I been slacking on my blogging with the long weekend.

I been slacking on my blogging with the long weekend.Frankly, I needed a break from doom/gloom/stocks.

Long weekend doom & gloom news roundup:

Trump Entertainment misses interest payment - My Spin - Doesn't Trump go bankrupt every time there is a downturn?

Bank of Japan to change collateral standards for banks - My Spin - Japan's the largest purchaser of US debt, and recently had a 10+ year recession, not good......

OPEC defers cutting oil production, seeks 75 barrel oil - My Spin - Cheap gas for a while!

Microsoft back at the table to buy Yahoo for 20 Billion dollars - My Spin - It won't save MSFT from themselves.

Meltdown from Financial Crisis spreads to Hotels, Malls, and Commercial markets - My Spin - I should have held SRS when it was at 80....

FHA is the next crisis up to bat - My spin - KILL THE FHA! The US Government needs to get out of competing for us business! And if the US doesn't the FHA will commit suicide....and yet once again the Taxpayer will pay the funeral costs.

Pimco, Franklin, GM Bondholders May Lose 75% for Aid

Porsche backs out of VW takeover

Impact of global crisis on China deepening, official warns job losses could fuel instability - My Spin - Forget about decoupling in near future...

UK Automakers will need a bailout

Panasonic cuts forecast by 90% My Spin - ACK! 90%? Why the heck didn't these guys cut earlier? CEO / CFO must be eternal optimists!

PIMCO may delay November Dividend - My Spin - My 401K is in Vanguard Admiral fund, 1/2 the interest rate of PIMCO fund, there is a reason why...

Icelandic Bank files for US Bankruptcy protection - My Spin - You think USA has it bad? This quote says it all for Iceland: "The three banks together amassed debt of $61 billion, equivalent to about 12 times the size of the Icelandic economy"

Durable goods down 6.2%

Swiss National Bank To House $60 Billion UBS Asset Fund In Switzerland

Toyota credit rating cut first time in ten years

October US home sales fall 5.3%

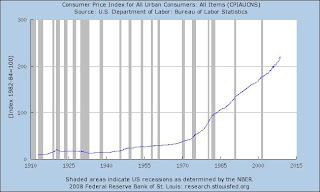

Article: Fed risks "spitting into the wind" with more pledges

Banks reserve ratio continues to decline, according to FDIC - My Spin - Got Cash?

WAMU to layoff 19,000 under JPMorgan My Spin - Layoff Conga line continues

(image source)