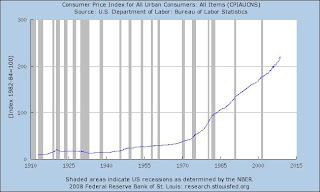

The Federal government is suppose to "fight" inflation, but there is no mechanism to judge or enforce this goal. To the right is am image of the Consumer Price Index in the USA from the federal Government.

The Federal government is suppose to "fight" inflation, but there is no mechanism to judge or enforce this goal. To the right is am image of the Consumer Price Index in the USA from the federal Government.Clearly this shows how the government has not controlled overall CPI since the 70's. Inflation in todays terms is segmented into "Core" vs other metrics, but the image on the right when taking cost of all goods, does not show good inflation control.

In any event, the government is about to embark on US Dollar printing like we have not seen before. There is no direct evidence that the US government will resort to naked printing, but mainstream news media is picking up on the concept of "where will all this spending come from?".

NYtimes article: Fed officials have made it clear they are prepared to print as much money as needed

Washington Post: So the Fed is effectively printing money and funneling it to home buyers

CNBC Video: buy stock in an ink manufacturer, we are in effect printing money

My timing may be completely off, but the government has historically increased debt to solve all it's issues. Currently the government is increasing the money supply through new debt obligations, and hopefully the US never resorts to raw printing.

Once the deflation monster is overcome with printing, money in fixed income will "lose" value compared to the inflation.

No comments:

Post a Comment