If the accounting rules in place since the Great Depression weren't suspended back in 2009, by now the markets would have bottomed, and we could start rebuilding.

Instead the markets are manipulated by changing the gauge used to measure health of companies. Further, the Central Banks have changed every conceivable rule to benefit the insolvent banks, to the point of purchasing directly the worst debt instruments to the tune of 1.4 trillion dollars, all someday to fall onto the US taxpayer to pay off.

The only wildcard now is, how does the problems play out? Another market collapse worse than 2008? Or maybe a collapse of the dollar, with resources flying high? Or something else?

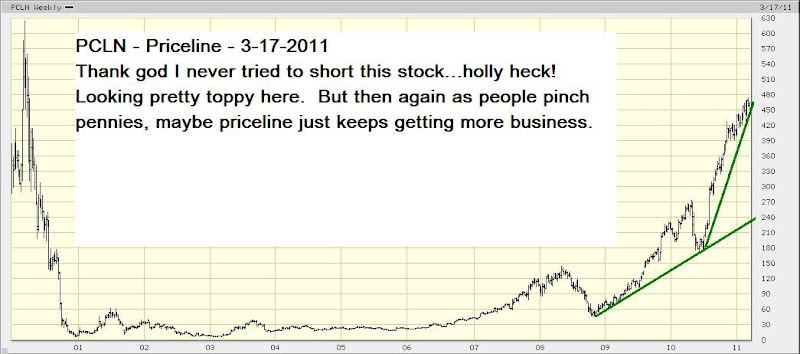

I reflected today on the "momo" stocks. These are stocks that have flown high the last 2-3 years.

Maybe its time for the reversion to the mean. By no means am I suggesting shorting these stocks. If you do, put in an order HIGHER than the current price, and short only "gifts". I'd buy puts but of course, for this ride down, there will be no free lunches. the VIX is doubled in the last couple of months, so options are expensive.

For now, I am still long natural resources.....nervously watching the momos for a sign that the dam may break. I do have shorts in DECK, but thats it.

If you are long any stock that has superb gains, recommend putting in stop-loss orders in to protect gains NOW. Make sure to give "room" for wiggling, pick a level that you think today it won't get to.....so if it does your out.

To the charts!

No comments:

Post a Comment