Today was absolutely surreal, I was stunned. The Stock Market has lost about 3,000 points in 14 days, and about 1,700 in 3 days (or about 17%) The market in effect has entered into a free fall. DOW 6000? Who knows. This is beyond what I could have envisioned, and somehow it is exactly what I expected. A strong mega upswing wouldn't surprise me either once "all wanting to sell have sold" leaving mostly buyers.

Today was absolutely surreal, I was stunned. The Stock Market has lost about 3,000 points in 14 days, and about 1,700 in 3 days (or about 17%) The market in effect has entered into a free fall. DOW 6000? Who knows. This is beyond what I could have envisioned, and somehow it is exactly what I expected. A strong mega upswing wouldn't surprise me either once "all wanting to sell have sold" leaving mostly buyers.Countries around the world are being fiscally destroyed. Russia's market fell 85%, Iceland is basically insolvent, riots in Hong Kong.

I have been obsessing over this moment since August 2006, now that its here, what next?

Because of the market free fall, Ford and GM Stock fell by 50% in a week. Their stocks are priced so low, that mutual funds will be forced to sell the stock, further depressing their shares, and threatening their solvency.

Because of the market free fall, Ford and GM Stock fell by 50% in a week. Their stocks are priced so low, that mutual funds will be forced to sell the stock, further depressing their shares, and threatening their solvency.Since 700 Billion is earmarked for financial companies, not sure who will bail them out, except a foreign country or company not burdened with 12 Trillion dollars in debt.

Next up is interest rates will rise CRUSHING the economy. We are talking Global depression as all lending shuts down. Housing crisis will be regarded to be in it's infancy now, compared to the year to come.

Am I over-reacting? Take a look at the 1 month LIBOR (lending interest rate banks use). If the trend continues (it could fade) its very bad news.

Interest rates was at an average 2.48563% in September, currently about 4%, a whopping 65% rise in interest rates!

And the nail on the coffin is South American countries are also abandoning the USD. What has this world come to when South America doesn't want the USD? Argentenia? Aren't they home of 1000% inflation? I guess they can spot implosion better than the average country.

America's a debt nation, and needs to sell 700 billion in bonds ASAP, as the walls of protectionism erect for the firestorm spells even more disaster.

America's a debt nation, and needs to sell 700 billion in bonds ASAP, as the walls of protectionism erect for the firestorm spells even more disaster.But I do see light. Now the Government will have NO CHOICE But to do the right thing, fix the accounting of America's corporations. How odd it took a global economic collapse to force America to do what it should have done every day for the last 8 years.

Attempting to throw money at a problem did not solve it, but it did damage companies with clean balance sheets. But until this concept is made law, well, be prepared. Unfortunately, the trust is lost and will take years, if not a decade, to regain.

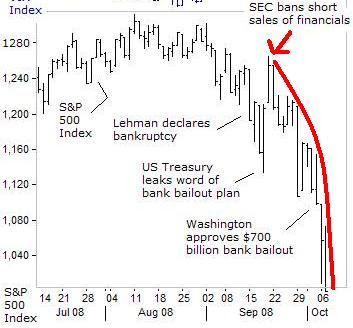

One stunning picture is what happened when the USA banned short selling. Look at the graph on the right, Notice when the stock market collapsed?

(image source)

This comment has been removed by a blog administrator.

ReplyDelete