodity prices are driven by a wide variety of factors, but the largest one is demand. As the world economy cools, demand for resources turns down. At some point, Commodities will be the play for the next decade as China, India, and the world population wants what Europe and America have. That will need ALOT of resources. But for next month to year, it doesn't currently look like a growth area.

Buy Real estate? The US Market (if not world) has seen the greatest bubble in real estate in the last 6 years ever, and therefore the greatest downturn is now occurring. How quick and deep this falls is unknown, especially with the government working with companies to slow the decent. Unless you can buy a house at 1/4th the list price, its difficult to recommend trying to buy into the collapse. Check out Sherrif Sales. A possible good investment is buying a 500K house in the Bahamas and gain citizenship, but that's a different play. :)

Safest play is still Cash (US Bonds). I don't recommend shifting out. But I DO recommend starting to diversify out of bonds. If the dollar does tank, or interest rates skyrocket, it will be difficult to act. I have had it happen to me a dozen times in the last two years. When things shift quickly, you become a deer in headlights trying to decide what to do.

By scaling in now, (say 5-10%) you will be better prepared to move quickly if the time comes.

The one play I like is buying GOLD MINERS, notice not gold directly? I have no clue if the near term (next 6 month) bottom for gold is 690, 600, 550, or 400. If gold ever breaks below 400, or OIL below 40 bucks a barrel, either is probably best to go 100% into for the foreseeable future.

But I digress, GOLD as a commodity is high risk = high reward. It's not for the faint of heart.

Stocks are pummeled in the USA, including Gold Miners. If the stock market does rally, the Gold miners will rally. If Gold rallies, the miners will rally. If the USD collapses, gold and implies miners will rally.

Also the price for gold miners as compared to gold is completely out of wack. Gold miners have been CRUSHED in this last dowturn. Why? Gold and stocks declined at the same time. That isn't typical. And not-typical brings opportunity.

Also in the last great depression gold miners did fantastic. (quotes around 500% return) Doesn't mean this will repeat, it was during those circumstances not current, but still nice to know.

To me, Gold Miners is a way to capture market rally, gold rally, USD Collapse, World panic (if Russia and other countries default), while taking less risk (and less gain) than buying gold (GLD) on the stock market. Some Gold Miners to look at as individual stocks:

AAUK, ABX, AUY, FCX, GG, GSS, HMY, IAG, NAK, NEM, PAAS, RGLD

Below is a graph of the gold miner index GDX, on Friday it hit 15.80 as a low. Assuming (and it may never) hit 15 bucks a share, whats the risk? The GDX could go to 10, maybe 7.50, but I can't see how it can go less than that. Afterall, they mine gold! Whats the upside? Easily could go to 50, if not much much higher.

UPDATE: As of 1/2/09, GDX hit $34 dollars a share, a clean double from this posting on 10/26/08 when GDX was $17

Buy gold? Well, gold in itself is a play, as gold bugs have found out as gold plummeted from 1,000 an once down to 690 an once this past week. And it could go down to 400 an ounce, but I think this is unlikely, but possible.

Buy US bonds? I have emailed, blogged, and discussed US Treasuries are safest parking spot for wealth. The interest rate doesn't mater, the name of the game is to NOT lose money. However at some point, next week, next month, 2 years from now, Interest rates will rise, and I believe rather sharply. If your in a 1 year bond at 1% return, if interest rates skyrocket you will be losing wealth by not keeping up with inflation and interest rates. Worse yet, if the US Dollar collapses, your wealth relative to the world will be greatly diminished.

US Bonds at interest rates of 1% are an excellent "parking spot" for wealth, but not for preservation.

Buy Stock? As I have blogged, I don't believe the US is out of this downturn, not by a long shot. Housing has not yet stabilized, every business sector, not just financial are looking for hand outs from the government. Car Manufacturers, Insurance Companies, Banks, general companies like GE, and a long line of additional companies are going bankrupt, cutting forecasts, cutting dividends, etc. The market will go up, the market will go down, but the TREND is what you want to be on the side of, and trend is still DOWN. See entry on when to buy US stocks.

Buy commodities? Oil, Steel, corn, etc where stellar plays in the summer as everything shot to the moon. All have since collapsed. Commodity prices are driven by a wide variety of factors, but the largest one is demand. As the world economy cools, demand for resources turns down. At some point, Commodities will be the play for the next decade as China, India, and the world population wants what Europe and America have. That will need ALOT of resources. But for next month to year, it doesn't currently look like a growth area.

Buy Real estate? The US Market (if not world) has seen the greatest bubble in real estate in the last 6 years ever, and therefore the greatest downturn is now occurring. How quick and deep this falls is unknown, especially with the government working with companies to slow the decent. Unless you can buy a house at 1/4th the list price, its difficult to recommend trying to buy into the collapse. Check out Sherrif Sales. A possible good investment is buying a 500K house in the Bahamas and gain citizenship, but that's a different play. :)

Safest play is still Cash (US Bonds). I don't recommend shifting out. But I DO recommend starting to diversify out of bonds. If the dollar does tank, or interest rates skyrocket, it will be difficult to act. I have had it happen to me a dozen times in the last two years. When things shift quickly, you become a deer in headlights trying to decide what to do.

By scaling in now, (say 5-10%) you will be better prepared to move quickly if the time comes.

The one play I like is buying GOLD MINERS, notice not gold directly? I have no clue if the near term (next 6 month) bottom for gold is 690, 600, 550, or 400. If gold ever breaks below 400, or OIL below 40 bucks a barrel, either is probably best to go 100% into for the foreseeable future.

But I digress, GOLD as a commodity is high risk = high reward. It's not for the faint of heart.

Stocks are pummeled in the USA, including Gold Miners. If the stock market does rally, the Gold miners will rally. If Gold rallies, the miners will rally. If the USD collapses, gold and implies miners will rally.

Also the price for gold miners as compared to gold is completely out of wack. Gold miners have been CRUSHED in this last dowturn. Why? Gold and stocks declined at the same time. That isn't typical. And not-typical brings opportunity.

Also in the last great depression gold miners did fantastic. (quotes around 500% return) Doesn't mean this will repeat, it was during those circumstances not current, but still nice to know.

To me, Gold Miners is a way to capture market rally, gold rally, USD Collapse, World panic (if Russia and other countries default), while taking less risk (and less gain) than buying gold (GLD) on the stock market. Some Gold Miners to look at as individual stocks:

AAUK, ABX, AUY, FCX, GG, GSS, HMY, IAG, NAK, NEM, PAAS, RGLD

Below is a graph of the gold miner index GDX, on Friday it hit 15.80 as a low. Assuming (and it may never) hit 15 bucks a share, whats the risk? The GDX could go to 10, maybe 7.50, but I can't see how it can go less than that. Afterall, they mine gold! Whats the upside? Easily could go to 50, if not much much higher.

UPDATE: As of 1/2/09, GDX hit $34 dollars a share, a clean double from this posting on 10/26/08 when GDX was $17

China positioning to take out Americas Dominance

The USA has lost it's credibility as a world leader on almost every front in the last 8 years.

Make no mistake, I am not a "fan" of China. However China has masterfully played its hand in the last 20 years while America has given everything to China without demanding same business rights as they have to America. China has no debt, 1.3 Billion people with an economy growing at 10% (this is their current recession rate), and obviously world military leader.

Make no mistake, I am not a "fan" of China. However China has masterfully played its hand in the last 20 years while America has given everything to China without demanding same business rights as they have to America. China has no debt, 1.3 Billion people with an economy growing at 10% (this is their current recession rate), and obviously world military leader.

For obvious reasons, I don't believe the world is looking for China to take center stage to dictate the political tone for the next 100 years. However, the world may have no choice.

China has a closed system, not allowing trading in their currency, allowing no one to buy into their stock markets, real estate, and therefore operate without direct global financial influence.

China, could at any time, change this. They could open their currency and markets to world investments. If this was to occur, the world may decide its safer to "store" its wealth in China over the USA, which would immediately collapse the USD and Bonds.

I am NOT predicting this occurs. This however clearly illustrates that the USA as a debtor nation is very weak, prime for its competitors (or enemies) to take it out without a bullet shot. DEBT IS NOT GOOD, as some have suggested over the last 30 years.

Between the USA's own resistance to providing transparency, allowing private busiensses to recognize financial losses, socializing every business in sight, other countries failing, there is one country with world clout that no one is questioning their strength, China.

America has completely failed at leading through this trying time. This story has not yet fully unfolded. When it has, the 9/11 transformation will pale in comparison to the new world view.

China's banks are now calling for the USA to be dethroned from its position as world currency. China will never let up and will continually attack the US as world leader undermining its actions until it gets what it wants.

I hope I am a complete lunatic on this topic and 100% wrong on this topic. I want the USA to stand center stage for the world for the next 100 years. However, I don't see the actions earning the right to keep the responsibility and center is currently holds. Maybe the next decade the new leadership will rise to the occasion to change the course of America. I can hope, but will prepare for the alternative.

UPDATES on news items for this topic I'll add below

10/27/08 - Case for Chinese Yuan to be world currency

As world protector and military leader, its action on preemptive strike changed the US as world protector to world bully. The good will from US attack on 9/11/01 was spent rather quickly on the Iraq War.

- The USA lost its position as world change leader on environment reform, social reform, human rights, education, and other social issues America regressed on all fronts.

- As world financial leader clearly America lead the way for the world into this situation. The World however, is 100% to blame for following our lead rather than questioning the soundness of "new financial instruments". Its easy to blame the US, but apparently much harder for the world to take responsibility for their own actions.

- The US Debt machine is out of control. The US hasn't had ANY fiscal restraint since 2000, and in last few months, easily doubled direct and indirect debt obligations with across the board the government taking on risk. In time of panic, this is viewed as leading and innovating, once the dust settles a more critical eye will be cast onto the US.

- The US dollar in the last 8 years had taken an enormous hit, up until a month ago. In the last month the US dollar is rallying at a parabolic rate. Once this fever is broken, it may be the last hurrah's for the US dollar. The US dollar, until last year or so, has been the standard for trading Oil, Banking, and all aspects of Finance. This has translated that the world has had to "deal" with the dollars weakness on a daily basis for years.

Make no mistake, I am not a "fan" of China. However China has masterfully played its hand in the last 20 years while America has given everything to China without demanding same business rights as they have to America. China has no debt, 1.3 Billion people with an economy growing at 10% (this is their current recession rate), and obviously world military leader.

Make no mistake, I am not a "fan" of China. However China has masterfully played its hand in the last 20 years while America has given everything to China without demanding same business rights as they have to America. China has no debt, 1.3 Billion people with an economy growing at 10% (this is their current recession rate), and obviously world military leader.For obvious reasons, I don't believe the world is looking for China to take center stage to dictate the political tone for the next 100 years. However, the world may have no choice.

China has a closed system, not allowing trading in their currency, allowing no one to buy into their stock markets, real estate, and therefore operate without direct global financial influence.

China, could at any time, change this. They could open their currency and markets to world investments. If this was to occur, the world may decide its safer to "store" its wealth in China over the USA, which would immediately collapse the USD and Bonds.

I am NOT predicting this occurs. This however clearly illustrates that the USA as a debtor nation is very weak, prime for its competitors (or enemies) to take it out without a bullet shot. DEBT IS NOT GOOD, as some have suggested over the last 30 years.

Between the USA's own resistance to providing transparency, allowing private busiensses to recognize financial losses, socializing every business in sight, other countries failing, there is one country with world clout that no one is questioning their strength, China.

America has completely failed at leading through this trying time. This story has not yet fully unfolded. When it has, the 9/11 transformation will pale in comparison to the new world view.

China's banks are now calling for the USA to be dethroned from its position as world currency. China will never let up and will continually attack the US as world leader undermining its actions until it gets what it wants.

I hope I am a complete lunatic on this topic and 100% wrong on this topic. I want the USA to stand center stage for the world for the next 100 years. However, I don't see the actions earning the right to keep the responsibility and center is currently holds. Maybe the next decade the new leadership will rise to the occasion to change the course of America. I can hope, but will prepare for the alternative.

UPDATES on news items for this topic I'll add below

10/27/08 - Case for Chinese Yuan to be world currency

Saturday, October 25, 2008

Where the Market Stands

This past week, I was "concerned" of a market collapse may occur.

This past week, I was "concerned" of a market collapse may occur.The market went down, but it didn't "collapse".

Unfortunately, without a panic-moment, I have little faith the market has reached a near-term bottom. Some people are calling the S&P500 low 839 from October 10th to be the near-term bottom, probably through 2008.

I have a hard time agreeing, if Friday has opened down big, and tested S&P 840 or 790 levels, and bounced, I would feel more comfortable the USA had a local bottom formed. On Friday before the open, CNBC and other media outlets hyped that Friday was looking extremely bad. I fell for it in my blog entry. But the "good news" is the market panic did not occur, The market did "rally" (if you can call it that) from down 852 to 896, ending up S&P down -32 for the day.

Negatives on US Market has hit a near-term bottom

1) It does not line up with previous support levels in 2002-2003 of 790-760 range.(see blog entry longer term view)

1) It does not line up with previous support levels in 2002-2003 of 790-760 range.(see blog entry longer term view)2) The market panic (fever) doesn't seem to be broken, just subsided, but it seems ready to flare up.

3) The USA and the world continue to have a never-ending stream of bad news from all corners of business and governments. Russia possibly defaulting cannot be good for the market, except the USA looks "stronger" vs the world. (for the moment)

4) Mike Morgan, (and legions of others) a blogger is calling for market collapse shortly, based upon his viewpoint inside the world financial market.

On the "plus" side, in favor of market bottom.

1) The markets outside the USA had a terrible Thursday night, and the US markets did not panic sell on Friday.

1) The markets outside the USA had a terrible Thursday night, and the US markets did not panic sell on Friday.2) The markets did go down to 852, somewhat close to recent 839 bottom, suggesting some support growing.

3) The US dollar is extremely strong vs Euro, parabolic even. Notice in the last 10 years, the USD has never risen or fallen as such a steep rate. When the USD rally slows, stops, or reverses the US Stock market should see a rally. Parabolic runs cant last forever. I expect resistance around 0.8 - 0.85 vs Euro.

4) The market is acting numb to the stream of bad news and not panicking, it seems that everyone is starting to realize the severity of the situation. Panic seems to be subsiding into acceptance.

My viewpoint of the US collapsing for the last two years was much easier to trade the market than currently. I do not believe the USA has even come remotely close to a bottom. This won't happen until 2009-2010. But for the near-term, now through 2009 is my main focus, and the US Market could still plunge to 2002-2003 lows before finding a bottom. And it wouldn't surprise me if the US Bond market has a dislocation that we blow right through 2002-2003 lows to back to 1996 levels. However I find this scenario much less likely.

In any event, I'll blog more why I am liking gold miners as a positive play and why I have almost no shorts after shorting the market for 2+ years.

Friday, October 24, 2008

Market Collapse may have arrived

I wake up to news machine (CNBC) ranting market may collapse,, hyping up, etc.

I wake up to news machine (CNBC) ranting market may collapse,, hyping up, etc.Boy I better be careful what I put in my blog.....

UPDATE: 10 am, no crash, that's what I get for listening to mainstream media. Day's not over could end lower last hour or so.

Please remember, if you buy or sell anything today, its "panic day" so be careful.

Also the market could get shut down, resulting in whatever you do being "stuck" there until Monday.

In any event, if the market collapses, the GDX play (possibly at 15 bucks now!) is a opportunity of a lifetime for the next 6 months to a year.

Good luck!

NEWS:

Russia may default

Futures "circuit breakers" blew, meaning the futures where down so much, they where shut down

South Korea Stock market halted after down 10%

VOLVO Net intake into Europe sales 115 compared to 41,970 a year ago

We are EXACTLY 79 years from the date of the 1929 market crash (not really news, but may help panic)

NOTE: SEE previous post Dangerous times for next support level

(image source)

More bad news blah blah blah

I have plenty of good news in my personal life, but all around elsewhere its blah blah blah. I'm tired of reading doom and gloom. I am at the point I want the market to crash just so we can change the topic. Here is my roundup of earth moving developments....

I have plenty of good news in my personal life, but all around elsewhere its blah blah blah. I'm tired of reading doom and gloom. I am at the point I want the market to crash just so we can change the topic. Here is my roundup of earth moving developments....GE going to fed to borrow money

There has been a conga line of banks and some insurance companies going to the fed to secure loans to prop up their business during the fiscal crunch they are experiencing.

But GE, a company regarded as "Secure" by most, must go to the FED to get a loan. One can assume they needed cash, and could not secure it elsewhere.

In other news, hot dog stands across the country go to the Fed discount window to bridge their financial gap.......

AIG says "90 billion" in loans is not enough. Nore is 122 billion. My spin, lets get it over with and give them 400 billion, why nickel and dime AIG? To make Fed lending more efficient, the fed should issue special fax machines to fax billion dollar notes on-demand.

GM suspends payments to 401K accounts. Wow, think about that, GM is so strapped for cash, it can't do 401K matching for the remaining employees. And to boot, they expect to cut workforce by 15% in 2009. My Spin: GM should ask car purchasers with a check box on the car form to donate 5 bucks to help GM employees soon to be layed off with their 401K fund.......

Wall Street to layoff 200,000 workers by the end of 2008. My Spin: In other news, Presidents and Vice Presidents on the same wallstreet firms get a bonus $100,000 per head laid off as cost savings in their annual bonus......and 10M bonus to those who volunteer to retire early.

Initial jobless claims rose to over 478,000. My Spin: Someone needs to improve their counting method, this published number is a joke.

US Treasuries seems to have a rampant occurrence where the bond is not delivered, resulting where people may have money listed as in Treasuries, but it's not backed by actual Treasury notes! Well, as people who have lives, this is getting ridiculous, who has the time and the will to double check if their brokerage/bank/investment company secured the funds with actual treasury notes?

US foreclosures up 71% in Q3. My spin: Lets all be thankful its not 80%, because that would be much worse!

I am loving every day that GDX goes down as a better buy. GDX is an index fund of gold miners. If it hits 15 bucks, its a steal. I'll try to blog this weekend why I am turning into a gold bug. See my previous post.

Ready to go into a cave and wait this out, be prepared and buy some food here.

(image source)

Thursday, October 23, 2008

Dangerous Times

Once again, the stock market is on the verge of collapse. If it does collapse, the DOW could go to 4,000. The US government and the world have performed many "stick saves". Each time the market reacts for less time before down turning once again.

If the stock market opens down Thursday AM, this may be the next major leg down.

Its hard to say where the bottom is, but I believe the bottom will be in 2009, DOW 4,000 - 5,800 range. In the near term a "collapse" maybe DOW 7,000-7,400 and able to find a local bottom.

Unfortunately, if I am correct, DOW 5,800 is 1996 levels is really like 1980s levels once you take into account inflation. The "buy and hold" for the long term mentality of America may finally become broken next year, if holding 20+ years is not "long enough" to make a decent buck.

Unfortunately, if I am correct, DOW 5,800 is 1996 levels is really like 1980s levels once you take into account inflation. The "buy and hold" for the long term mentality of America may finally become broken next year, if holding 20+ years is not "long enough" to make a decent buck.

I may have been early with the gold miner post yesterday. Buying ANY Stock, including "gold miners" will not be good in a deflationary collapse. Cash will be king. I'll keep you posted as best as I can as this unfolds.

UPDATE 8:30 am.

Multiple "stick saves" out today, everyone wants to pitch in.

Federal Reserve - Bernanke says he sees "new ways" to ease credit

Senate - Senators seek guidelines to ensure banks boost lending

President - Bush administration floating plan to help directly borrowers

Former Fed Res - Greenspan states tighter regulation needed

Hopefully the USA can staff off a collapse......... until next year.

There is a slew of bad news daily, at this point its almost mute to post. If you want to see bad news real time daily, click here for high level list.

UPDATE 12:50 PM

Mish has a great article articulating the "crash count" of the stock market, and compares it to the Japanese stock market.

If the stock market opens down Thursday AM, this may be the next major leg down.

Its hard to say where the bottom is, but I believe the bottom will be in 2009, DOW 4,000 - 5,800 range. In the near term a "collapse" maybe DOW 7,000-7,400 and able to find a local bottom.

Unfortunately, if I am correct, DOW 5,800 is 1996 levels is really like 1980s levels once you take into account inflation. The "buy and hold" for the long term mentality of America may finally become broken next year, if holding 20+ years is not "long enough" to make a decent buck.

Unfortunately, if I am correct, DOW 5,800 is 1996 levels is really like 1980s levels once you take into account inflation. The "buy and hold" for the long term mentality of America may finally become broken next year, if holding 20+ years is not "long enough" to make a decent buck.I may have been early with the gold miner post yesterday. Buying ANY Stock, including "gold miners" will not be good in a deflationary collapse. Cash will be king. I'll keep you posted as best as I can as this unfolds.

UPDATE 8:30 am.

Multiple "stick saves" out today, everyone wants to pitch in.

Federal Reserve - Bernanke says he sees "new ways" to ease credit

Senate - Senators seek guidelines to ensure banks boost lending

President - Bush administration floating plan to help directly borrowers

Former Fed Res - Greenspan states tighter regulation needed

Hopefully the USA can staff off a collapse......... until next year.

There is a slew of bad news daily, at this point its almost mute to post. If you want to see bad news real time daily, click here for high level list.

UPDATE 12:50 PM

Mish has a great article articulating the "crash count" of the stock market, and compares it to the Japanese stock market.

Wednesday, October 22, 2008

Stock to buy

UPDATE: FIRST READ DANGEROUS TIMES POST

UPDATE: FIRST READ DANGEROUS TIMES POSTI try to avoid making any specific comments on stocks to buy or sell.

I did back in August, and if you followed the advice, PNC so far is about 15 bucks lower, BAC 12, and the other two about the same, USB, WFC.

So if you shorted 1,000 each, you are up 27K.

My next one is a bit riskier. The dollar has rallied hard in recent weeks. And a quick run usually means a down turn is around the corner. If the dollar goes down, gold/oil typically go up.

Instead of buying gold/oil, buy some beaten stocks based on gold or oil.

A friend told me, and I agreed with buying NAK at 2 bucks a share.

Read this article as to why.

Sell at 4 bucks to double your profits, or hold long term to hedge against a dollar fall.

If you don't like the risk NAK has, go with an index fund of gold miners, GDX. At 15 bucks, an absolute steal, at current price of 19.50, start buying.

NOTE: I am not a financial adviser, and as such, do your own research and I take zero responsibility for your actions. Be prepared to lose all money in a $2 stock.

(image source)

Bond Interest Rates

Bonds are bland, fixed income between 1% and 6%, low risk, low return, not news worthy. The bond market has almost no media coverage, its just not exciting. However, the bond market may be become the main event of the downturn.

Bonds are bland, fixed income between 1% and 6%, low risk, low return, not news worthy. The bond market has almost no media coverage, its just not exciting. However, the bond market may be become the main event of the downturn.The US and the world has seen a massive flight to safety as people dumped their stocks and ran to US Bonds for safety. Simultaneously the US government opened its coffers to everyone, which it could do without raising interest rates due to the massive purchase of US Treasuries.

As the world calms from the near term panic, people, companies, and countries may stop buying US Treasuries in droves. Since the USA has committed to guaranteeing everything in sight, plus 700 Billion in bailout cash, FDIC coverage, normal billions of dollars a day budget deficit spending, and other debt commitments made in recent months, the US government is going to need the world to continue to buy US Treasuries to finance this spending without raising rates.

What if there isn't enough buyers for the US Debt machine? Interest rates will rise to "attract" dollars (see inflation vs deflation). The more US Federal Bond interest rates rise, the more NEW fixed mortgages interest rates rise. New home buyers and resetting ARM mortgages will pay more interest. This will yield in home price's falling further.

NOTE: If the cages of fear keep rattling, this beast will remain in the shadows.

This sentiment can be found in an article in Money week, as well as my previous blog rantings here, here, and here.

(image source)

Tuesday, October 21, 2008

Inflation vs Deflation

Every day brings an onslaught of news, today is no different. However, most of the news isn't earth moving, so I decided to talk about inflation vs deflation. Why? Because what the USA is and will experience between the two choices affects where is best to invest. I'll give my high level spin, feel free to click on the two links above to get the full version from Wikipedia.

is best to invest. I'll give my high level spin, feel free to click on the two links above to get the full version from Wikipedia.

Inflation is where there is "too much money" chasing "too few goods". Think of an "over-heated economy" or a banana republic printing cash like a free photo copy machine. The value of the currency is "less" and therefore it takes "more currency" to purchase an item.

Currently the USA is experiencing for 2008 inflation rate of about 10-12%. That means if you did NOT get a 12% raise this year, in effect you have taken a pay-cut relative to your expenses. Further if your investments and assets did not grow by 12%, you are less rich.

Typically in an inflation environment, interest rates rise for debt, to compete with the inflation effect on currency. For those 40+ year olds, this would be best described as what was experienced in the USA during the 70's. Inflation generally speaking punishes those with cash or low interest rate bonds.

Deflation is where there is "not enough money" to go around, and goods/services prices drop "chasing" money. As an example, housing, retail goods, stocks, interest rates, and other prices drop trying to attract cash to the business. In the modern world, this is also typified by "credit collapse" where money is not created through lending. Money is horded, not spent. The Great Depression was a good example of a deflationary environment in the USA.

Deflation is where there is "not enough money" to go around, and goods/services prices drop "chasing" money. As an example, housing, retail goods, stocks, interest rates, and other prices drop trying to attract cash to the business. In the modern world, this is also typified by "credit collapse" where money is not created through lending. Money is horded, not spent. The Great Depression was a good example of a deflationary environment in the USA.

What the Federal government is trying to do is print/create money as quickly as possible over-power the forces of deflation. The problem is how can the government "inject" cash into private hands, and how can the government insist people lend to each other?

Deflation generally rewards those with cash, or low interest rate bonds. "Cash is King" at the depths of an deflation collapse, allowing the cash to buy goods on the cheap.

That is what we are facing today, we are in no doubt, a deflationary collapse. The bigger question is, how long will it stay deflationary, and will the unprecedented lending and printing of money by the government eventually result in inflation or hyper-inflation?

In my blogs, this is why I have stated the best place to be is in federal bonds, but be prepared to flip out into other investments. In an hyper-inflationary environment, buying gold, oil, and possibly stock is a way to preserve wealth as the USA dollar collapses in value.

My Spin: The USA stays deflationary into 2009, and if inflation does gain steam, it will be due to the over-reaction by the federal government flooding with free cash now. Or possibly mix of the two, higher interest rates for debt AND deflation. In any event if interest rates rise it will further cripple the real estate, states, federal government, companies, and the consumer as the USA debtor nation has to pay more for it's debt. The next president (Obama?) may take the blame for inflation due to that president's policies. But the reality will be the actions taken today seal the US fate next year.

(image source image source)

is best to invest. I'll give my high level spin, feel free to click on the two links above to get the full version from Wikipedia.

is best to invest. I'll give my high level spin, feel free to click on the two links above to get the full version from Wikipedia.Inflation is where there is "too much money" chasing "too few goods". Think of an "over-heated economy" or a banana republic printing cash like a free photo copy machine. The value of the currency is "less" and therefore it takes "more currency" to purchase an item.

Currently the USA is experiencing for 2008 inflation rate of about 10-12%. That means if you did NOT get a 12% raise this year, in effect you have taken a pay-cut relative to your expenses. Further if your investments and assets did not grow by 12%, you are less rich.

Typically in an inflation environment, interest rates rise for debt, to compete with the inflation effect on currency. For those 40+ year olds, this would be best described as what was experienced in the USA during the 70's. Inflation generally speaking punishes those with cash or low interest rate bonds.

Deflation is where there is "not enough money" to go around, and goods/services prices drop "chasing" money. As an example, housing, retail goods, stocks, interest rates, and other prices drop trying to attract cash to the business. In the modern world, this is also typified by "credit collapse" where money is not created through lending. Money is horded, not spent. The Great Depression was a good example of a deflationary environment in the USA.

Deflation is where there is "not enough money" to go around, and goods/services prices drop "chasing" money. As an example, housing, retail goods, stocks, interest rates, and other prices drop trying to attract cash to the business. In the modern world, this is also typified by "credit collapse" where money is not created through lending. Money is horded, not spent. The Great Depression was a good example of a deflationary environment in the USA.What the Federal government is trying to do is print/create money as quickly as possible over-power the forces of deflation. The problem is how can the government "inject" cash into private hands, and how can the government insist people lend to each other?

Deflation generally rewards those with cash, or low interest rate bonds. "Cash is King" at the depths of an deflation collapse, allowing the cash to buy goods on the cheap.

That is what we are facing today, we are in no doubt, a deflationary collapse. The bigger question is, how long will it stay deflationary, and will the unprecedented lending and printing of money by the government eventually result in inflation or hyper-inflation?

In my blogs, this is why I have stated the best place to be is in federal bonds, but be prepared to flip out into other investments. In an hyper-inflationary environment, buying gold, oil, and possibly stock is a way to preserve wealth as the USA dollar collapses in value.

My Spin: The USA stays deflationary into 2009, and if inflation does gain steam, it will be due to the over-reaction by the federal government flooding with free cash now. Or possibly mix of the two, higher interest rates for debt AND deflation. In any event if interest rates rise it will further cripple the real estate, states, federal government, companies, and the consumer as the USA debtor nation has to pay more for it's debt. The next president (Obama?) may take the blame for inflation due to that president's policies. But the reality will be the actions taken today seal the US fate next year.

(image source image source)

Monday, October 20, 2008

Credit Default Swaps

I have blogged quite a few times about need to create transparency in accounting to build trust. One area I haven't dived into is "Credit Default Swaps".

Lifted right from Wikipedia:

Credit Default Swaps (CDS) is a swap contract in which a buyer makes a series of payments to a seller and, in exchange, receives the right to a payoff if a credit instrument goes into default or on the occurrence of a specified credit event, for example bankruptcy or restructuring. The associated instrument does not need to be associated with the buyer or the seller of this contract.

Basically a bank, insurance company, mortgage dealer, or any other financial company pays a different company to "accept the risk" that if the underlying financial instrument fails, that "different company" makes good by paying off the default.

It is estimates that the CDS market for all liabilities is 55 TRILLION dollars. Read that again, it is more than all the countries GDP combined. The CDS market is UNREGULATED. Which means the SEC and for that matter, any government in the world, has almost no vision to the health or disaster the CDS market may be facing.

It is estimates that the CDS market for all liabilities is 55 TRILLION dollars. Read that again, it is more than all the countries GDP combined. The CDS market is UNREGULATED. Which means the SEC and for that matter, any government in the world, has almost no vision to the health or disaster the CDS market may be facing.

On Saturday, the SEC head calls for transparency in the "Credit Default" swap.

Normally I would applaud this as a step in the right direction, if it wasn't for one nasty problem, timing.

Why the heck would the SEC call for transparency NOW of all times?

My Spin: The SEC realizes that CDS is in trouble, and if it collapses, the SEC wants to be in a position to show they where trying to address it before it collapsed.

If the SEC really had an interest in transparency, the time to act was years ago. And once again, quote me on this, it will become transparent only AFTER the CDS market collapses. To bolster this line of thought, a US Treasury Official stated the US Situation is quite grim, hoping to rebound in 2010. (notice not 2008/2009)

So I'll add to my diatribe about transparency for accounting & MBS by adding CDS market needs to be transparent.

Lifted right from Wikipedia:

Credit Default Swaps (CDS) is a swap contract in which a buyer makes a series of payments to a seller and, in exchange, receives the right to a payoff if a credit instrument goes into default or on the occurrence of a specified credit event, for example bankruptcy or restructuring. The associated instrument does not need to be associated with the buyer or the seller of this contract.

Basically a bank, insurance company, mortgage dealer, or any other financial company pays a different company to "accept the risk" that if the underlying financial instrument fails, that "different company" makes good by paying off the default.

It is estimates that the CDS market for all liabilities is 55 TRILLION dollars. Read that again, it is more than all the countries GDP combined. The CDS market is UNREGULATED. Which means the SEC and for that matter, any government in the world, has almost no vision to the health or disaster the CDS market may be facing.

It is estimates that the CDS market for all liabilities is 55 TRILLION dollars. Read that again, it is more than all the countries GDP combined. The CDS market is UNREGULATED. Which means the SEC and for that matter, any government in the world, has almost no vision to the health or disaster the CDS market may be facing.On Saturday, the SEC head calls for transparency in the "Credit Default" swap.

Normally I would applaud this as a step in the right direction, if it wasn't for one nasty problem, timing.

Why the heck would the SEC call for transparency NOW of all times?

My Spin: The SEC realizes that CDS is in trouble, and if it collapses, the SEC wants to be in a position to show they where trying to address it before it collapsed.

If the SEC really had an interest in transparency, the time to act was years ago. And once again, quote me on this, it will become transparent only AFTER the CDS market collapses. To bolster this line of thought, a US Treasury Official stated the US Situation is quite grim, hoping to rebound in 2010. (notice not 2008/2009)

So I'll add to my diatribe about transparency for accounting & MBS by adding CDS market needs to be transparent.

Sunday, October 19, 2008

American Fiscal Diet

EXCELLENT article by Mish on what Americans (and many other countries) must do.

EXCELLENT article by Mish on what Americans (and many other countries) must do.Go on a fiscal diet after gorging for years.

http://globaleconomicanalysis.blogspot.com/2008/10/age-of-frugality.html

The longer term view for Markets

Several bloggers I read have been coming together eerily to be calling for the same result.

The inflationary and deflationary bloggers now BOTH say Deflation has "won" for now, and has taken grip on the USA (and probably world).

Deflation basically means cash will be king, and prices will come down. Houses, Stock market, just about everything.

Many of the bloggers look at stock market charts and use various theories for stock market charting. I am not a chartist believer, but do respect the practice, since hoards of chartists can together make theory into reality. Basically if 100,000 chartists specialists in corporations, banks, and professional investors "see" the same pattern, use the same theories, to come to same conclusions, they will act in unison without confirming with each other. This could then become self-fulfilling prophecy.

In any event, the chartists are saying a few things in unison now.

1) We may see the start of a major dislocation in the market this week, most calling to be Wednesday or later.

1) We may see the start of a major dislocation in the market this week, most calling to be Wednesday or later.

2) The next leg down will be ..... disturbing? Bringing the market back to 2003 lows. That will be a moment of truth, if we hold we rally for a few weeks/months, possibly into next year.

3) If the 2003 lows don't hold, the charts think we WILL hold 1997 support levels, then rebound, fiercely for months into next year.

4) After the next rally, probably 2009, final collapse back to 1995 levels.

All of these scenarios are not good. We are talking decimation of 401K, pension plans, not good things.

I for one, will try to "profit" from this. My best scenario is I am 100% wrong, bottom is in, and I lose my shirt. Really, that's what I hope happens. But I believe that the chartists are correct, the USA is targeting wiping out over 13 years of gains. And that DOESN'T take into consideration inflation, which if adjusted for, could make it much much worse of a decline in real value.

What to do? Sit tight, STAY OUT of the market, stay in bonds.

The inflationary and deflationary bloggers now BOTH say Deflation has "won" for now, and has taken grip on the USA (and probably world).

Deflation basically means cash will be king, and prices will come down. Houses, Stock market, just about everything.

Many of the bloggers look at stock market charts and use various theories for stock market charting. I am not a chartist believer, but do respect the practice, since hoards of chartists can together make theory into reality. Basically if 100,000 chartists specialists in corporations, banks, and professional investors "see" the same pattern, use the same theories, to come to same conclusions, they will act in unison without confirming with each other. This could then become self-fulfilling prophecy.

In any event, the chartists are saying a few things in unison now.

1) We may see the start of a major dislocation in the market this week, most calling to be Wednesday or later.

1) We may see the start of a major dislocation in the market this week, most calling to be Wednesday or later.2) The next leg down will be ..... disturbing? Bringing the market back to 2003 lows. That will be a moment of truth, if we hold we rally for a few weeks/months, possibly into next year.

3) If the 2003 lows don't hold, the charts think we WILL hold 1997 support levels, then rebound, fiercely for months into next year.

4) After the next rally, probably 2009, final collapse back to 1995 levels.

All of these scenarios are not good. We are talking decimation of 401K, pension plans, not good things.

I for one, will try to "profit" from this. My best scenario is I am 100% wrong, bottom is in, and I lose my shirt. Really, that's what I hope happens. But I believe that the chartists are correct, the USA is targeting wiping out over 13 years of gains. And that DOESN'T take into consideration inflation, which if adjusted for, could make it much much worse of a decline in real value.

What to do? Sit tight, STAY OUT of the market, stay in bonds.

Friday, October 17, 2008

Main Street

First, the financial issues America is facing was "contained" to sub-prime, then just one or two financial companies, then just wall street, now affecting only the world financial markets.

First, the financial issues America is facing was "contained" to sub-prime, then just one or two financial companies, then just wall street, now affecting only the world financial markets.The actions being taken have been spun to protect "Main Street".

Main Street is being affected, but I still contend that Wall Street reflects the health of Main Street, not the other way around. As shown by the picture main street is starting to really feel the pinch, a long line for low paying 80 jobs. Further, U.S. Retail Sales Slump 1.2%, Most in Three Years and U.S. Industrial Production Fell 2.8%, Most Since 1974.

Expect further declines as consumer sentiment in USA, Canada, India, and others hit decade lows.

All of the actions taken to "protect" main street will actually cripple main street for the decade(s) to come. How? With higher taxes, higher interest rates, and eventually (6 months to 2 years from now) hyperinflation. Main street is already being crippled by seeing Mortgage Rates Post Biggest Increase in 21 Years.

Layoffs and businesses continue to close, Linens and Things going out of business and GM to lay off 1,500 workers in Michigan & Delaware.

The Federal government is spending money at a break-neck speed. The Federal government is backing most risk, including Commercial Paper Subsidies.

With all this spending, we may eventually see the Federal government be downgraded from AAA to lower. States are already being downgraded as Rhode Island's GOs to 'AA-' to Outlook Stable, which results in Rhode Island paying higher interest on all it's debt, further restricting that states actions.

The BEST action to protect main street isn't to "back" all debt, but to keep the US government strong by not compromising it with unprecedented debt. Further, the reckless actions of the government printing money will eventually yield adverse effects, such as interest rates rising, further hurting main street. There will be a time that the US government will truly need to spend billions if not trillions of dollars to help the country, but I fear when that time comes, the ammunition will have been spent.

This is not to say we won't see a stock market spike higher, nothing moves in a straight line. But all of the action being taken still doesn't address TRUST. I still can't see how the government can spawn co-operation and expansion without it.

Thursday, October 16, 2008

TRUST is THE issue

I wanted to take the time to focus on what I believe is the root cause of all the turmoil in the Financial Industry, which is now adversely affecting all other business areas.

I wanted to take the time to focus on what I believe is the root cause of all the turmoil in the Financial Industry, which is now adversely affecting all other business areas.It comes down to TWO things.

1) Re-assessing "assets" to their correct valuation (Mortgage Backed Securities)

2) TRUST that the business(es) you lend or do business with have the correct risk assessment, by providing financial transparency.

Re-assessing "assets" (Mark to Market)

Item 1 is what has been described as "mortgage backed securities". The media spin has been because of falling housing prices and failures (defaults) on payments, these "mortgage backed securities" are causing problems in the financial world.

If you have taken history lessons, or are over the age of 30, you have knowledge that everything in life ebbs and flows. Housing since the dawn of time have risen and fallen in price, depending on supply and demand. So this "blame" on housing prices falling is NOT THE PROBLEM. The problem is the "mortgage backed securities" where created using FICTITIOUS math to value the securities with unrealistic assumptions. The securities should have been auto-correcting, like your own house, allowing them to be revalued as required. Since they are not revalued automatically, using "mark to market" accounting, these assets are over-inflated in valuation.

When they do go to sale, they are marked lower than values expected, since the whole scheme has no transparency. Buyers will only risk purchasing them with "plenty of cushion" for valuations lower. For a more detailed dissection of these securities, click here.

TRUST

Trust is THE problem. Not Liquidity, Not mortgage foreclosures, not insolvency, not any mis-direction the media is spinning. It comes down to TRUST.

There is trillions upon trillions of dollars around the world ready to be "lent", create new businesses, or buy stock. At the heart of the issue is, who is it SAFE to do business with? Bear Sterns, Lehman Brothers, AIG, Indy Mac, Freddie Mae, Freddie Mac, Countrywide, and multitude of other businesses gave little warning of failure. Within days or couple of months all of these businesses went from "A great business" to bankrupt or crippled. Why?

Because the internationally accepted rules of accounting and failing to mark to market "assets" are not being performed.

Instead, the industry and USA government sponsor "delaying" mark to market, or correcting the accounting rules.

Failure to fix USA corporations and create transparency IS the ROOT cause of the death spiral the USA is experiencing. Yes, mortgage failures may have been the trigger, but only because the "assets" these represent in businesses are not transparent.

Above all the buzz, all the trillions of dollars, all the political posturing, Trust is the heart of the issue. Until it is addressed, the world will continue to collapse. And at the bottom of the collapse, mark my words, only then will the laws change, and trust will be fixed and restored. Why wait? So the corporations that used these FRAUDULENT securities can get the bad assets paid by the USA taxpayer or foreign investors and avoid bankruptcy.

And today, the SEC authorized banks to DELAY marking to market their assets. The USA government is the ROOT CAUSE of this issue. If the government had any type of leadership, it would force the transparency and let the insolvent businesses fail. This would allow the rest of the companies to pick of the pieces and move on.

UPDATES:

1) See Credit Default Swap Post

2) Well known economist and Clinton adviser Robert Reich agrees TRUST is the issue (after my blog entry of course)

Wednesday, October 15, 2008

Alter the report card, forget about the student

From my perspective, the financial markets are "report cards" and the business's performance is equivalent to the "student performance". In the USA education system, people have focused on the "report card" losing sight that the important thing is the child learning, not that he or she got a A,B, or C on the report card. The report card is suppose to be an indicator, an ALERT if you will to push the student harder or give kudos to a job well done. The student will be better off for the rest of his or her life from what is learned, not the grade.

From my perspective, the financial markets are "report cards" and the business's performance is equivalent to the "student performance". In the USA education system, people have focused on the "report card" losing sight that the important thing is the child learning, not that he or she got a A,B, or C on the report card. The report card is suppose to be an indicator, an ALERT if you will to push the student harder or give kudos to a job well done. The student will be better off for the rest of his or her life from what is learned, not the grade.The Financial Markets parallel what has happened to school focus. No longer is the question about how healthy the economy is, or if the corporations are worthy of solvency. The question is how can we fix the "report card"?

In the school analogy, you can cheat, bribe, or fraudulently alter the report card, but the underlying reality of the education the student receives will eventually be revealed.

We have now entered into the USA the surreal, complete and utter vision lost of the concept that the Financial Markets Valuation is not the root of the problem, the corporations (students) are.

In the latest changes being instituted, 250 BILLION dollars using taxpayer cash will be used to BUY preferred stock. Notice, not to buy the bad debt, or spend it to clean up the corporations. But to give a golden parachute to those who own preferred stock in banks.

What does this FIX? Does it help the "people losing their homes"? Does this action fix the TRUST in banks to lend? Ensure as ARMs are rolled over, that home owners can afford the new rate?

It FIXES one thing, the Report "card" or grade the company has by inflating the stock prices. What happens once this phase passes? We will learn of course the company (student) is still in bad shape.

Next up, the FDIC to cover 1.4 TRILLION dollars in unsecured debt. So corporations did not take proper steps to "Secure" their debt, through proper insurance or lending practices, and now the taxpayer is responsible for this debt? Why not force banks to SECURE the debt? Attention Banks! Stop attempting to do anything responsible, the governments got your back!

So what does the US deficit look for 2008? How about 455 billion dollars! And for 2009 looking like 700 Billion! Last year's debt was 176 Billion, to put into perspective.

NOTE: These numbers do NOT take into account the trillions and trillions of dollars the US is now guaranteeing! To put this in perspective in 2000 there was a budget surplus and total debt was 5.7 trillion dollars. Currently debt is at about 11 trillion, not including Freddie Mac, Fannie Mae (6 trillion guaranteed) or any other guarantee being issued.

What is the government trying to fix? A report card, until the next time the teacher re-examines the student, and they are hoping that will happen after the next elections.

(image source)

Tuesday, October 14, 2008

Celebrate Socialism!

The Republicans have fought (and rightfully so) against socialism trends in America, whether it be health care, social security, education, or other typical government socialism trends. Yet America has announced it will buy stock in top 9 banks to the tune of 250 Billion dollars, and its great news!

The Republicans have fought (and rightfully so) against socialism trends in America, whether it be health care, social security, education, or other typical government socialism trends. Yet America has announced it will buy stock in top 9 banks to the tune of 250 Billion dollars, and its great news!If my memory serves me correctly, the capitalists have stated for decades that socialism depresses corporate profits and suppresses capitalist competition, and yet now its great news? Look at it for what it is, a desperation move to shore up public trust WITHOUT fixing accounting to restore trust.

And Europe trumps the USA for bailout effort, putting 2.3 Trillion dollars on the line to back European banks.

UPDATE: The US Central bank is offering "UNLIMITED" dollars to to the European Central Bank, Bank of England and Swiss National Bank. Previous cap was 620 Billion dollars. Does anyone else see a trend here? Governments around the world are accepting the risk previously negotiated by banks and corporations. Does anyone know what taking that type of risk on may yield?

If you are "long" stocks, this is yet another, and possibly final time to get out of the positions. Wait until the DJIA hits 10,000 and sell 25% of your long assets to reduce the exposure to risk. If the US stock market claws it's way back to 11,000, do your portfolio a favor and take the gift, get out of the market before Dow 6,500 becomes a reality.

Please read my post on when to buy into the market and when to be out of the market by clicking here.

(image Source)

Monday, October 13, 2008

MEGA RALLY!

As mentioned last week and earlier today (8:30 am), it was to be expected to have a "mega rally", one the likes we have never seen before, and quite likely not to see again!

The DJIA was up almost 1,000 points in a day!

From Friday at 3pm to Monday at 4pm, with about 7 1/2 hours of trading, the DJIA ran 17% up!

To put this in perspective, from January 2004 through December 2006, a full 3 years in a "bull market", the market rose about 17%. And we rallied 17% in less than 8 hours!

WOW! That's one for the record books!

WOW! That's one for the record books!Don't believe the hype, we may rally more, but the higher we rally, the next fall, if it occurs suddenly, will likely be the final major down move, before we enter into a long choppy downward slant.

I really hope I am wrong and the US government fixes trust by establishing honest accounting, but to date this has not occurred.

I'll blog more later, but with such an impressive run in 7 1/2 hours, had to blog on this topic.

NOTE! Sudden spikes like this occur ONLY in a bear market rally, meaning going down. This confirms the market has likely not bottomed!

US Treasury's Seven Point Rescue plan

The US Treasure released a seven point plan to shore up the US financial markets.

The US Treasure released a seven point plan to shore up the US financial markets.Notice one SIGNIFICANT omission from the seven point plan.

Absent is forcing companies to adhere to international accounting standards and force full transparency onto US companies, thereby building trust in the industry.

Until this occurs, I cannot recommend the bottom is in.

Fidelity investments has joined the government backing Money Market band wagon, with now 95% of private industry funds 100% backed by the US Government. Great for short-term confidence building, but this and other measures will have long term adverse effects with moral-hazard, affecting USA credit rating, and free market dynamics.

In Europe banks offered "Unlimited liquidity". Talk about moral hazard! Great for short-term bounce.

These unprecedented steps to throw money at the financial markets by risking countries solvency, without addressing root cause of "TRUST" is a recipe for disaster. DOW 6,000 would no longer surprise me. But there is still time to announce fixing accounting and creating true transparency for trust building before the markets fail.

However based upon the treasury & Europe announcement, combined with countries around the world announcing their own bailout plans, we could see a mega-rally for next few days.

Wednesday bank earnings start being released. In a normal environment, the earnings should be regarded as horrendous, and the market should tank. But my concern is the market has fallen so much, with significant bad news released, that the earnings will be spun as "could be worse". If this is the case the rally will continue.

Disclosure: I went long several stocks on Friday. I haven't gone long in years, but I'll close some positions before Wednesday.

Sunday, October 12, 2008

Uncertain Times